Form Gst Manual

What is the Form Gst Manual

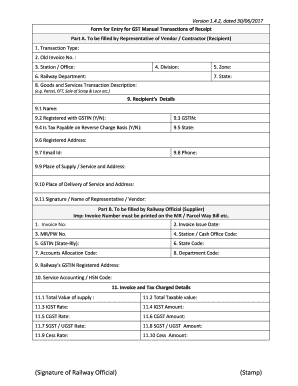

The Form Gst Manual is a document used for reporting and processing transactions related to goods and services tax (GST) in various contexts, particularly within the railway sector. This form serves as a record of manual transactions, ensuring compliance with tax regulations. It is essential for businesses and individuals involved in the transportation of goods to maintain accurate records of GST payments and receipts. The form is designed to facilitate transparency and accountability in financial dealings, making it a crucial tool for effective tax management.

How to use the Form Gst Manual

Using the Form Gst Manual involves several straightforward steps. First, gather all necessary information regarding the transaction, including details about the goods or services provided, the parties involved, and the applicable GST rates. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays in processing. Once the form is filled, it can be submitted electronically or in paper format, depending on the requirements of the relevant authority. It is vital to keep a copy of the submitted form for your records, as it may be needed for future reference or audits.

Steps to complete the Form Gst Manual

Completing the Form Gst Manual requires attention to detail. Follow these steps for accurate submission:

- Begin by entering your personal or business information at the top of the form.

- Provide details about the transaction, including the date, description of goods or services, and the total amount.

- Calculate the GST amount based on the applicable rate and include it in the designated section.

- Review all entries for accuracy to prevent any errors that could lead to compliance issues.

- Sign and date the form to validate the information provided.

Legal use of the Form Gst Manual

The legal use of the Form Gst Manual is governed by various tax regulations that mandate accurate reporting of GST transactions. To ensure that your form is legally valid, it must be completed with truthful and complete information. Additionally, compliance with electronic signature laws, such as the ESIGN Act, is necessary when submitting the form electronically. This ensures that the form holds the same legal weight as a traditional paper document, provided that all legal requirements are met.

Key elements of the Form Gst Manual

Understanding the key elements of the Form Gst Manual can enhance compliance and accuracy. Important components include:

- Transaction Details: Information about the goods or services, including descriptions and quantities.

- GST Calculation: The total GST amount due based on the transaction value.

- Signatures: Required signatures from the involved parties to validate the transaction.

- Date of Transaction: The date on which the transaction occurred, which is crucial for record-keeping.

Form Submission Methods

The Form Gst Manual can be submitted through various methods, ensuring flexibility for users. Options include:

- Online Submission: Many authorities allow electronic submission via secure portals, making the process quicker and more efficient.

- Mail Submission: The form can be printed and mailed to the relevant tax authority, ensuring that it is sent to the correct address.

- In-Person Submission: Users may also have the option to submit the form in person at designated offices, which can be beneficial for immediate assistance.

Quick guide on how to complete form gst manual

Complete Form Gst Manual effortlessly on any device

Online document management has gained prominence among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Handle Form Gst Manual on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Form Gst Manual with ease

- Find Form Gst Manual and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or mask sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form Gst Manual and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form gst manual

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a GST manual transaction?

A GST manual transaction refers to the process of recording goods and services tax obligations without automated systems. This process allows businesses to maintain accurate records of their GST liabilities and ensure compliance. Understanding GST manual transactions is crucial for businesses to avoid penalties and streamline their accounting.

-

How does airSlate SignNow support GST manual transactions?

airSlate SignNow offers a simple and efficient way to manage GST manual transactions by providing easy-to-use templates for invoicing. Users can quickly create and send documents while ensuring all necessary GST details are included. This streamlines the process of recording GST manual transactions and helps businesses maintain compliance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to the needs of businesses of all sizes. Each plan provides essential features that support VAT and GST manual transaction processes, ensuring affordability without sacrificing quality. Explore the pricing page to find the plan that best fits your organization's requirements.

-

Can I integrate airSlate SignNow with other accounting software for GST manual transactions?

Yes, airSlate SignNow can seamlessly integrate with a variety of accounting software to facilitate GST manual transactions. This integration helps businesses synchronize financial data, ensuring accurate reporting and compliance. By connecting your accounting tools, you can streamline the management of GST manual transactions.

-

What benefits does airSlate SignNow provide for businesses handling GST manual transactions?

airSlate SignNow simplifies the process of handling GST manual transactions by automating document management and eSignatures. This reduces the likelihood of errors and ensures that all records are kept up-to-date. Ultimately, businesses can save time and resources while staying compliant with GST requirements.

-

Is airSlate SignNow suitable for small businesses managing GST manual transactions?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses dealing with GST manual transactions. With its robust features, small teams can efficiently manage their documents without overwhelming their budgets or resources.

-

How secure is airSlate SignNow for handling GST manual transactions?

Security is a top priority for airSlate SignNow, especially when managing sensitive data related to GST manual transactions. The platform employs advanced encryption and compliance measures to protect user information and ensure data integrity. You can confidently manage your GST manual transactions knowing that your documents are secure.

Get more for Form Gst Manual

- Dse forms

- Fire alarm commissioning certificate download form

- A musical story worksheet answer key form

- Arthur burke form

- Form h1028 employment verification form h1028 employment verification

- Lease prince georges county maryland form 1105

- Leistungen und hilfen fr schwerbehinderte menschen in form

- Bitte ankreuzen welche aussagen auf das antrag stellende unternehmen zutrifftzutreffen form

Find out other Form Gst Manual

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple