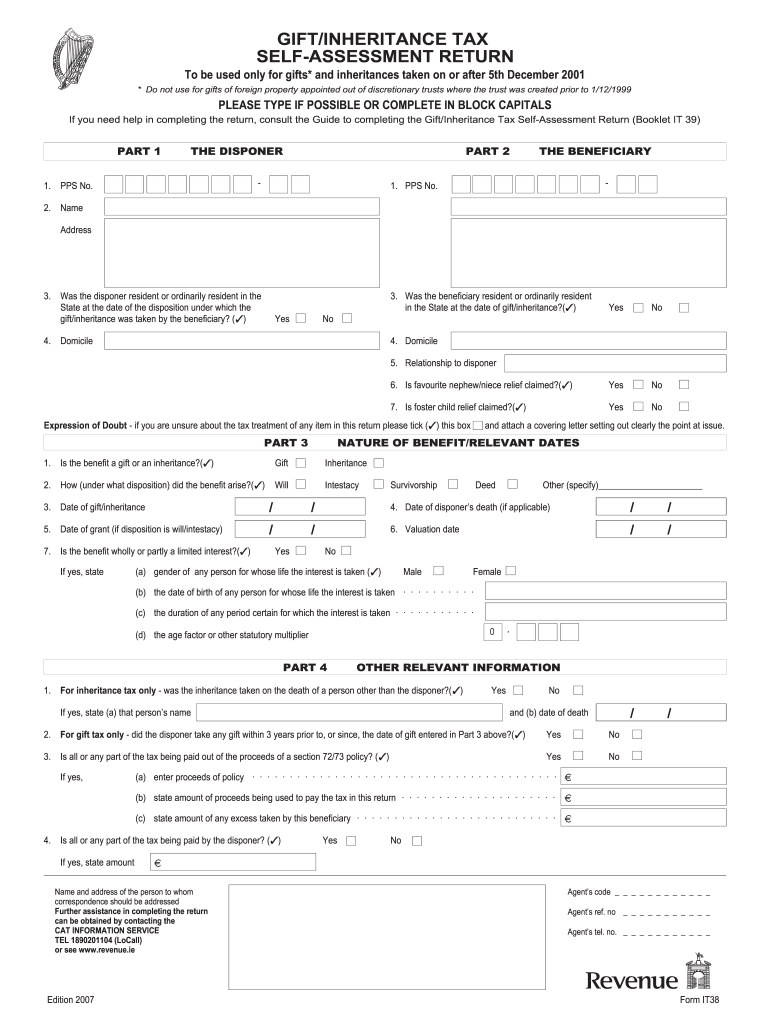

It38 Form

What is the IT38 Form?

The IT38 form is a tax document used by individuals and businesses in the United States to report specific financial information to the Internal Revenue Service (IRS). It is often associated with the filing of income tax returns and is crucial for ensuring compliance with federal tax regulations. This form helps taxpayers accurately report their income, deductions, and credits, which ultimately affects their tax liability. Understanding the purpose and requirements of the IT38 form is essential for anyone involved in the tax filing process.

How to Obtain the IT38 Form

Obtaining the IT38 form is a straightforward process. Taxpayers can access the form online through the IRS website, where it is available for download in PDF format. Additionally, the form can be requested through various tax preparation software, which often provides guidance on filling it out correctly. For those who prefer a physical copy, local IRS offices and some public libraries may also have printed versions available. Ensuring that you have the correct version of the IT38 form is vital for accurate filing.

Steps to Complete the IT38 Form

Completing the IT38 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, receipts for deductions, and any relevant tax credits. Follow these steps:

- Enter personal information, including your name, address, and Social Security number.

- Report all sources of income, such as wages, interest, and dividends.

- List applicable deductions and credits, ensuring you have documentation to support each claim.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy before submission.

Taking the time to carefully complete each section will help prevent errors and potential delays in processing your tax return.

Legal Use of the IT38 Form

The legal use of the IT38 form is governed by federal tax laws, which require accurate reporting of financial information. This form must be filled out truthfully and submitted by the appropriate deadlines to avoid penalties. Electronic signatures are acceptable for eFiled forms, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Utilizing a reliable eSignature solution ensures that your submission meets legal standards and maintains the integrity of your information.

Filing Deadlines / Important Dates

Filing deadlines for the IT38 form are crucial for compliance with tax regulations. Typically, the deadline for submitting the form is April 15 of each year, unless it falls on a weekend or holiday, in which case the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, such as filing for an automatic extension, which can provide additional time to submit the form. Keeping track of these important dates helps avoid late fees and ensures timely processing of your tax return.

Required Documents

To complete the IT38 form accurately, several documents are required. These include:

- W-2 forms from employers, detailing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills or charitable contributions.

- Statements for any investment income, including dividends and interest.

Having these documents readily available will streamline the process of filling out the IT38 form and help ensure that all financial information is accurately reported.

Quick guide on how to complete it38 form

Complete It38 Form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly option to traditional printed and signed documents since you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage It38 Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign It38 Form seamlessly

- Locate It38 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about misplaced files, tedious document searches, or errors requiring the reprinting of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign It38 Form to ensure outstanding communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it38 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS gov IT38 form and how does it relate to airSlate SignNow?

The IRS gov IT38 form is typically used for tax purposes in relation to tax-exempt organizations. AirSlate SignNow can help you easily eSign and send this document securely, ensuring compliance with the IRS requirements while streamlining your workflow.

-

How does airSlate SignNow support eSigning IRS gov IT38 forms?

AirSlate SignNow allows users to upload and eSign IRS gov IT38 forms electronically, making the process faster and more efficient. With its user-friendly interface, you can quickly manage documents without the hassle of printing and scanning.

-

What are the pricing options for airSlate SignNow when eSigning IRS gov IT38 forms?

AirSlate SignNow offers flexible pricing plans that cater to organizations of all sizes. By choosing a plan, you can efficiently manage the eSigning of IRS gov IT38 forms along with other documents, providing cost-effective solutions for your business needs.

-

Can I integrate airSlate SignNow with my existing tools for processing IRS gov IT38 forms?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to simplify your workflow for processing IRS gov IT38 forms. This helps you maintain efficiency and speed while using your favorite tools within the same platform.

-

What are the benefits of using airSlate SignNow for IRS gov IT38?

Using airSlate SignNow for IRS gov IT38 provides several benefits, including ease of use, enhanced security, and the ability to track document status in real time. This can signNowly reduce the time required for document processing and increase overall productivity.

-

Is airSlate SignNow compliant with IRS regulations when handling the IT38?

Absolutely, airSlate SignNow complies with IRS regulations, ensuring that all eSigned documents, including IRS gov IT38 forms, are legally binding and secure. This compliance reassures users that their data and documents are protected in line with federal requirements.

-

What features does airSlate SignNow offer for IRS gov IT38 processing?

AirSlate SignNow offers a range of features including customizable templates, bulk send options, and mobile accessibility for IRS gov IT38 processing. These tools allow you to streamline your document workflows from anywhere, anytime.

Get more for It38 Form

Find out other It38 Form

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement