Bir Form 2551q Download Excel

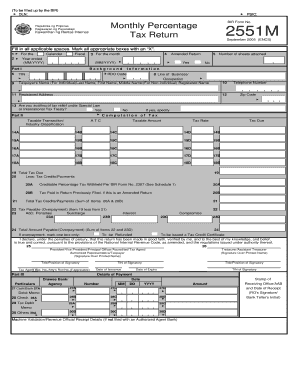

What is the Bir Form 2551m Excel Download?

The Bir Form 2551m is a tax document used by businesses in the Philippines to report their monthly value-added tax (VAT) liabilities. The Excel download format allows users to fill out the form electronically, making it easier to complete calculations and maintain accurate records. This format is particularly beneficial for those who prefer digital documentation over traditional paper forms, streamlining the filing process.

How to Use the Bir Form 2551m Excel Download

Using the Bir Form 2551m in Excel is straightforward. After downloading the form, open it in your preferred spreadsheet software. Enter the necessary data into the designated fields, ensuring that all calculations are accurate. The Excel format often includes built-in formulas to assist in calculating totals and VAT liabilities. Once completed, you can save the document for your records or print it for submission.

Steps to Complete the Bir Form 2551m Excel Download

Completing the Bir Form 2551m involves several key steps:

- Download the Excel file from a trusted source.

- Open the file in Excel or compatible software.

- Fill in the required information, including sales, purchases, and VAT amounts.

- Review the calculations to ensure accuracy.

- Save the completed form for your records.

- Print the form if required for submission.

Legal Use of the Bir Form 2551m Excel Download

The Bir Form 2551m must be filled out accurately to comply with tax regulations. Using the Excel format does not affect the legal standing of the form, provided that all information is correct and submitted on time. It is essential to keep a copy for your records, as this document may be required for audits or verification by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Bir Form 2551m typically fall on the 20th of the month following the reporting period. It is crucial to be aware of these deadlines to avoid penalties. Keeping track of important dates ensures that your submissions are timely and compliant with tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The completed Bir Form 2551m can be submitted through various methods. Businesses may file online through the Bureau of Internal Revenue (BIR) e-filing system, or they can choose to mail the form to the appropriate BIR office. In-person submissions are also accepted at designated BIR locations. Each method has its own requirements and processing times, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete bir form 2551q download excel

Complete Bir Form 2551q Download Excel effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional physical and signed papers, enabling you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to generate, adjust, and electronically sign your documents quickly and efficiently. Manage Bir Form 2551q Download Excel on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The most effective way to modify and eSign Bir Form 2551q Download Excel without difficulty

- Locate Bir Form 2551q Download Excel and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors necessitating new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Bir Form 2551q Download Excel and ensure excellent communication at any phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bir form 2551q download excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the bir form 2551m excel download?

The bir form 2551m excel download is an electronic version of the BIR Form 2551M, which is used for the monthly income tax return in the Philippines. By downloading it in Excel format, users can easily fill in their data and calculate their tax liabilities efficiently.

-

How can I get the bir form 2551m excel download?

You can easily obtain the bir form 2551m excel download from the airSlate SignNow website. Simply visit our landing page, navigate to the downloads section, and you will find the Excel template available for quick access and easy use.

-

What are the benefits of using the bir form 2551m excel download?

Using the bir form 2551m excel download simplifies the tax preparation process by providing a pre-formatted template that auto-calculates your tax obligations. This reduces the chances of errors and helps you save time, ensuring accurate submissions to the BIR.

-

Is the bir form 2551m excel download compatible with other software?

Yes, the bir form 2551m excel download is compatible with Microsoft Excel and other spreadsheet programs that support .xlsx file formats. This allows you to edit, customize, and maintain your documents as needed with ease.

-

Can I eSign the bir form 2551m excel download using airSlate SignNow?

Absolutely! After filling out the bir form 2551m excel download, you can upload the document to airSlate SignNow for easy electronic signing. This feature streamlines the process and allows you to finalize your tax returns swiftly and securely.

-

Is there a fee for downloading the bir form 2551m excel?

The bir form 2551m excel download is available for free on our platform. We aim to provide accessible solutions to help businesses manage their tax requirements efficiently without financial burdens.

-

How does airSlate SignNow enhance the use of the bir form 2551m excel download?

With airSlate SignNow, users benefit from an intuitive interface that facilitates document management and eSigning. By integrating the bir form 2551m excel download into our platform, you can enhance workflow efficiency while ensuring compliance with tax regulations.

Get more for Bir Form 2551q Download Excel

Find out other Bir Form 2551q Download Excel

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free