Ct W4 Form

What is the CT W4?

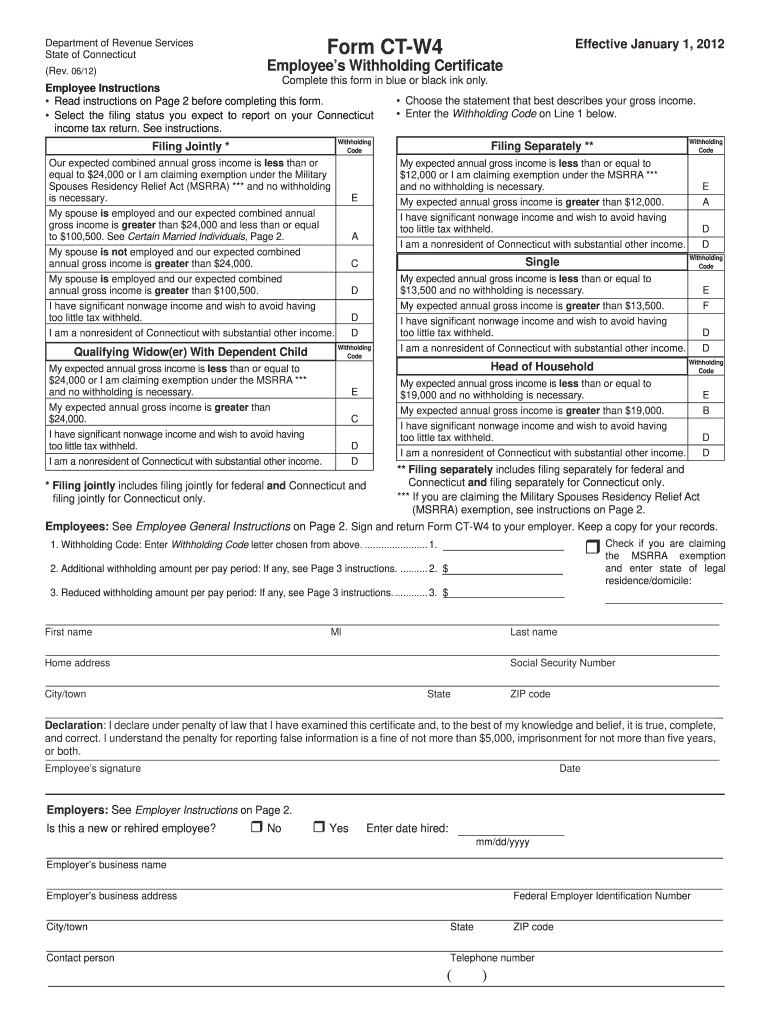

The CT W4 is a state tax form used by employees in Connecticut to determine the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of tax is deducted based on an individual's personal financial situation. The CT W4 allows employees to provide information such as filing status, number of allowances, and any additional withholding amounts. Understanding this form is crucial for compliance with state tax regulations and for effective financial planning.

Steps to Complete the CT W4

Filling out the CT W4 involves several straightforward steps to ensure accuracy and compliance. Here’s how to complete the form:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status by selecting from the provided options, such as single or married.

- Calculate the number of allowances you are claiming. This number affects your withholding amount; more allowances typically mean less tax withheld.

- If applicable, specify any additional amount you want withheld from each paycheck.

- Review your completed form for accuracy, then sign and date it.

How to Obtain the CT W4

The CT W4 form can be easily obtained through various sources. It is available online on the Connecticut Department of Revenue Services website, where you can download a printable version. Additionally, employers may provide this form during the onboarding process or upon request. It is important to ensure you are using the most current version of the form to comply with any recent changes in tax regulations.

Legal Use of the CT W4

The CT W4 is legally binding once completed and submitted to your employer. It is crucial that the information provided is accurate, as incorrect details can lead to improper withholding of state taxes. The form must be filled out in accordance with Connecticut tax laws, and any changes in personal circumstances, such as marital status or number of dependents, should be updated promptly to maintain compliance.

Key Elements of the CT W4

Understanding the key elements of the CT W4 is essential for effective tax withholding. Important components include:

- Personal Information: This includes your name, address, and Social Security number.

- Filing Status: Indicates whether you are filing as single, married, or head of household.

- Allowances: The number of allowances you claim affects how much tax is withheld.

- Additional Withholding: Option to specify any extra amount to be withheld from your paycheck.

Form Submission Methods

Once the CT W4 is completed, it must be submitted to your employer. This can typically be done in several ways:

- In-Person: Hand the completed form directly to your human resources or payroll department.

- By Mail: Some employers may allow you to mail the form to their payroll office.

- Electronically: If your employer uses digital payroll systems, you may be able to submit the form electronically through their platform.

Quick guide on how to complete ct w4

Effortlessly Prepare Ct W4 on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Ct W4 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign Ct W4 with Ease

- Find Ct W4 and then click Get Form to begin.

- Use the tools at your disposal to fill out your document.

- Highlight essential parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Don’t worry about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Ct W4 to ensure effective communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct w4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are CT W4 forms?

CT W4 forms are tax withholding forms used by employees in Connecticut to inform their employers about the amount of state income tax to withhold from their wages. Completing these forms accurately ensures that employees meet their tax obligations and avoid under- or over-withholding.

-

How can airSlate SignNow help with CT W4 forms?

airSlate SignNow simplifies the process of completing and eSigning CT W4 forms by providing a user-friendly platform. With our solution, you can electronically fill out the forms, ensuring accuracy and compliance while also speeding up the process.

-

Is airSlate SignNow cost-effective for managing CT W4 forms?

Yes, airSlate SignNow offers a cost-effective solution for managing CT W4 forms. Our pricing plans are designed to fit businesses of all sizes, allowing you to streamline document management without overspending while also enhancing productivity.

-

Can I integrate airSlate SignNow with other applications for CT W4 forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications to help manage CT W4 forms efficiently. This means you can incorporate eSigning features into your existing systems, optimizing your workflow and ensuring a smooth experience.

-

What are the benefits of using airSlate SignNow for CT W4 forms?

Using airSlate SignNow for CT W4 forms provides several benefits, including increased efficiency, enhanced security, and reduced paperwork. You can easily track the status of your forms, ensure they are submitted on time, and keep your sensitive information secure.

-

How does eSigning CT W4 forms work with airSlate SignNow?

eSigning CT W4 forms with airSlate SignNow is straightforward. Once you've filled out the form, you can simply send it to the relevant parties for their electronic signature, eliminating the need for physical copies and streamlining the approval process.

-

Are CT W4 forms available in multiple formats on airSlate SignNow?

Yes, airSlate SignNow supports various formats for CT W4 forms, allowing users to upload existing documents or create new ones from scratch. This flexibility ensures that you can work with the documents that best suit your needs.

Get more for Ct W4

- Krec open listing agreement form

- Pest control service plan form

- Biblical counseling worksheets pdf form

- Lma5 form

- Mall fr kvalitetsgranskning av studier med kvalitativ forskningsmetodik patientupplevelser form

- Forget about losing your job form

- Minor release and waiver of liability and indemnit form

- One year church bulletin advertising contract diocesancom form

Find out other Ct W4

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors