Employee Personal Details Form

What is the Employee Personal Details

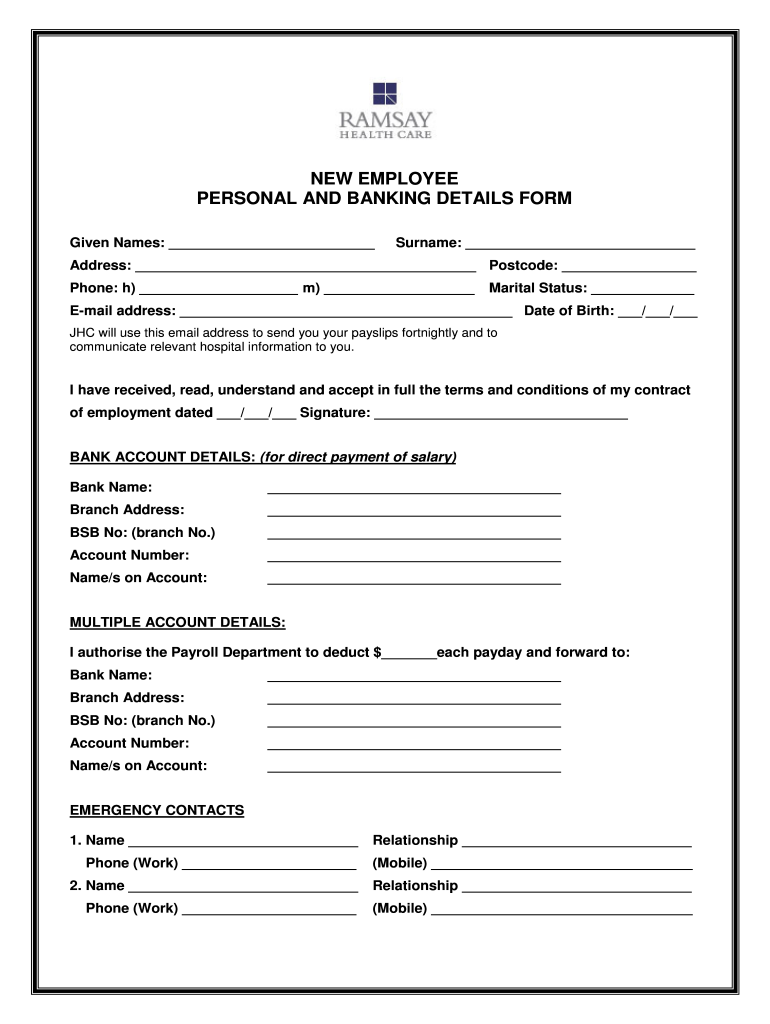

The Employee Personal Details form is a crucial document that collects essential information about an employee. This form typically includes personal particulars such as name, address, contact information, Social Security number, and emergency contact details. It serves various purposes, including payroll processing, tax reporting, and compliance with labor laws. Accurate completion of this form is vital for both the employer and employee to ensure proper record-keeping and adherence to legal requirements.

Steps to complete the Employee Personal Details

Completing the Employee Personal Details form involves several key steps:

- Gather necessary information: Collect all required personal details, including full name, address, date of birth, and Social Security number.

- Fill in the form: Carefully enter the gathered information into the appropriate fields of the form, ensuring accuracy.

- Review for errors: Double-check all entries for mistakes or omissions to prevent issues later on.

- Submit the form: Provide the completed form to the designated HR representative or submit it through the appropriate digital platform.

Legal use of the Employee Personal Details

The Employee Personal Details form is governed by various legal frameworks that protect both the employee's privacy and the employer's right to collect necessary information. Compliance with laws such as the Fair Labor Standards Act (FLSA) and the Family Educational Rights and Privacy Act (FERPA) is essential. Employers must ensure that personal details are stored securely and accessed only by authorized personnel. Additionally, employees should be informed about how their information will be used and their rights concerning privacy and data protection.

Required Documents

To complete the Employee Personal Details form, certain documents may be required. These typically include:

- Proof of identity: Such as a driver's license or passport.

- Social Security card: To verify the employee's Social Security number.

- Bank account information: For direct deposit setup, if applicable.

- Tax forms: Such as W-4 for withholding information.

Examples of using the Employee Personal Details

Employers utilize the Employee Personal Details form in various scenarios, including:

- Onboarding new employees: Collecting necessary information to set up payroll and benefits.

- Updating records: When an employee changes their address, marital status, or emergency contacts.

- Compliance audits: Ensuring that employee records are accurate and up-to-date for regulatory purposes.

Form Submission Methods

The Employee Personal Details form can be submitted through multiple methods, depending on the employer's preferences:

- Online submission: Many companies use digital platforms for employees to fill out and submit their personal details securely.

- Mail: Employees may also send the completed form via postal service to the HR department.

- In-person: Some employers may require employees to submit the form in person during the onboarding process.

Quick guide on how to complete employee personal details form

Prepare Employee Personal Details effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without delays. Manage Employee Personal Details on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign Employee Personal Details with ease

- Locate Employee Personal Details and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that task.

- Create your eSignature using the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device of your choice. Modify and electronically sign Employee Personal Details and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How do I apply online for an instant personal loan?

Faced with an unexpected financial requirement? One of the quickest and smoothest solutions that you can get via a formal channel would be to avail of a personal loan. Like other loan products, banks and financial institutions (including NBFCs) offer a personal loan by applying in person, but with advanced technology a loan can be made available to you literally at the click of a button.Most of the larger banks in India offer a personal loan online, simplifying the process such that not only is it hassle-free, but the loan is sanctioned within a few hours, cutting down on processing time signNowly. Let’s take a quick look at the process, should you want to apply online.Step 1: Log on to the lender’s website.Step 2: Fill in a simple, easy-to-use online application form. Depending on whether you are salaried or self-employed, the information will differ.Step 3: Check your eligibility online.Step 4: Once your application is approved, the money will be credited to your account via an online transfer. Some lending institutions disburse loans within 72 hours, following a small 5-minute approval process. Hence before you apply for a loan, compare loan offerings across lenders before you make the decision to proceed.What you should know:Most lenders offer online loans of up to Rs. 25.0 lacs, with loan repayment tenures ranging from between 24 months to 60 months.Make use of online personal loan EMI calculators, that help you approximately gauge the amount you would need to repay month on month towards your loan.Once you have availed of a loan, lenders provide you online access to help you track your loan – right from personal details to complete loan information including g the repayment schedule, interest certificate and other relevant details.Check for any offers or promotions that the lender may have going at the time you apply, to ensure you get yourself the best deal out there. For example: discounted interest rates or lower processing fees for a certain promotional period, or as an ongoing offer for employees of category A companies (as defined by the lender).And finally…Do keep in mind that any loan you avail of needs to be repaid in a timely manner, to ensure that your credit score is not impacted negatively. With this information at hand, go ahead and live your dream!

-

How do I know if Facebook people tried to hack into my personal Facebook account?

You don’t. And Facebook engineers don’t need to ‘hack’ into any accounts; all Facebook engineers have access to the Facebook accounts. However, they need to fill out a request form with extremely specific details as to what they will do and why they need access to an account. It is approved on a case-by-case basis, and very rarely too. If any employee is caught snooping, they’re basically kicked out on the spot.You really shouldn’t worry about Facebook engineers snooping. No sane or smart person would give up their 6 digit salary just to snoop around.Source: my sister works at Facebook.

-

How do I change a registered mobile number in HDFC bank?

You can change registered mobile number in HDFC Bank account online by following the steps given below:Step-1: Go to official website of HDFC BankStep-2: Login to HDFC Net Banking PageStep-3: Click on Update Email ID and Landline NumberStep-4: Edit the number you want to changeStep-4: Confirm the number by typing it once againAfter following the steps mentioned in above articles, you can change or update mobile nimber registered in your HDFC Bank Account Online without visiting the bank branch.Your New Mobile Number will be Updated within 24 Hours!!!Point to be NotedIt is true that you can change your mobile number in HDFC Bank Account online still I recommend you to get this done personally by visiting the bank branch. It will eliminate risk( although very rare) of hacking confidential information.Hope this works for you.

-

How do I fill out the SSB details in the AFCAT form?

Just write whatever is asked for. You may not be able to mention some special characters like hyphen, slash etc.Its alright, just mention the course number without it (if thats what you are asking)Any other doubt, you can mention in the comments.Hope it helps!

-

What are the common mistakes that seed-funded startup founders make?

I raised $500,000 at 19. I was on my way to change the world. Three years later everything burned down.This post is not about how to shoot for the stars or run a company. Others are better at that.This is about what not to do.I’ve made every mistake possible. But ironically, I’m constantly meeting teams doing the exact same things that caused my first startup to implode. Everything I’m writing about I’ve experienced first hand through my own startups as well as various businesses I’ve been involved in. It’s been all my fault and this is my story.Some of you will disagree with me. Others will have things to add. I’m happy to discuss in the comments.Here’s my attempt.ZUCKERBERG SYNDROMMy girlfriend didn’t know what I was working on for nine months. I slept with a chair blocking the front door. My phone was tapped. Corporate America and Uncle Sam were listening. Someone was going to kill me to steal the idea.I really believed this. So I did everything possible (literally) to avoid getting feedback out of the fear of having our idea stolen.Ultimately, secrecy and stupidity killed us. Three years and hundreds of thousands later, we released an alpha version to a modest 30 people for the first time. Everyone hated it. Our capital was gone. Our morale: zero.I see this all the time. Startup founders hiding their ideas because of the fear that someone will steal it. Remember: no one cares about you. Your biggest issue is getting discovered. If someone steals your idea, that means you’re doing something right.Because of this syndrome, most startups are wasting their time and money building products no one wants. Why? Lack of testing. The biggest mistake a company can make (product wise) is to avoid talking to and testing with potential and current users. Every day. It’s also one of the main reasons startup’s fail.If you’re not constantly releasing and looking for feedback you’re either a) delusional (me) thinking too many people will sign up/buy your product and you won’t be able to scale b) scared that it’s not good enough (me) or c) someone will steal your idea (as I was).A. SCALING“Your priority, in short, is proving that people will use your product at all. If they won’t, then it won’t matter if you can’t scale. If they will, then you will figure out a way to scale. I’ve never seen a startup die because it couldn’t scale fast enough. I’ve seen hundreds of startups die because people refused to embrace their product.” — Guy Kawasaki [Emphasis mine]I’ve done this and I’ve experienced this in the past three startups I’ve worked in. It’s completely delusional. If five out of five people tell you that they wouldn’t use your product (before you build), quit. If eight out of ten people tell you that they hate this feature and you empirically see that they’re not using it, kill it. Don’t assume. Always be testing.More on feedback below.b. TESTINGSee point A.C. STEALING(!)No one will steal your idea. It takes time, money, skills and immorality to steal. Not everyone is born that lucky.Most importantly, no one cares about your idea.They’ll only start caring when there’s a massive amount of initial traction (50,000+ users). By then, you’ve already established a strong user/customer base and it’s too late for the others.HIRING FOR WEAKNESSOnly hire for a strength that needs to be filled in your company. Never for a weakness.Not once did any of the startups I worked in hire for a strength. I repetitively recommended hiring people purely out of loneliness, fear and scarcity repetitively. Each time it sunk us deeper.But what does that mean?Hiring for a weakness means that you attempt to fill a weakness in the fundamenetals in your company by hiring for a weakness. Example: If you’re building a product and it’s not gaining traction and your company doesn’t have inherent fundamentals, hiring Ryan Holiday to sell your product won’t help. You can’t fight weakness with weakness.However, if you have a rockstar engineering team and you want to add a marketing person to help take the product get to another level, then you’re adding a strength.Hiring for weakness also means:a. You hire a B+ player instead of a A+ player.b. You hire people so that they go through the struggle with you, so that they share your fears and paranoia. Not so they execute on what’s needed.c. Hiring someone to fill a position. Not to compliment the rest of the company.d. Hiring someone and not having any idea of what the hell you want them to do.e. It means hiring someone because you think there’s no one else. Scarcity.f. Hiring a client’s friend. Because you’re scared.It’s ultimately about the fundamentals. If the fundamentals of the product and the team aren’t there, adding someone is just adding a weakness. It won’t help, because it’s not a strength.PAINTER’S DILEMMAApproving emails? One week treks. Our first wireframes? $40K and four months. Did we have a working product after all this? No. We failed.The Painter’s Dilemma is when you’re so deep in the details of your project that you don’t even know what the idea is anymore. You’re blind. When you’re too deep you need help.How to solve it? Stop. Talk to people. Get feedback. Iterate and build. Release. Breathe.Repeat the loop.The more feedback you get the healthier you and your product are.FEEDBACK*I can’t emphasize this enough. If you don’t get feedback (everyday) you will die. I never got feedback. EVER. Well, until the cash ran out. Oops.If you’re not getting qualitiative and quantitive feedback/data everyday, the cancer will start.It’s easy: speak to people, Google Analytics, send surveys. Just don’t hide from it.*This is the crucial and worth a dedicated blog post in the future.COMMUNICATE“Don’t talk to him, he doesn’t understand. He’s out of the picture next funding round anyways.” I hid everything internally. It was easy, we were in 5 different countries! Our developers were remote (I’ll get to that) and Basecamp was our only means of communication. In other startups, I wouldn’t included people from discussions because “it isn’t necessary. That isn’t their job”New features, awful designs, conniving plans were all pushed through a funnel. I was the leader of the deceiving. Architecting a blue print to push my own delusional “never test and succeed” agenda. My style? The longer the email the less likely someone important will read it. What a strategy. As always, the CEO is the biggest idiot.I don’t care if you’re a church, a tech startup or a non-profit. If you don’t have a system of communication in place that keeps everyone aware of what everyone is doing in the company, in real-time, for every milestone, everyday, you will die very soon.Lesson: Live and breath Scrum.SCREW LAWYERSLawyers are criminals.I spent $15,000 on legal documents/fees we never used. Every entrepreneur/startup I’m involved with thinks lawyers are the first step to success. Bullshit.DOCSAll the legal documents you ever need are available online. If you’re B2B, all companies that you’ll work with have their own standard LOEs, NDAs, etc., that they anyways steal from Fortune 500 companies. Request it. Then use it. B2C? Here.BUT I NEED A TRADEMARK!Unless you have 10,000 clients you don’t need to think about copyright or even the name. Prove the concept first. Worry later. If you do have to worry, those are very nice worries to have.PATENT IT!Patenting something that isn’t validated with at least 10,000 clients is moronic. Ironically, this is the only mistake my first startup didn’t follow through with (fully, at least).DECISION MAKINGI was traumatized from taking decisions. Most startups never take decisions. In other statups I work in, decisions took weeks. People join startups for the reason of avoiding bureaucracy but everyone still does it. Why? Lack of trust and overview of the team, so they choke the process (have I suggested Scrum?).The board should decide on the vision and the group should decide what to execute on by creating a backlog for the week. The team should then have the power to execute it. With a great communication process in place, teammates should be able to take decisions without reporting to anyone while keeping everyone updated with everything’s that going on, live. Have a flat structure to achieve this by using Scrum.Let people do their jobs. Trust them. Don’t have a tedious review process as most startups do. Don’t suffocate the system. Empower your people.Read Scrum by Jeff Sutherland on how to manage your team. Then read Team of Teams by General Stanley McChrystal for how to organize the information flow. Both books compliment each other perfectly.THE BOARDThe ideal board is 3–5 people maximum if you’re a startup. Anything above that means that either no decisions will ever be taken (my first company) or someone has a hidden agenda and profits from a discombobulated board.A business is not a democracy. Unanimous decisions don’t work and will never work.Who’s should I put on the Board?Only investors/shareholders who hold a large stake and are extremely active in the success of your venture.INVESTORSSmart Money vs Still MoneyJust because someone is offering you cash almost always means you shouldn’t accept it.Your investor can have the greatest contacts in the pharmecutical industry. She can be CEO of Merck. If she doesn’t have a massive network in whatever industry you’re in, it’s worthless. The money will be worth nothing. This is true 100% of the time.Always onboard investors that can help you in your niche industry.MEETINGSThis is my top 3 favorites. Most won’t agree with me on this.I’ve never been to a meeting that has made me money/funded my venture. I don’t think anyone has. Has anyone ever handed you a check at a meeting? I doubt it. Today, it usually happens by wire-transfer.Meetings are pointless. Every team I meet, consult for/work with all think that going to meetings is the most crucial part of business. Most importantly, the whole team should be there. Pick up the fucking phone. Travel is time and money expensive. Even if you’re taking a cab.I would fly 10,000 miles for a 3 hour meeting and then fly back to Europe that same day. $30K. Gone.“If you had to identify, in one word, the reason why the human race has not achieved, and never will achieve, its full potential, that word would be: ‘meetings.’” - Dave BarryMost of the discussion can be ironed out over email and FaceTime.Ok yes, I agree. Meeting in person is important. But not until it’s necessary. Most of the time, it’s unecessary. And even when it is, it shouldn’t always be an excuse to leave work for a business lunch or to Shanghai for the day.Avoid meetings. Get more done.It’s a waste of time 99% of the time.FOUNDING PARTNERS = YOUR SPOUSEYou will be married to your partners and investors for the next 7–10 years. Choose wisely.Know your team. Speak to your investor’s enemies. Get references for everyone.Don’t be a deceiver. Use Scrum.WORKING HOURSWe worked 16 hour days. Yey! Startup life!No. Work 8–10 hours and you’ll get more done than working 18 hours a day. Don’t believe me. It’s proven.Working 18 hour days leads to a burn out, which leads to painter’s dilemma, then delusion, then deceiving others around you, then depression. Then it’s too late.Ultimately, the more you work the more mistakes you’re prone to make. Mistakes made are mistakes that need to be corrected. Mistakes that aren’t correct can take up to 24x longer to correct than if they were corrected immediately.But you can’t see that. You’re burned out. You’re in Painter.PRODUCT / MARKET VALIDATIONAnother reason I refused to test in the three product startups I was involved in was because “the ideas work successfully elsewhere. They will also work here.” Doesn’t work like that.Just because you’re making a mishmash of several products that have product/market validation elsewhere doesn’t mean people are willing to use your product. I have yet to meet a new founder who hasn’t claimed this.In order for someone to switch to your product, your product needs to be at least 8x better.*Is your product really 8x better than your biggest competitor? If the answer isn’t a clear yes, quit.*Read Hooked by Nir Eyal and Ryan Hoover for how to build habit forming products.RECREATING THE WHEEL“God gave you eyes, so plagarize.” -Michael LewisNo need to re-create the wheel. Everything is out there already for a reason. Use APIs, read books (many books), steal functions, designs, ideas, marketing slogans, branding, on boarding processes, software, colors, clients, everything from other people/companies who are successful.This doesn’t mean that you shouldn’t test it in your own environment. You must validate every single function that you put out there. Use the Lean Startup KanBan by Ash Maurya for this.DILUTIONWe gave away 51% for our first funding round. How much did we plan to keep when we “exited?” Think about that. It doesn’t make sense.Startups do this all the time. If you retain 51% after the seed round, how much does the founding team plan to keep by Series B? 20%? If you take the average of what you got paid for equity after the exit + your salary you’ll be paying more in taxes with a minimum wage paycheck for the past 8 years it took you to exit. Might as well work in a shoe store.If you don’t have the bargaining power (a validated product) to raise money with, quit.GUYS IN SUITSOur tech partners wore suits. That made us comfortable. They ended up quoting $100k. We ended up with nothing.If you see tech people in suits, run.OUTSOURCINGI lost well over $100,000 for our first version that was outsourced. We were smart enough to not learn from our mistakes so we found another team to outsource with. Another hefty sum gone. Only myself to blame.I’ve had terrible experiences with outsourcing and great experiences with in-house development.However, many products (we all use everyday) have found great success in outsourcing. I also know many entrepreneurs who outsource and are extremely succesful. While there are massive benefits, there are also downfalls. If you plan to, find a free consulting company that has pre-screened teams.Either way, using Scrum increases your chances of success in-house or out.YOUR TEAMEntrepreneurs read about Steve Jobs’ management style and think he was a tyrant. So they curse at their employees and tell everyone that they are “shit.” They think that’s how a company should be run and that’s how teammates should be treated. Wrong. Treat your team like shit and you’ll get shit.Either way, that’s not how Steve Jobs did it. Steve Jobs empowered his team. He told them that what they’re outputting is shit because he knew that they could do better. Because they are the best in the industry. He made them feel good. He challenged them and today Apple is Apple because of that.On the other hand, I lied. Didn’t speak about the hard things and repressed whatever fear or worry we had. We were scared that someone would quit or that we would look bad if we showed our emotions in front of our investors.You should always be able to tell your teammates all the fears and worries you have. Chances are, if you’re worried about something, everyone is worried about the same thing. Bring it up. Talk about it. I keep mentioning Scrum* because it encourages team members telling each other what’s bothering them and what’s impending the growth progress. This is key to not failing.Not once, in any of the startups I was in, did I or others get credit for great work or for their ideas that ended up being implemented. Not once did anyone congratualte a teammate on a engineering triumph, a beautiful design or a new lead. Startups think “business is business. This isn’t a cute place to pat each other on the backs.”BUT THAT’S EXACTLY WHAT A BUSINESS SHOULD BE. You should be holding each other up, helping one another and listening to the problems in the team. Because ultimately, you’re on the same mission.The second the negativity flows in people become scared. They stop raising issues, telling you how they feel and how to improve the business. When that happens you start to slowly die because you’ve fell into dillusion that everything is working. Six months later, you’re on the street.Empower your team. Congratulate people. Love each other. When someone screws up, tell them that. But also tell them how to improve and ask them why they think they screwed up and how to make their job easier.You’re a team. Be one.*Believe it or not, I’m not affiliated with Scrum in anyway. I’m not even a Scrum Master.—When I reflect on all the stupidity I’ve personally done and the startups I’ve been involved in, I realize that the only thing I ever followed up through and executed with absolute perfection, were the things that eventually ended up killing us: not telling a soul what our idea was. Talking to lawyers. Partnering with bad teams. Hiring out of weakness. Going to too many meetings. No decision making system. Not using Scrum. Hiring people out of fear. Hiding from reality.Mistakes are simple to make but hard to correct. They’re usually the first option that pops up. But as entrepreneurs we do thing because they’re hard, not because they’re easy.Hard choices take a long time to get right. It takes guts, intuition, experience and lots of luck. But never settle. Never accept your situation.Life can always be better.…..This was originally posted on the NY Observer and our blog on Penta.Follow me @lukaivicev or contact me directly at luka@getpenta.com.

-

How can anyone respect Elizabeth Warren knowing she lied about Native American heritage in order to qualify for a job?

If anyone reads my content here, they’ll know I talk about this phenomenon of White (and Black) Americans falsely claiming to be “Cherokee” or have some degree of Native Americans ancestry, all the damn time. And yes, it is usually just false family lore. That’s just the blunt facts.However, as much as I discuss this kind of thing in my content (along with VERY detailed information about Warren’s specific claims), I have never seen any evidence that she claimed it in order to qualify for a job. In fact, I see no evidence that it came into the hiring process at all.What I actually see is what might be called a box checker. Meaning, this was part of a demographic or record keeping sort of deal. It’s sort of like the federal Census form or any other personnel information document that is filled out by the individual, applicant or employee. This is simply based on self-identification.In that respect, Warren is no different than the millions of Americans that recycle these unsupported - and usually false - family myths.This is extremely common!However, the only reason this got latched onto is because it is now part of a partisan battle.So, she’s entrenched in her position that this is just “part of my heritage” (and ain’t nobody gonna take that away from her!). It apparently doesn’t require anything other than the recitation of the lore or claim that there is blood back there “somewhere.” No real ancestry or affiliation to a tribe is required. It’s a sort of independent endeavor.And on the other hand, conservative enemies have latched onto a narrative that they like.But, they are also somewhat delusional or self-selecting narratives that suit their personal psychological needs. Bear in mind, many of these folks that latch onto this anti-Warren rhetoric are staunch right-wing partisans. They are the folks that elected Trump, so they actually have no claim to moral principles anyway.One side (Warren) is just engaging in a common White American social quirk (claiming “Cherokee blood”) and isn’t backing down because she’s stubborn (not necessarily a bad trait to have in some cases). And the other (right wingers) is totally insane and latches onto anything that might be seen to discredit a “libtard.” Or, they’ll make a mountain out of a mole hill at the very least, as long as is about someone seen as a political enemy.

Create this form in 5 minutes!

How to create an eSignature for the employee personal details form

How to generate an electronic signature for your Employee Personal Details Form in the online mode

How to generate an electronic signature for your Employee Personal Details Form in Google Chrome

How to make an eSignature for signing the Employee Personal Details Form in Gmail

How to create an electronic signature for the Employee Personal Details Form straight from your smartphone

How to generate an electronic signature for the Employee Personal Details Form on iOS

How to make an electronic signature for the Employee Personal Details Form on Android

People also ask

-

What is a personal details form PDF and why is it important?

A personal details form PDF is a digital document designed to collect and share personal information securely. This format is important for maintaining professionalism and efficiency in handling sensitive data while ensuring easy access and submission.

-

How can I create a personal details form PDF using airSlate SignNow?

To create a personal details form PDF with airSlate SignNow, simply log in to your account, select the template feature, and customize the form as needed. You can add specific fields to capture personal information and then save it as a PDF for distribution.

-

Is there a cost associated with using personal details form PDFs in airSlate SignNow?

airSlate SignNow offers a variety of pricing plans that include features for creating and managing personal details form PDFs. You can choose a plan that fits your business needs and budget, ensuring cost-effective solutions for document management.

-

What features does airSlate SignNow offer for personal details form PDFs?

airSlate SignNow provides features like eSigning, document tracking, and customizable templates for personal details form PDFs. These features enhance the user experience by streamlining document workflows and ensuring secure handling of personal information.

-

Can I integrate airSlate SignNow with other applications for my personal details form PDFs?

Yes, airSlate SignNow offers integration capabilities with various applications like Google Drive, Salesforce, and Dropbox. This allows for seamless management and storage of personal details form PDFs alongside your existing tools.

-

What are the benefits of using airSlate SignNow for personal details form PDFs?

Using airSlate SignNow for personal details form PDFs streamlines the process of collecting and managing personal information securely. It enhances collaboration, reduces turnaround times, and ensures compliance with industry standards for data protection.

-

Is it easy to eSign personal details form PDFs with airSlate SignNow?

Yes, it is very easy to eSign personal details form PDFs with airSlate SignNow. The user-friendly interface enables quick eSigning, allowing multiple recipients to sign documents effortlessly while keeping track of all signatures in real-time.

Get more for Employee Personal Details

Find out other Employee Personal Details

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple