Td4 Form Trinidad

What is the Td4 Form Trinidad

The Td4 form is a tax document used in Trinidad and Tobago, primarily for reporting income earned by employees and other individuals. This form is essential for both employers and employees as it helps in the accurate reporting of income to the Trinidad and Tobago Board of Inland Revenue. The Td4 form includes details such as the employee's name, address, and taxpayer identification number, along with the amounts paid and any deductions applicable. Understanding the purpose of the Td4 form is crucial for compliance with local tax regulations.

How to use the Td4 Form Trinidad

Using the Td4 form involves several steps that ensure accurate reporting of income. Employers must fill out the form for each employee who has received payments during the tax year. It is important to gather all necessary information, including the employee's personal details and payment history. Once completed, the form should be submitted to the Board of Inland Revenue, either electronically or via mail. Employers should keep a copy for their records, as it may be required for future reference or audits.

Steps to complete the Td4 Form Trinidad

Completing the Td4 form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant information about the employee, including their full name, address, and taxpayer identification number.

- Document the total payments made to the employee during the tax year.

- Include any deductions that apply, such as taxes withheld or other relevant withholdings.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the Board of Inland Revenue by the specified deadline.

Legal use of the Td4 Form Trinidad

The Td4 form is legally recognized as a valid document for tax reporting in Trinidad and Tobago. It must be completed accurately to ensure compliance with local tax laws. Failure to submit the Td4 form or providing incorrect information can lead to penalties, including fines or other legal repercussions. It is essential for both employers and employees to understand the legal implications of this form to avoid issues with the tax authorities.

Key elements of the Td4 Form Trinidad

Several key elements must be included in the Td4 form to ensure its validity:

- Employee Information: Full name, address, and taxpayer identification number.

- Payment Details: Total amount paid to the employee during the reporting period.

- Deductions: Any applicable deductions that affect the taxable income.

- Employer Information: Name and address of the employer, along with their taxpayer identification number.

Form Submission Methods

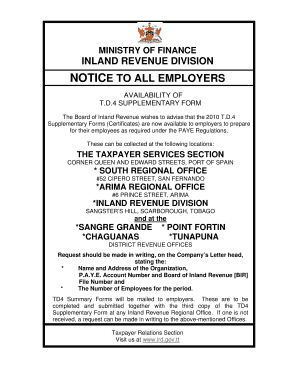

The Td4 form can be submitted to the Board of Inland Revenue through various methods. Employers have the option to submit the form electronically, which is often the preferred method due to its efficiency. Alternatively, the form can be mailed to the appropriate office or delivered in person. It is important to check for any specific submission guidelines or deadlines to ensure compliance.

Quick guide on how to complete td4 form trinidad

Accomplish Td4 Form Trinidad effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Handle Td4 Form Trinidad on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Td4 Form Trinidad without stress

- Obtain Td4 Form Trinidad and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Td4 Form Trinidad and ensure remarkable communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the td4 form trinidad

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the td4 form trinidad used for?

The td4 form trinidad is a tax declaration form used by individuals in Trinidad to report their income and calculate their tax obligations. It is essential for ensuring compliance with the local tax laws and is typically required annually. Submitting the td4 form trinidad accurately can help you avoid penalties and ensure you benefit from any available deductions.

-

How can airSlate SignNow help with submitting the td4 form trinidad?

airSlate SignNow simplifies the process of completing and submitting the td4 form trinidad by providing a user-friendly electronic signature solution. You can easily fill out the form, eSign it, and send it directly to the relevant authorities. This helps streamline the submission process, saving you time and reducing the chances of errors.

-

What are the pricing options for airSlate SignNow when using the td4 form trinidad?

airSlate SignNow offers various pricing plans to accommodate different business needs, including a plan that includes features for managing the td4 form trinidad. You can choose a monthly or annual subscription based on your usage requirements, ensuring you get the best value for eSigning and document management. Visit our pricing page to find the best option for your needs.

-

Is airSlate SignNow secure for handling the td4 form trinidad?

Yes, airSlate SignNow prioritizes security and compliance, making it a secure choice for handling sensitive documents like the td4 form trinidad. Our platform uses industry-standard encryption to protect your data, and we adhere to compliance regulations to keep your information safe. You can trust us to provide a reliable environment for your eSigned documents.

-

Can airSlate SignNow integrate with other software for managing the td4 form trinidad?

Absolutely! airSlate SignNow supports integration with various third-party applications to help you manage the td4 form trinidad effectively. These integrations allow you to sync data with accounting software and customer relationship management (CRM) systems, enhancing your workflow and ensuring seamless document processing.

-

What features does airSlate SignNow offer for the td4 form trinidad?

airSlate SignNow provides powerful features to streamline the completion and submission of the td4 form trinidad. You can leverage templates, automated workflows, customizable fields, and reminders to keep track of important deadlines. These capabilities enhance efficiency and help ensure that your tax documents are always accurate and submitted on time.

-

How do I get started with airSlate SignNow for the td4 form trinidad?

Getting started with airSlate SignNow for the td4 form trinidad is easy. Simply sign up for an account on our website, and you’ll gain access to our document management tools. From there, you can upload your td4 form trinidad, fill it out, and start eSigning in no time.

Get more for Td4 Form Trinidad

Find out other Td4 Form Trinidad

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement