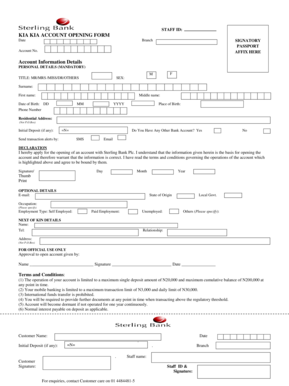

Sterling Bank Kia Kia Loan Form

What is the Sterling Bank Kia Kia Loan

The Sterling Bank Kia Kia Loan is a financial product designed to provide quick access to funds for individuals in need. This loan is often utilized for personal expenses, emergencies, or other financial needs. It is characterized by its straightforward application process and competitive interest rates, making it an appealing option for borrowers. The loan can be accessed through various methods, including a mobile app and USSD code, ensuring convenience for users.

How to use the Sterling Bank Kia Kia Loan

Using the Sterling Bank Kia Kia Loan is a simple process. Borrowers can initiate their loan application through the Kia Kia loan app or by using the USSD code. Once the application is submitted, users will receive a confirmation of their loan status. If approved, funds are typically disbursed quickly, allowing for immediate access to the necessary capital. This ease of use is one of the key advantages of the Kia Kia Loan.

Steps to complete the Sterling Bank Kia Kia Loan

To successfully complete the Sterling Bank Kia Kia Loan application, follow these steps:

- Download the Kia Kia loan app or access the service via the USSD code.

- Fill out the required application form with accurate personal and financial information.

- Submit the application and wait for a confirmation message regarding your loan status.

- If approved, review the loan terms and conditions before accepting.

- Receive the funds directly into your bank account or as specified in the loan agreement.

Legal use of the Sterling Bank Kia Kia Loan

The legal use of the Sterling Bank Kia Kia Loan is governed by regulations that ensure compliance with financial laws. Borrowers are expected to use the funds for legitimate purposes, such as personal expenses or emergencies. It is important for users to understand their obligations, including repayment terms and any associated fees. Compliance with these regulations helps maintain the integrity of the lending process.

Eligibility Criteria

To qualify for the Sterling Bank Kia Kia Loan, applicants must meet specific eligibility criteria. Generally, this includes being of legal age, having a valid identification document, and demonstrating a stable source of income. Additionally, credit history may be considered, although the Kia Kia Loan is designed to be accessible to a wide range of borrowers. Meeting these criteria is essential for a successful application.

Required Documents

When applying for the Sterling Bank Kia Kia Loan, certain documents are typically required to verify the applicant's identity and financial status. Commonly needed documents include:

- Government-issued identification (e.g., driver's license, passport)

- Proof of income (e.g., pay stubs, bank statements)

- Social Security number or Tax Identification Number

Having these documents ready can streamline the application process and improve the chances of approval.

Quick guide on how to complete sterling bank kia kia loan

Effortlessly Prepare Sterling Bank Kia Kia Loan on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to quickly create, edit, and eSign your documents without delays. Manage Sterling Bank Kia Kia Loan on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Sterling Bank Kia Kia Loan with Ease

- Find Sterling Bank Kia Kia Loan and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for those purposes by airSlate SignNow.

- Produce your eSignature using the Sign feature, which only takes a few seconds and holds the same legal authority as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign Sterling Bank Kia Kia Loan and ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sterling bank kia kia loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the kiakia loan app?

The kiakia loan app is a convenient mobile application designed to help users access loans quickly and easily. With a user-friendly interface, it allows borrowers to apply for personal loans and receive funds directly without lengthy paperwork.

-

How does the kiakia loan app work?

The kiakia loan app simplifies the borrowing process by enabling users to complete their loan applications online. After downloading the app, users enter their information and submit, with approval notifications typically received within minutes.

-

What are the benefits of using the kiakia loan app?

Using the kiakia loan app offers numerous benefits, including fast approval times, an intuitive interface, and the ability for users to manage their loans right from their smartphones. Plus, the streamlined process reduces the stress often associated with traditional loan applications.

-

Are there any fees associated with the kiakia loan app?

The kiakia loan app may have certain fees depending on the type of loan and repayment terms selected. Prospective borrowers are encouraged to review the app's fee structure to ensure they understand the total costs involved before committing to a loan.

-

Can I use the kiakia loan app on multiple devices?

Yes, the kiakia loan app is compatible with both Android and iOS devices, allowing users to access their accounts from smartphones or tablets. This cross-device functionality ensures a seamless experience for managing loans whether at home or on the go.

-

What types of loans can I obtain through the kiakia loan app?

The kiakia loan app offers various loan options, including personal loans, payday loans, and emergency funds. This variety allows users to choose the type of loan that best suits their financial needs.

-

Is my personal information secure with the kiakia loan app?

Security is a top priority for the kiakia loan app. The app employs advanced encryption technologies and robust privacy measures to protect users' personal and financial information throughout the application and borrowing process.

Get more for Sterling Bank Kia Kia Loan

- Bjs donation request form

- Scott credit union skip a payment form

- Champva school enrollment certification letter form

- Cigna promptpa form

- Raspa price in east avenue medical form

- Assumed name certificate bexar county form

- Application to join the flat rate scheme hm revenue amp customs hmrc gov form

- Anti fraud unit complaint form 1 2 4 5 ok

Find out other Sterling Bank Kia Kia Loan

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form