Notarized Statement of Assets and Liabilities Form

What is the notarized statement of assets and liabilities

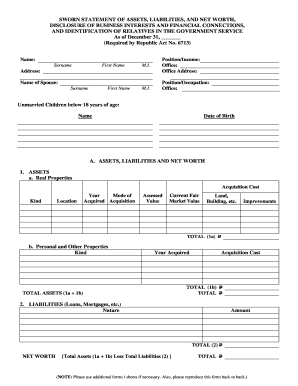

A notarized statement of assets and liabilities is a formal document used to declare an individual's or entity's financial position. This document typically includes a detailed list of all assets, such as cash, real estate, investments, and personal property, alongside all liabilities, including loans, credit card debts, and other obligations. The notarization process adds a layer of authenticity, ensuring that the information provided is verified by a licensed notary public. This is particularly important in legal situations, such as divorce proceedings, bankruptcy filings, or loan applications, where an accurate representation of financial status is required.

Key elements of the notarized statement of assets and liabilities

When preparing a notarized statement of assets and liabilities, several key elements must be included to ensure its validity and usefulness:

- Identification Information: Full name, address, and contact details of the individual or entity.

- Asset Details: A comprehensive list of all assets, categorized by type (e.g., cash, property, investments) with their respective values.

- Liability Information: A detailed account of all liabilities, including outstanding debts and obligations.

- Net Worth Calculation: A summary that calculates the net worth by subtracting total liabilities from total assets.

- Notary Section: A designated area for the notary public to sign and seal the document, confirming its authenticity.

Steps to complete the notarized statement of assets and liabilities

Completing a notarized statement of assets and liabilities involves several steps to ensure accuracy and compliance:

- Gather Financial Information: Collect all relevant documents, including bank statements, property deeds, and loan agreements.

- List Assets and Liabilities: Create a detailed list of all assets and liabilities, including their current values.

- Calculate Net Worth: Subtract total liabilities from total assets to determine net worth.

- Draft the Statement: Use a template or format that includes all necessary sections and information.

- Schedule a Notary Appointment: Find a licensed notary public to review and notarize the document.

- Sign in Presence of Notary: Sign the document in front of the notary to complete the notarization process.

Legal use of the notarized statement of assets and liabilities

The notarized statement of assets and liabilities serves various legal purposes. It is often required in court proceedings, such as family law cases, where financial transparency is crucial. Additionally, lenders may request this document during loan applications to assess the borrower's financial stability. In bankruptcy cases, it helps establish the debtor's financial situation, influencing the court's decisions. The notarization adds credibility, making the document more likely to be accepted by legal entities and financial institutions.

Examples of using the notarized statement of assets and liabilities

There are several scenarios in which a notarized statement of assets and liabilities may be utilized:

- Divorce Proceedings: To disclose financial status during asset division negotiations.

- Loan Applications: To provide lenders with a clear picture of the applicant's financial health.

- Bankruptcy Filings: To outline assets and liabilities for the court's review.

- Estate Planning: To clarify the financial situation of an individual when creating wills or trusts.

Quick guide on how to complete notarized statement of assets and liabilities

Complete Notarized Statement Of Assets And Liabilities effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without hindrances. Manage Notarized Statement Of Assets And Liabilities on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to alter and electronically sign Notarized Statement Of Assets And Liabilities without hassle

- Find Notarized Statement Of Assets And Liabilities and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Notarized Statement Of Assets And Liabilities and ensure effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notarized statement of assets and liabilities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the difference between asset vs liabilities in financial reporting?

In financial reporting, assets represent what a company owns, while liabilities represent what it owes. Understanding the difference between asset vs liabilities is crucial for evaluating a company's financial health. This differentiation helps businesses make informed decisions about resource allocation and investment opportunities.

-

How can airSlate SignNow help with managing assets vs liabilities?

airSlate SignNow streamlines document management processes, enabling businesses to efficiently track and manage assets vs liabilities. By digitally signing and sending financial reports, you can ensure that all documentation regarding assets and liabilities is accurate and readily accessible. This can lead to better financial decision-making and improved regulatory compliance.

-

Is airSlate SignNow cost-effective for tracking assets vs liabilities?

Yes, airSlate SignNow offers a cost-effective solution for managing documents related to assets vs liabilities. With flexible pricing plans, businesses can choose a package that fits their financial budget while still enjoying robust features for document management. This enables organizations to save money while effectively managing their financial statements.

-

What features of airSlate SignNow are beneficial for asset vs liabilities documentation?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage, making it easier to manage asset vs liabilities documentation. These features help ensure that all related paperwork is organized and easily retrievable, which is essential for financial planning and audits. This efficiency allows businesses to focus on growth rather than paperwork.

-

Can airSlate SignNow integrate with accounting software for better asset vs liabilities tracking?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to enhance your tracking of asset vs liabilities. This integration allows for automatic updating of financial documents whenever changes occur, ensuring that your records are always current. It facilitates better collaboration between teams handling different aspects of asset and liability management.

-

What are the benefits of using airSlate SignNow for asset vs liabilities management?

Using airSlate SignNow for asset vs liabilities management offers several benefits, including improved accuracy, reduced processing time, and enhanced security. By eliminating paper documents, businesses can quickly and securely manage their asset vs liabilities without the risk of loss or misplacement. Additionally, the platform supports eSigning, minimizing delays in document approvals.

-

How does airSlate SignNow ensure the security of documents related to asset vs liabilities?

airSlate SignNow employs advanced encryption and security protocols to protect documents related to asset vs liabilities. This ensures that sensitive financial information stays confidential while being easily accessible to authorized users. Regular security audits and compliance measures also guarantee the highest levels of data protection.

Get more for Notarized Statement Of Assets And Liabilities

Find out other Notarized Statement Of Assets And Liabilities

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online