Formulario 3911

What is the Formulario 3911

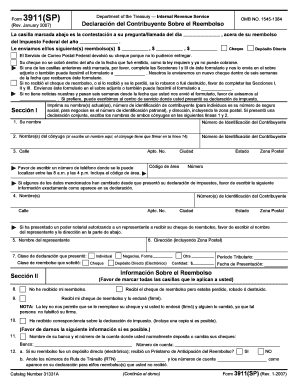

The Formulario 3911, also known as the IRS Form 3911, is a document used by taxpayers in the United States to request a refund trace. This form is particularly useful for individuals who have not received their tax refund or have concerns about the status of their refund. By completing this form, taxpayers can initiate an investigation into the whereabouts of their refund, ensuring they receive the funds they are entitled to.

How to use the Formulario 3911

To use the Formulario 3911 effectively, taxpayers need to provide specific information regarding their tax return and refund. This includes details such as the taxpayer's name, address, Social Security number, and the tax year in question. The form also requires information about the refund amount and the method of payment, whether it was via check or direct deposit. Once completed, the form can be submitted to the IRS for processing.

Steps to complete the Formulario 3911

Completing the Formulario 3911 involves several straightforward steps:

- Gather necessary information, including your tax return details and refund status.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check the information for correctness to avoid delays.

- Submit the form to the appropriate IRS address or via an authorized electronic method.

Legal use of the Formulario 3911

The Formulario 3911 is legally recognized as a valid means for taxpayers to request a refund trace. It complies with IRS regulations, ensuring that the information provided is protected under privacy laws. Proper use of this form can facilitate the resolution of refund issues, making it an essential tool for taxpayers who need assistance in tracking their refunds.

Key elements of the Formulario 3911

Several key elements must be included in the Formulario 3911 to ensure its effectiveness:

- Taxpayer Information: Name, address, and Social Security number.

- Tax Year: The specific year for which the refund is being traced.

- Refund Amount: The total amount of the expected refund.

- Payment Method: Indication of whether the refund was issued by check or direct deposit.

Form Submission Methods

The Formulario 3911 can be submitted through various methods, allowing flexibility for taxpayers. Options include:

- Mail: Sending the completed form to the designated IRS address.

- Online: Utilizing electronic submission options through authorized platforms.

- In-Person: Visiting a local IRS office to submit the form directly.

Quick guide on how to complete formulario 3911 44735

Complete Formulario 3911 effortlessly on any gadget

Digital document administration has gained traction among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Formulario 3911 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to alter and electronically sign Formulario 3911 without hassle

- Find Formulario 3911 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to preserve your modifications.

- Select your preferred delivery method for your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Formulario 3911 to ensure effective communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the formulario 3911 44735

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3911 sp and why is it important?

Form 3911 SP is a critical document used to request a refund for overpaid taxes. Understanding this form is essential for ensuring accurate tax filings and prompt refunds. With airSlate SignNow, businesses can eSign and manage Form 3911 SP efficiently, minimizing delays.

-

How does airSlate SignNow help with form 3911 sp?

airSlate SignNow offers a streamlined process for completing and signing Form 3911 SP electronically. It enhances the efficiency of tax-related paperwork, allowing businesses to save time and reduce errors in form submissions. Plus, the easy-to-use interface ensures that users can navigate the process effortlessly.

-

What pricing plans are available for using airSlate SignNow when filing form 3911 sp?

airSlate SignNow provides flexible pricing plans that cater to various business needs when managing forms, including Form 3911 SP. These plans are competitively priced and designed to be cost-effective for businesses of all sizes. You can choose the plan that best fits your organization's workflow and budget.

-

Are there integration options with other tools for form 3911 sp?

Yes, airSlate SignNow integrates seamlessly with a variety of business tools and applications, making it easier to manage Form 3911 SP alongside your existing workflows. This integration helps ensure that all your data is synchronized and accessible across platforms, enhancing productivity.

-

What are the benefits of using airSlate SignNow for form 3911 sp?

Using airSlate SignNow for managing Form 3911 SP provides numerous benefits, including quick eSigning capabilities, enhanced document security, and easy tracking of the signing process. Furthermore, it helps businesses avoid the hassle of traditional paperwork and simplifies the overall tax refund process.

-

Can I store my form 3911 sp securely with airSlate SignNow?

Absolutely! airSlate SignNow offers secure storage options for documents, including Form 3911 SP. Your sensitive information is protected with advanced encryption and compliance with industry standards, ensuring that your data remains confidential and safe.

-

How can I get support for issues related to form 3911 sp on airSlate SignNow?

airSlate SignNow provides excellent customer support to assist users with any issues related to Form 3911 SP. You can signNow out via their support channels, including live chat and email, to get prompt assistance. Their knowledgeable support team is ready to help you navigate any challenges you may face.

Get more for Formulario 3911

Find out other Formulario 3911

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement