H 3gov Form

What is the H 3gov

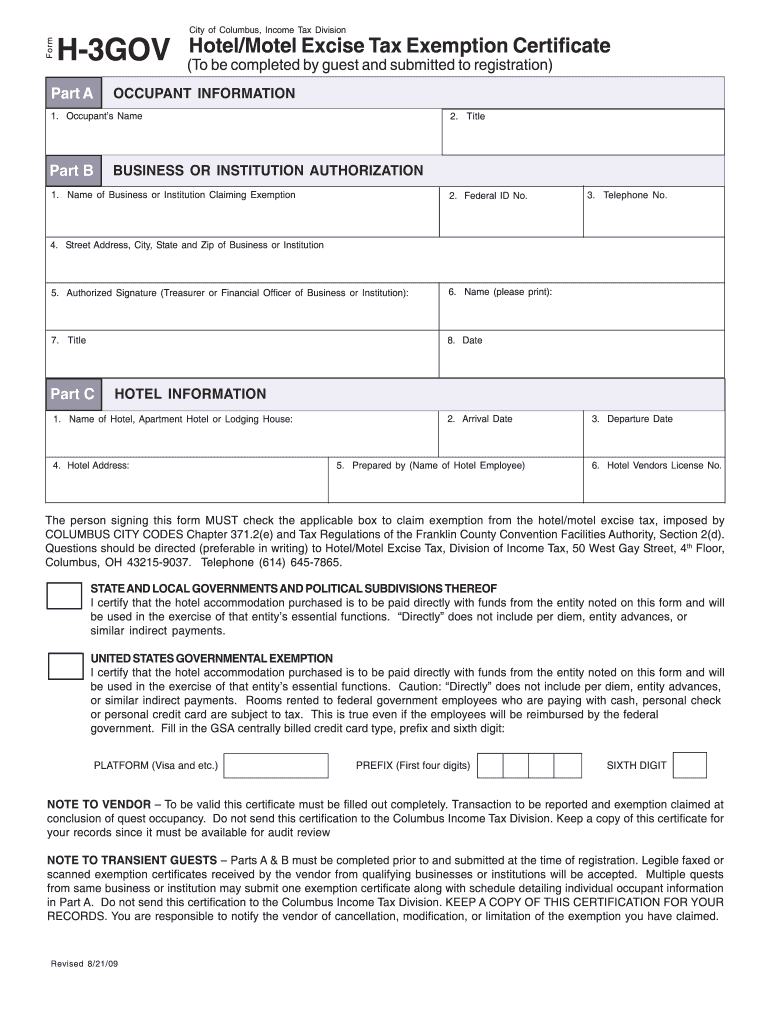

The H 3gov is a specific form used in Ohio for hotel tax exemption purposes. It allows businesses and individuals to claim exemption from hotel taxes under certain conditions, particularly when the stay is related to official business or government activities. This form is essential for ensuring compliance with state tax regulations while also providing a means for eligible parties to avoid unnecessary expenses related to hotel accommodations.

How to use the H 3gov

Using the H 3gov involves several steps to ensure that the form is completed correctly. First, gather all necessary information, including the details of the stay, the purpose of the trip, and the name of the hotel. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, it should be presented to the hotel at the time of check-in to facilitate the tax exemption process.

Steps to complete the H 3gov

Completing the H 3gov involves a straightforward process:

- Gather necessary information, including identification and travel details.

- Access the H 3gov form online or obtain a physical copy.

- Fill out the form with accurate information, ensuring all fields are completed.

- Review the form for any errors or omissions.

- Submit the form to the hotel at check-in to claim the tax exemption.

Legal use of the H 3gov

The H 3gov form is legally binding when completed accurately and submitted in accordance with Ohio state laws. It is important to ensure that the information provided is truthful and that the exemption is applicable to the stay. Misuse of the form can lead to penalties, including fines or denial of the exemption.

Eligibility Criteria

To qualify for using the H 3gov, individuals or businesses must meet specific eligibility criteria. Typically, this includes being a government employee or a representative of a tax-exempt organization traveling for official purposes. It is essential to verify that the reason for the hotel stay aligns with the exemption requirements outlined by Ohio tax regulations.

Required Documents

When completing the H 3gov, certain documents may be required to support the exemption claim. These documents often include:

- Proof of government employment or tax-exempt status.

- Details of the travel itinerary and purpose.

- Identification, such as a government-issued ID.

Form Submission Methods

The H 3gov can typically be submitted in person at the hotel during check-in. Some hotels may also accept the form via email or fax, but this varies by establishment. It is advisable to check with the hotel in advance regarding their submission preferences to ensure a smooth check-in process.

Quick guide on how to complete h 3gov

Effortlessly prepare H 3gov on any device

Digital document management has gained traction among companies and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without any delays. Manage H 3gov on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign H 3gov with ease

- Obtain H 3gov and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to confirm your adjustments.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets all your document management needs with just a few clicks from any device of your preference. Alter and eSign H 3gov and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the h 3gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is h 3gov and how does it relate to airSlate SignNow?

h 3gov refers to a specific legal compliance framework that airSlate SignNow helps businesses adhere to by providing secure electronic signatures. This compliance ensures that your eSigning processes meet regulatory requirements, making it an ideal solution for both public and private sector organizations.

-

What are the pricing options for airSlate SignNow under the h 3gov framework?

airSlate SignNow offers various pricing plans that cater to different organizational needs, including options for h 3gov compliance. Depending on the features you require, you can choose from basic to advanced plans to ensure that your business stays compliant while maximizing efficiency.

-

What features does airSlate SignNow offer for h 3gov compliance?

The platform provides a range of features including customizable templates, advanced security measures, and detailed audit trails, which are essential for maintaining h 3gov compliance. These features enhance the user experience and ensure secure and legally binding eSignatures.

-

How does airSlate SignNow support integration with other tools while ensuring h 3gov compliance?

airSlate SignNow seamlessly integrates with popular business applications, such as CRMs and document management systems, all while supporting h 3gov compliance. This allows organizations to streamline their processes without sacrificing security or compliance.

-

What are the benefits of using airSlate SignNow for h 3gov compliance?

Using airSlate SignNow for h 3gov compliance offers numerous benefits, including enhanced security, improved efficiency, and reduced processing time for documents. Additionally, it enables teams to collaborate more effectively, ensuring that all members are aligned with compliance requirements.

-

Is airSlate SignNow suitable for both small businesses and large enterprises under the h 3gov guidelines?

Yes, airSlate SignNow is designed to be scalable, making it suitable for both small businesses and large enterprises seeking h 3gov compliance. Regardless of your organization's size, our solution can be tailored to meet your specific needs for document management and eSigning.

-

Can airSlate SignNow help with training staff on h 3gov compliance processes?

Absolutely! airSlate SignNow provides resources and training materials that focus on h 3gov compliance processes. This ensures that your staff is well-equipped to handle eSigning in accordance with the necessary regulations and enhances their overall productivity.

Get more for H 3gov

Find out other H 3gov

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF