Form 60

What is the Form 60

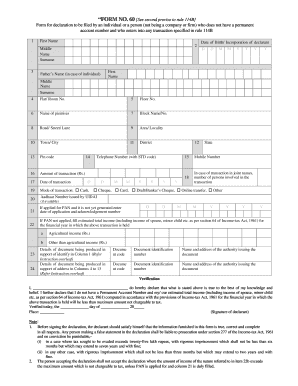

The Form No 60 is a declaration form used primarily in the context of tax compliance in the United States. It is typically required when individuals or entities do not possess a Taxpayer Identification Number (TIN) or Social Security Number (SSN). This form serves as a means for taxpayers to provide necessary information to the Internal Revenue Service (IRS) or other relevant authorities, ensuring that their financial activities are properly documented and reported. By completing Form 60, individuals can avoid penalties associated with failing to provide a TIN or SSN when required.

Steps to complete the Form 60

Completing Form No 60 involves several straightforward steps. First, gather all necessary personal information, including your name, address, and any relevant financial details. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays or complications. It is essential to review the form for any errors before submission. Once completed, you can submit the form electronically or by mail, depending on the requirements of the specific authority requesting it. Make sure to keep a copy of the submitted form for your records.

Legal use of the Form 60

The legal use of Form No 60 is crucial for compliance with IRS regulations. This form must be filled out accurately to ensure that the information provided is valid and can be used for tax reporting purposes. The second proviso of Rule 114B outlines specific conditions under which this form can be utilized, emphasizing the importance of providing truthful and complete information. Failure to adhere to these guidelines can result in penalties, including fines or additional scrutiny from tax authorities.

How to obtain the Form 60

Obtaining Form No 60 is a simple process. The form is available through the IRS website or can be requested directly from tax offices. Additionally, many tax preparation software programs include this form as part of their offerings, allowing users to fill it out digitally. If you prefer a physical copy, you can print the form from the IRS website or request it by mail. Ensure that you have the most current version of the form to avoid any compliance issues.

Form Submission Methods

Form No 60 can be submitted through various methods, depending on the requirements of the specific authority. The most common methods include online submission through the IRS e-file system, mailing a physical copy to the appropriate address, or delivering it in person to a local tax office. When submitting electronically, ensure that you use a secure platform that complies with eSignature regulations to maintain the integrity of your submission.

Required Documents

When completing Form No 60, certain documents may be required to support the information provided. These documents typically include proof of identity, such as a driver's license or passport, and any relevant financial records that demonstrate your income or financial activities. Having these documents ready can facilitate the completion of the form and ensure that all necessary information is accurately reported to the IRS or other authorities.

Quick guide on how to complete form 60 389151962

Effortlessly Prepare Form 60 on Any Device

Managing documents online has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Form 60 on any platform using airSlate SignNow apps on Android or iOS and streamline any document-related task today.

How to Edit and eSign Form 60 Without Difficulty

- Find Form 60 and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for this purpose provided by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or a shared link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and eSign Form 60 to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 60 389151962

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form No 60 Second Proviso Rule 114B?

Form No 60 under the second proviso of Rule 114B is a declaration used by individuals to provide their personal information when making certain transactions. It allows individuals who do not have Permanent Account Numbers (PAN) to engage in specified financial activities. Understanding Form No 60 and its requirements can simplify paperwork and compliance for those who need it.

-

How does airSlate SignNow support the signing of Form No 60 Second Proviso Rule 114B?

airSlate SignNow offers a streamlined platform for electronically signing Form No 60 under the second proviso of Rule 114B. Users can quickly upload the form, get it signed, and store it securely. This helps maintain compliance while ensuring that the signing process is efficient.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate the needs of different businesses, starting from a free trial to premium subscriptions. Each plan includes features tailored for electronic signing and document management, including support for Form No 60 Second Proviso Rule 114B. Evaluate which plan best suits your volume of transactions and user requirements.

-

What features does airSlate SignNow provide for managing documents like Form No 60?

With airSlate SignNow, users gain access to features such as customizable templates, automated workflows, and easy document sharing. These features enhance the process of managing documents like Form No 60 under the second proviso of Rule 114B, making it simpler and faster to handle essential paperwork. Additionally, users can track the status of signed documents in real-time.

-

Are there integrations available with airSlate SignNow for document processing?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing document processing capabilities. This includes CRM systems, cloud storage solutions, and productivity tools, allowing for easy management of Form No 60 and other documents. These integrations help streamline workflows, making it easier to comply with regulations like Rule 114B.

-

What are the benefits of using airSlate SignNow for Form No 60?

Using airSlate SignNow for Form No 60 under the second proviso of Rule 114B provides numerous benefits, such as cost savings, time efficiency, and enhanced security. The platform ensures that all documents are handled securely and compliantly, which is crucial for sensitive financial information. Furthermore, the user-friendly interface simplifies the signing process for all parties involved.

-

How can businesses ensure compliance when using Form No 60 with airSlate SignNow?

Businesses can ensure compliance while using Form No 60 under Rule 114B by leveraging the compliance features built into airSlate SignNow. This includes secure storage of signed documents and audit trails that track every step of the signing process. By adhering to these practices, businesses can confidently handle transactions without any regulatory concerns.

Get more for Form 60

Find out other Form 60

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement