Good Faith Estimate Form

What is the Good Faith Estimate

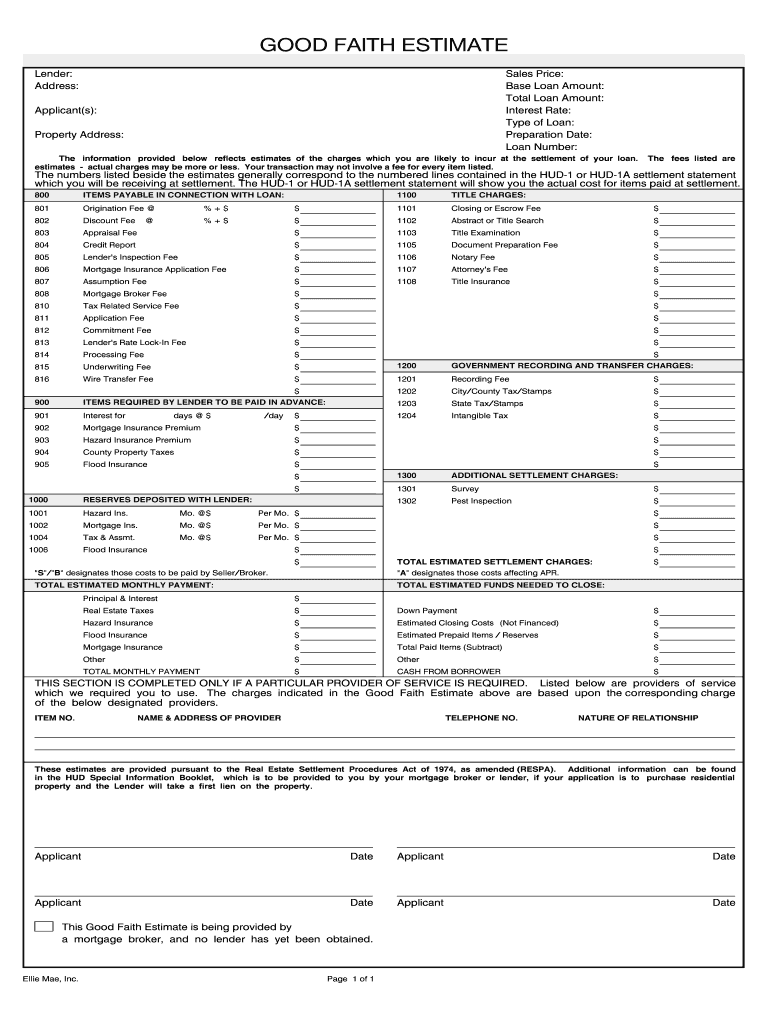

The Good Faith Estimate (GFE) is a crucial document in the mortgage process that outlines the estimated closing costs associated with a loan. It provides borrowers with a clear understanding of the financial obligations they will incur when finalizing a mortgage. The GFE includes various fees, such as loan origination fees, title insurance, and appraisal costs, allowing borrowers to compare offers from different lenders effectively. Understanding the GFE is essential for making informed decisions about mortgage options and ensuring transparency in the lending process.

How to use the Good Faith Estimate

Using the Good Faith Estimate involves several steps to ensure that borrowers can effectively evaluate their mortgage options. First, review the GFE carefully to understand each fee listed. Compare the estimates from different lenders to identify the most competitive offers. Pay particular attention to the total estimated closing costs and the interest rates provided. This comparison helps borrowers make informed choices about which lender to select. Additionally, keep the GFE on hand during the loan process, as it serves as a reference point for what was initially discussed with the lender.

Key elements of the Good Faith Estimate

The Good Faith Estimate contains several key elements that are vital for borrowers to understand. These elements typically include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Estimated Monthly Payment: A projection of what the monthly payments will be, including principal and interest.

- Closing Costs: A breakdown of all fees associated with closing the loan, including lender fees, title fees, and third-party charges.

- Prepayment Penalties: Information on any penalties for paying off the loan early.

Understanding these components helps borrowers navigate the mortgage process with greater clarity and confidence.

Steps to complete the Good Faith Estimate

Completing the Good Faith Estimate requires careful attention to detail. Here are the steps to follow:

- Gather Information: Collect all necessary financial documents, including income statements and credit reports.

- Consult with Your Lender: Discuss your financial situation and loan needs with your lender to receive an accurate GFE.

- Review the Estimate: Examine the GFE for accuracy, ensuring all fees and terms are clearly outlined.

- Ask Questions: If any part of the GFE is unclear, reach out to your lender for clarification.

- Keep Records: Store the GFE in a safe place for future reference during the loan process.

Following these steps can help ensure that borrowers complete the GFE accurately and understand their mortgage commitments.

Legal use of the Good Faith Estimate

The Good Faith Estimate is legally required under the Real Estate Settlement Procedures Act (RESPA). Lenders must provide this document to borrowers within three business days of receiving a loan application. The GFE serves to protect consumers by ensuring they receive transparent and accurate information about the costs associated with their mortgage. Failure to comply with RESPA regulations can result in penalties for lenders, making it essential for borrowers to understand their rights regarding the GFE.

How to obtain the Good Faith Estimate

Obtaining a Good Faith Estimate is a straightforward process. Borrowers can request a GFE from potential lenders when applying for a mortgage. It is advisable to approach multiple lenders to compare their estimates. Most lenders provide the GFE as part of the initial loan application process, either in person or through their online platforms. Ensuring that you receive the GFE promptly allows you to make informed decisions about your mortgage options.

Quick guide on how to complete good faith estimate 100069520

Easily Prepare Good Faith Estimate on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Good Faith Estimate on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The Simplest Way to Modify and eSign Good Faith Estimate Effortlessly

- Find Good Faith Estimate and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious document searches, or errors that necessitate reprinting. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Edit and eSign Good Faith Estimate and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the good faith estimate 100069520

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does the gfe acronym stand for in business communications?

The gfe acronym typically stands for 'Good Faith Estimate,' which is a document that provides an estimate of the costs a borrower will incur when closing a loan. In business communications, understanding the gfe acronym is essential for ensuring transparency and trust between parties. airSlate SignNow simplifies the sharing of such documents, making the process more efficient.

-

How can airSlate SignNow help with gfe acronym documentation?

airSlate SignNow facilitates the electronic signing and management of documents related to the gfe acronym, such as Good Faith Estimates. By using our platform, users can quickly send, sign, and store these critical documents securely, ensuring compliance and reducing processing time for all parties involved.

-

Is there a pricing plan for businesses needing gfe acronym services?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet the needs of different businesses, including those working with the gfe acronym. Our plans are designed to provide cost-effective solutions for document generation, e-signatures, and secure storage, making it accessible for companies of all sizes.

-

What features does airSlate SignNow offer for handling the gfe acronym?

Our platform offers user-friendly features for managing documents associated with the gfe acronym, including customizable templates and collaboration tools. Advanced tracking and reporting functionalities allow users to monitor document status and ensure timely processing. These features enhance efficiency and keep your transactions organized.

-

Can airSlate SignNow integrate with other tools for gfe acronym management?

Absolutely! airSlate SignNow provides seamless integrations with various tools that can help manage the gfe acronym efficiently, such as CRM platforms, project management software, and cloud storage services. This connectivity ensures that all your document needs, including Good Faith Estimates, are handled effortlessly.

-

What are the benefits of using airSlate SignNow for gfe acronym-related documents?

Using airSlate SignNow for gfe acronym documents streamlines the entire process of document management. It enhances security with encrypted signatures, increases turnaround times, and reduces paper usage. These benefits not only save time but also support eco-friendly practices in your business.

-

Is airSlate SignNow compliant with regulations related to the gfe acronym?

Yes, airSlate SignNow complies with industry regulations regarding the gfe acronym and electronic signatures. Our platform adheres to standards set by the ESIGN Act and UETA, ensuring that your Good Faith Estimate documents are legally valid and protected. You can rely on us for compliant document handling.

Get more for Good Faith Estimate

- Univita form

- Video production request form

- Hylife application form

- Dch 0893 vision approval site state of michigan michigan form

- Abandonment of right of way application city of delray beach form

- Financial gap administrator llc cancellation reque form

- Supplemental affidavit to request fee waiver fee103 form

- Form 12 901b3 petition for dissolution of florida courts

Find out other Good Faith Estimate

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract