Form P50 Ireland

What is the Form P50 Ireland

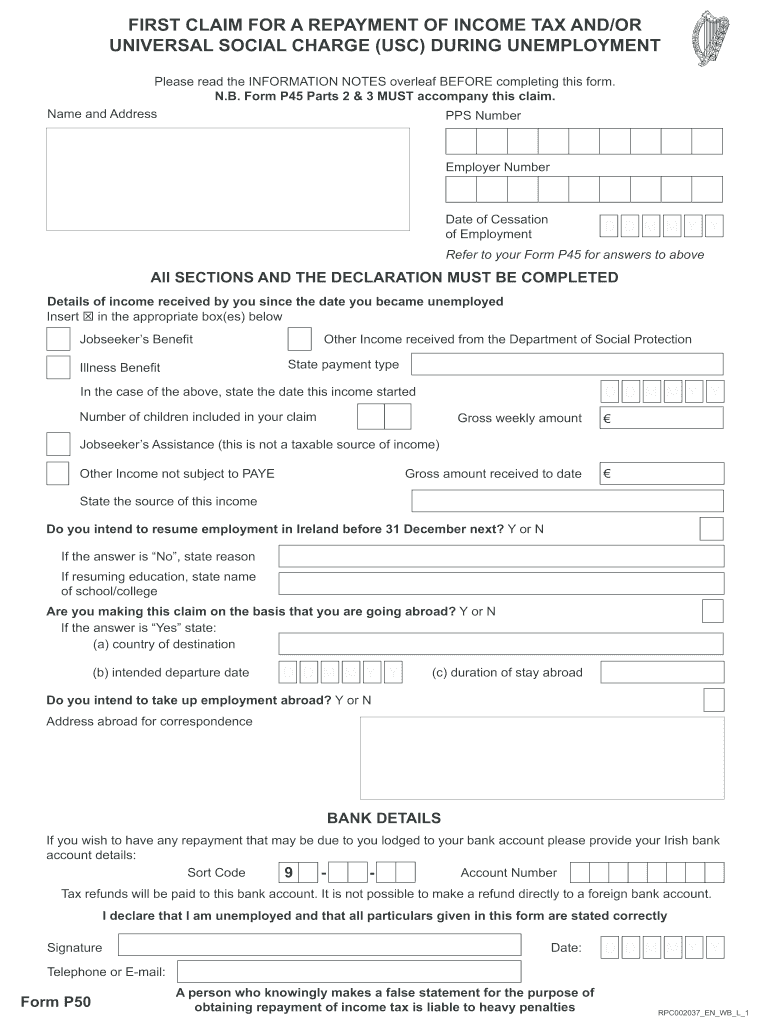

The Form P50 is a tax document used in Ireland, primarily for individuals who have ceased employment and wish to claim a refund of overpaid taxes. This form is essential for those who find themselves in a situation where they have paid more tax than they owe, particularly when they leave a job or become unemployed. The P50 allows them to reclaim their tax credits and ensure they receive the correct amount of tax back from the Revenue Commissioners.

How to use the Form P50 Ireland

To effectively use the Form P50, individuals must first ensure they meet the eligibility criteria, which typically includes having left employment and having overpaid tax. The form can be filled out online or printed for submission. It is crucial to provide accurate personal information, including your PPS number, and details about your previous employment. Once completed, the form should be submitted to the Revenue Commissioners for processing.

Steps to complete the Form P50 Ireland

Completing the Form P50 involves several key steps:

- Gather necessary information, including your PPS number and employment details.

- Access the form online or download the P50 PDF version.

- Fill in your personal information accurately, ensuring all details match your official records.

- Provide information about your previous employer and the reason for leaving your job.

- Review the form for any errors before submission.

- Submit the completed form to the Revenue Commissioners via the preferred method.

Legal use of the Form P50 Ireland

The legal use of the Form P50 is governed by tax regulations in Ireland. It is important to ensure that all information provided is truthful and accurate to avoid penalties. The form serves as a formal request for a tax refund and must be submitted in accordance with the guidelines set forth by the Revenue Commissioners. Misuse of the form or submission of false information can lead to legal repercussions, including fines or audits.

Required Documents

When submitting the Form P50, certain documents may be required to support your claim. These typically include:

- Proof of identity, such as a passport or driver's license.

- Documentation from your previous employer, such as a P45 or payslips.

- Any additional forms or evidence that substantiate your claim for a tax refund.

Form Submission Methods (Online / Mail / In-Person)

The Form P50 can be submitted through various methods to accommodate different preferences:

- Online submission via the Revenue Commissioners' website, which is often the quickest method.

- Mailing a printed version of the form to the appropriate Revenue office.

- In-person submission at local Revenue offices, though this may require an appointment.

Quick guide on how to complete form p50 ireland

Complete Form P50 Ireland effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form P50 Ireland on any platform using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

The easiest way to modify and eSign Form P50 Ireland seamlessly

- Locate Form P50 Ireland and then click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then hit the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form P50 Ireland and ensure excellent communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form p50 ireland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the p50 online feature in airSlate SignNow?

The p50 online feature in airSlate SignNow allows users to streamline their document signing process efficiently. This feature ensures that documents are signed promptly, enhancing workflow productivity and collaboration across teams.

-

How does pricing work for p50 online with airSlate SignNow?

Pricing for the p50 online service varies based on your business needs and the number of users. airSlate SignNow offers flexible plans that are both cost-effective and scalable, making it suitable for businesses of all sizes.

-

What are the key benefits of using p50 online?

Using p50 online through airSlate SignNow provides numerous benefits, including faster document turnaround times and improved operational efficiency. Additionally, it enhances the security of sensitive documents through encryption and compliance measures.

-

Can I integrate p50 online with other applications?

Yes, airSlate SignNow's p50 online feature integrates seamlessly with various applications, such as Google Drive, Salesforce, and more. This allows for a cohesive workflow and helps businesses manage their documents all in one place.

-

Is the p50 online feature easy to use for beginners?

Absolutely! The p50 online feature in airSlate SignNow is designed to be user-friendly, making it accessible for beginners. The intuitive interface guides users through the document signing process, minimizing the learning curve.

-

What types of documents can I sign using p50 online?

With p50 online, you can sign a variety of document types, including contracts, agreements, and forms. airSlate SignNow supports numerous file formats, ensuring you can manage all your signing needs without hassle.

-

How secure is my data when using p50 online?

Security is a top priority when using p50 online with airSlate SignNow. The platform employs robust encryption methods and follows industry standards to protect your confidential documents and sensitive information.

Get more for Form P50 Ireland

- Commissaryheadquarters letter of agreement form

- Public notice hearing examiners for appointment to panel form

- Statement of mailing 1f p 738 hawaii state judiciary form

- Twdb 0216 affirmative steps solicitation report form disadvantaged business enterprises dbe

- Assignment form supreme court cloudfront net

- Request for a duplicate instruction permitdriver license form

- Client tax organizer worksheet pdf download form

- 24 vtag application eastern mennonite university form

Find out other Form P50 Ireland

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors