Indiana St 103 Form

What is the Indiana St 103

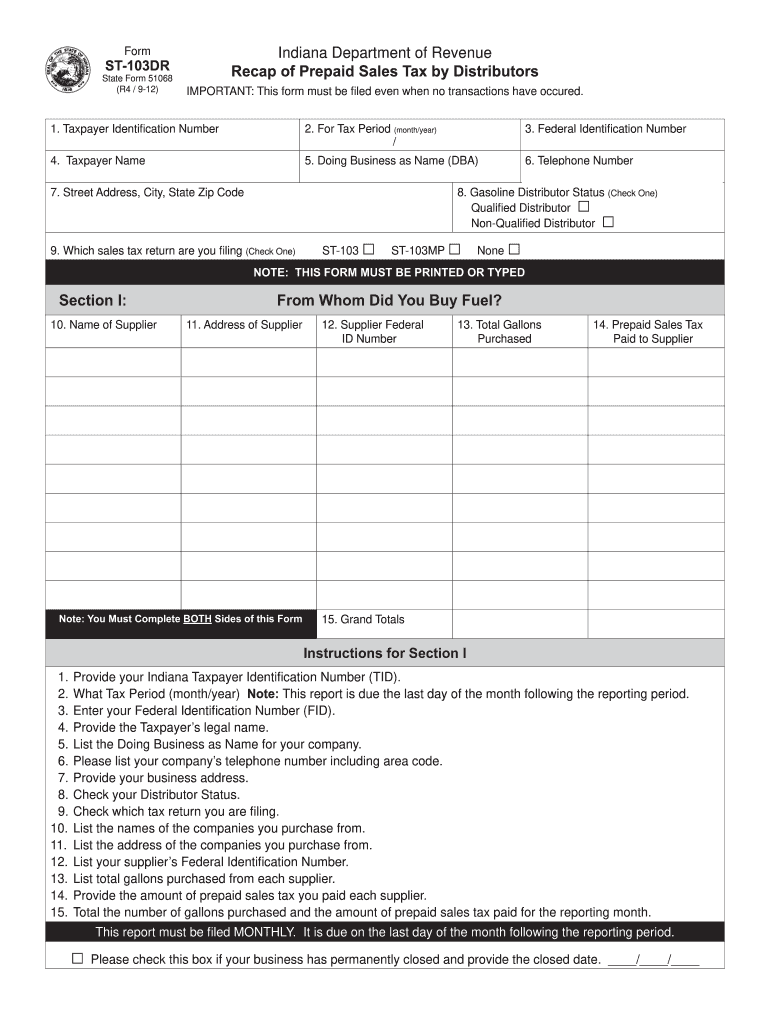

The Indiana St 103 is a sales tax return form used by businesses operating in Indiana. This form allows taxpayers to report and remit sales tax collected on taxable sales made during a specific period. It is essential for maintaining compliance with state tax regulations and ensuring that the correct amount of sales tax is paid to the state. The form is particularly relevant for retailers, wholesalers, and service providers who are required to collect sales tax from their customers.

How to use the Indiana St 103

Using the Indiana St 103 involves several key steps. First, businesses must gather all necessary sales records for the reporting period. This includes total sales, tax-exempt sales, and any deductions. Next, the taxpayer completes the form by entering the required information, such as total sales and the amount of sales tax collected. After filling out the form, it must be submitted to the Indiana Department of Revenue either electronically or via mail, depending on the business's filing preference.

Steps to complete the Indiana St 103

Completing the Indiana St 103 requires careful attention to detail. Follow these steps:

- Gather sales records for the reporting period.

- Calculate total sales and sales tax collected.

- Fill out the form with accurate figures.

- Review the form for any errors or omissions.

- Submit the completed form to the Indiana Department of Revenue.

Legal use of the Indiana St 103

The legal use of the Indiana St 103 is crucial for businesses to avoid penalties and ensure compliance with state laws. The form must be completed accurately and submitted by the designated deadlines. Failure to file or incorrect reporting can result in fines or other legal consequences. It is important for businesses to understand their obligations under Indiana sales tax law to maintain good standing with the state.

Filing Deadlines / Important Dates

Filing deadlines for the Indiana St 103 vary based on the business's reporting frequency. Generally, monthly filers must submit their forms by the 20th of the following month, while quarterly filers have until the 20th of the month following the end of the quarter. Annual filers must submit their forms by January 31 of the following year. Keeping track of these dates is essential to avoid late fees and ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Indiana St 103 can be submitted through various methods. Businesses may choose to file online via the Indiana Department of Revenue's e-filing system, which is often the quickest and most efficient option. Alternatively, the form can be mailed to the appropriate address provided by the state. In-person submissions may also be possible at designated state offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete indiana st 103

Easily Prepare Indiana St 103 on Any Device

Digital document management has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Indiana St 103 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to Modify and eSign Indiana St 103 Effortlessly

- Find Indiana St 103 and click Get Form to start.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from any preferred device. Modify and eSign Indiana St 103 and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana st 103

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana ST-103 printable form?

The Indiana ST-103 printable form is a sales tax exemption certificate used for tax-exempt purchases in the state of Indiana. It allows qualified buyers to make purchases without paying sales tax. Using airSlate SignNow, you can digitally fill out, sign, and securely send the Indiana ST-103 printable form with ease.

-

How can I access the Indiana ST-103 printable form?

You can easily access the Indiana ST-103 printable form through the airSlate SignNow platform. Once you log in, navigate to the templates section where you can find and customize the form to suit your needs. This makes it simple to prepare your Indiana ST-103 printable form anytime, anywhere.

-

Is there a cost associated with using airSlate SignNow for the Indiana ST-103 printable form?

airSlate SignNow offers flexible pricing plans tailored to various business needs, including the use of the Indiana ST-103 printable form. We provide cost-effective solutions that scale with your organization, so you can manage your documents and forms without breaking the bank.

-

Can I customize the Indiana ST-103 printable form in airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize the Indiana ST-103 printable form to meet your specific requirements. You can add fields, logos, or additional instructions and modify the layout as needed. This flexibility ensures that your form aligns perfectly with your business branding.

-

How does airSlate SignNow improve the efficiency of using the Indiana ST-103 printable form?

Using airSlate SignNow streamlines the process of handling the Indiana ST-103 printable form, enabling you to eSign and share documents quickly and securely. This eliminates the need for printing, scanning, and physical delivery, saving you time and reducing paperwork. Enjoy a more efficient workflow with our user-friendly platform.

-

Are there any integrations available for the Indiana ST-103 printable form with airSlate SignNow?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, making it easy to use the Indiana ST-103 printable form within your existing workflows. Whether you're using CRM systems, cloud storage services, or productivity tools, our integrations help streamline the entire process while maintaining ease of access.

-

What are the security features for the Indiana ST-103 printable form in airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Indiana ST-103 printable form. We deploy advanced encryption protocols, secure cloud storage, and user authentication processes to protect your data effectively. You can trust that your sensitive information remains safe while using our platform.

Get more for Indiana St 103

- 604c pdf form

- British council certificate pdf form

- Mad minute online form

- Modern marvels renewable energy worksheet answers form

- Prn authorization letter 76441204 form

- Tattoo apprenticeship checklist form

- Home affordable modification program hardship affidavit form 1021 home affordable modification program hardship affidavit

- Employee starter form 650166683

Find out other Indiana St 103

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure