Wht 436 Form

What is the WHT 436?

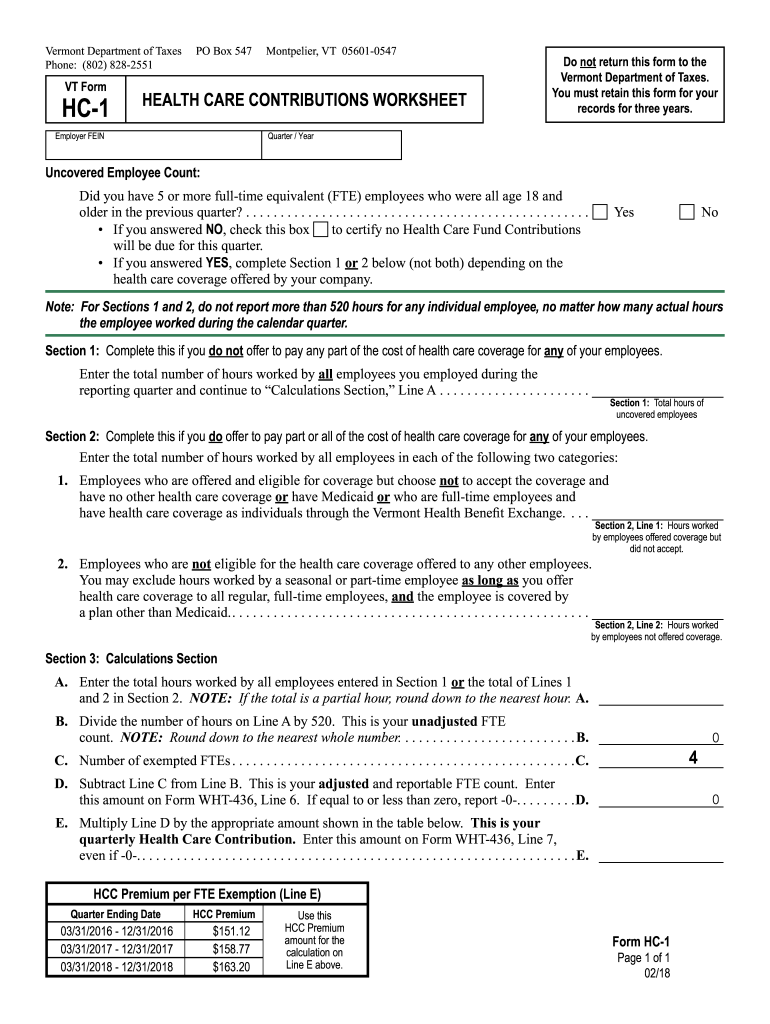

The WHT 436 is a Vermont state tax form used primarily for withholding tax purposes. It is designed for businesses and employers who are required to report and remit state income tax withheld from employee wages. This form is essential for ensuring compliance with Vermont tax regulations and helps streamline the process of reporting withheld taxes to the Vermont Department of Taxes.

How to Use the WHT 436

Using the WHT 436 involves several key steps to ensure accurate completion and submission. First, gather all necessary information regarding employee wages and the amount withheld for state taxes. Next, carefully fill out the form, ensuring that all required fields are completed accurately. After completing the form, it can be submitted electronically through the Vermont Department of Taxes website or printed and mailed to the appropriate address. It is important to retain a copy for your records.

Steps to Complete the WHT 436

Completing the WHT 436 requires attention to detail. Follow these steps:

- Gather employee wage data and withholding amounts.

- Enter your business information, including name, address, and tax identification number.

- List each employee's name, Social Security number, and the amount withheld.

- Double-check all entries for accuracy.

- Submit the form electronically or print it for mailing.

Legal Use of the WHT 436

The WHT 436 must be used in accordance with Vermont state law. It is legally binding and must be submitted by employers who withhold state income tax from employee wages. Failure to file this form can result in penalties and interest on unpaid taxes. Employers should ensure they are familiar with the legal requirements surrounding this form to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the WHT 436 are critical for compliance. Typically, employers must submit this form on a quarterly basis, with specific deadlines for each quarter. It is important to stay informed about these dates to avoid penalties. Check the Vermont Department of Taxes website for the most current filing schedule and any updates regarding deadlines.

Form Submission Methods

The WHT 436 can be submitted through multiple methods, providing flexibility for employers. The form can be filed electronically via the Vermont Department of Taxes online portal, which is often the quickest and most efficient method. Alternatively, employers may choose to print the form and mail it directly to the department. Ensure that all submissions are completed by the appropriate deadlines to avoid any compliance issues.

Quick guide on how to complete wht 436

Effortlessly prepare Wht 436 on any device

Digital document management has surged in popularity among businesses and individuals alike. It offers a superb environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and store it securely online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Wht 436 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Wht 436 with ease

- Obtain Wht 436 and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight signNow sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Wht 436 to ensure exceptional communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wht 436

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is WHT 436 Vermont and how does it relate to airSlate SignNow?

WHT 436 Vermont is a specific tax form that businesses need to complete for various transactions. airSlate SignNow provides an efficient solution to eSign this document securely and quickly, ensuring compliance with state requirements.

-

What features does airSlate SignNow offer for handling WHT 436 Vermont?

airSlate SignNow includes robust features for managing WHT 436 Vermont, such as customizable templates, secure eSignature options, and document tracking. These features streamline the signing process and enhance productivity.

-

How does airSlate SignNow ensure the security of WHT 436 Vermont documents?

Security is a top priority for airSlate SignNow. The platform utilizes advanced encryption and authentication measures to protect your WHT 436 Vermont documents, ensuring that sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other tools for managing WHT 436 Vermont?

Yes, airSlate SignNow offers integrations with various applications and platforms, making it easy to connect your existing tools for managing WHT 436 Vermont. These integrations help create a seamless workflow.

-

What are the pricing options for using airSlate SignNow for WHT 436 Vermont?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. You can choose a plan that best suits your requirements for managing WHT 436 Vermont without breaking your budget.

-

Is it easy to use airSlate SignNow for WHT 436 Vermont?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy to navigate and execute WHT 436 Vermont effortlessly. Anyone can sign documents with just a few clicks.

-

What are the benefits of using airSlate SignNow for WHT 436 Vermont?

Using airSlate SignNow for WHT 436 Vermont provides numerous benefits, including reduced paperwork, improved efficiency, and faster turnaround times for document signing. It enhances overall productivity.

Get more for Wht 436

Find out other Wht 436

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter