Mw507 Form

What is the MW507?

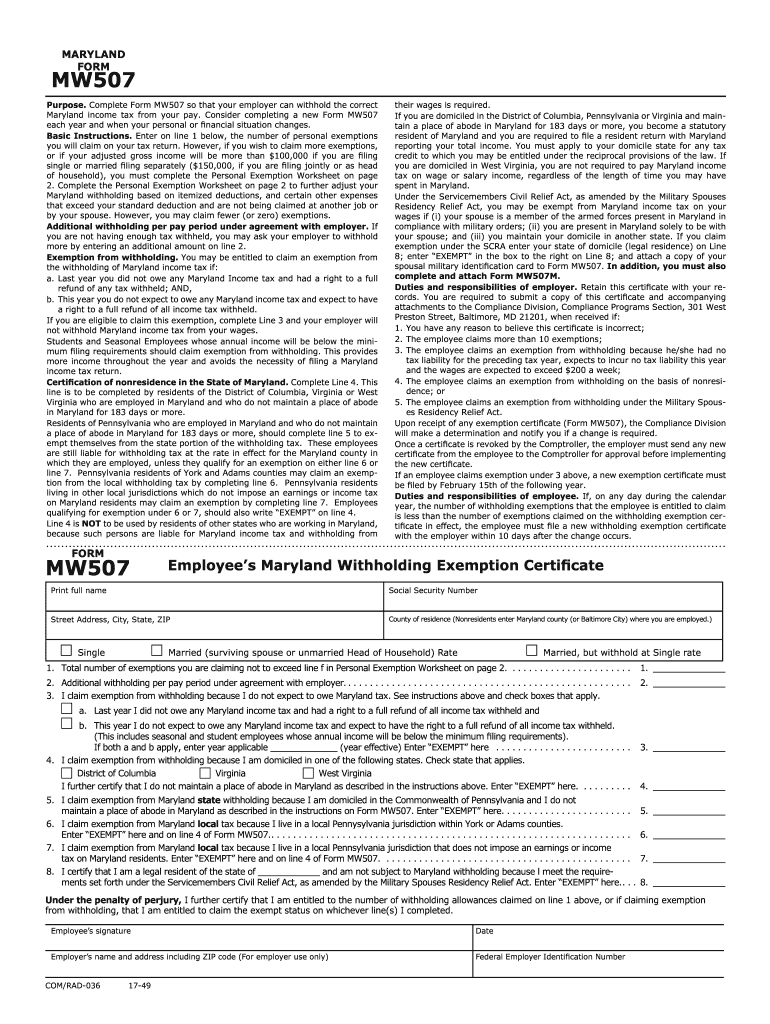

The MW507 is a Maryland state tax form used by employees to claim exemptions from state income tax withholding. This form allows individuals to indicate their eligibility for exemptions based on specific criteria, such as income level or tax status. Understanding the MW507 is essential for ensuring accurate withholding and compliance with state tax regulations.

Steps to Complete the MW507

Filling out the MW507 requires attention to detail to ensure accuracy. Here are the steps to follow:

- Obtain the MW507 form, which can be found on the Maryland Comptroller's website or through your employer.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which may include options like single, married, or head of household.

- Claim any exemptions by checking the appropriate boxes based on your eligibility.

- Sign and date the form to certify the information provided is accurate.

Legal Use of the MW507

The MW507 must be completed accurately to be considered legally valid. It is crucial to ensure that all information is truthful and reflects your current tax situation. Misrepresentation on this form can lead to penalties or issues with the Maryland Comptroller's office. Additionally, the form must be submitted to your employer, who will use it to adjust your state income tax withholding accordingly.

Key Elements of the MW507

Several key elements are essential when filling out the MW507:

- Personal Information: Accurate details about the employee, including name and Social Security number.

- Filing Status: Correctly identifying your filing status is crucial for determining your tax withholding.

- Exemption Claims: Clearly marking any exemptions you qualify for helps ensure proper withholding.

- Signature: A valid signature is necessary to confirm the accuracy of the information provided.

Examples of Using the MW507

Understanding practical scenarios can help clarify when to use the MW507. For instance:

- An employee who qualifies for tax exemptions due to low income may complete the MW507 to avoid unnecessary withholding.

- A married couple filing jointly may use the MW507 to adjust their withholding based on their combined income and exemptions.

- A student working part-time may claim exemptions on the MW507 if their income falls below the taxable threshold.

Filing Deadlines / Important Dates

It is important to be aware of the deadlines associated with the MW507. Typically, employees should submit the form to their employer at the start of employment or whenever their tax situation changes. Additionally, if you wish to adjust your withholding for the upcoming tax year, submitting the MW507 before the first paycheck of the year is advisable to ensure the correct amount is withheld.

Quick guide on how to complete mw507 56402

Effortlessly Prepare Mw507 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your files quickly without delays. Handle Mw507 on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Mw507 with Ease

- Obtain Mw507 and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for those purposes.

- Craft your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Mw507 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw507 56402

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the MW507 form?

The MW507 form is used by Maryland employers to determine the correct state withholding for their employees. Understanding how to fill out MW507 example accurately is crucial to ensure compliance with state tax laws and prevent issues with over- or under-withholding.

-

How does airSlate SignNow simplify the eSigning process for MW507 forms?

airSlate SignNow allows users to easily upload, fill out, and eSign the MW507 form online. By providing templates and customizable fields, it signNowly streamlines the process of how to fill out MW507 example, making it efficient and error-free.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, users benefit from features such as document templates, cloud storage, and real-time collaboration. These features enhance the user experience and make learning how to fill out MW507 example more manageable and organized.

-

Is airSlate SignNow cost-effective for businesses?

Yes, airSlate SignNow provides various pricing plans that cater to different business sizes and needs, ensuring that it remains a cost-effective solution. This affordability is a signNow advantage when considering how to fill out MW507 example efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with popular business applications such as Google Drive, Slack, and Salesforce. This compatibility makes it easy to access documents and learn how to fill out MW507 example within the tools you already use.

-

What benefits does using airSlate SignNow provide for filling out forms?

Using airSlate SignNow enhances productivity by speeding up the document preparation and signing process. This is particularly useful for understanding how to fill out MW507 example, as users can complete and send documents quickly, reducing downtime and improving workflow.

-

Are there any mobile options for using airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows users to access and sign documents on the go. This flexibility is particularly beneficial for those who need to learn how to fill out MW507 example while traveling or away from their desks.

Get more for Mw507

Find out other Mw507

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice