Misc 1099 Form

What is the Misc 1099 Form

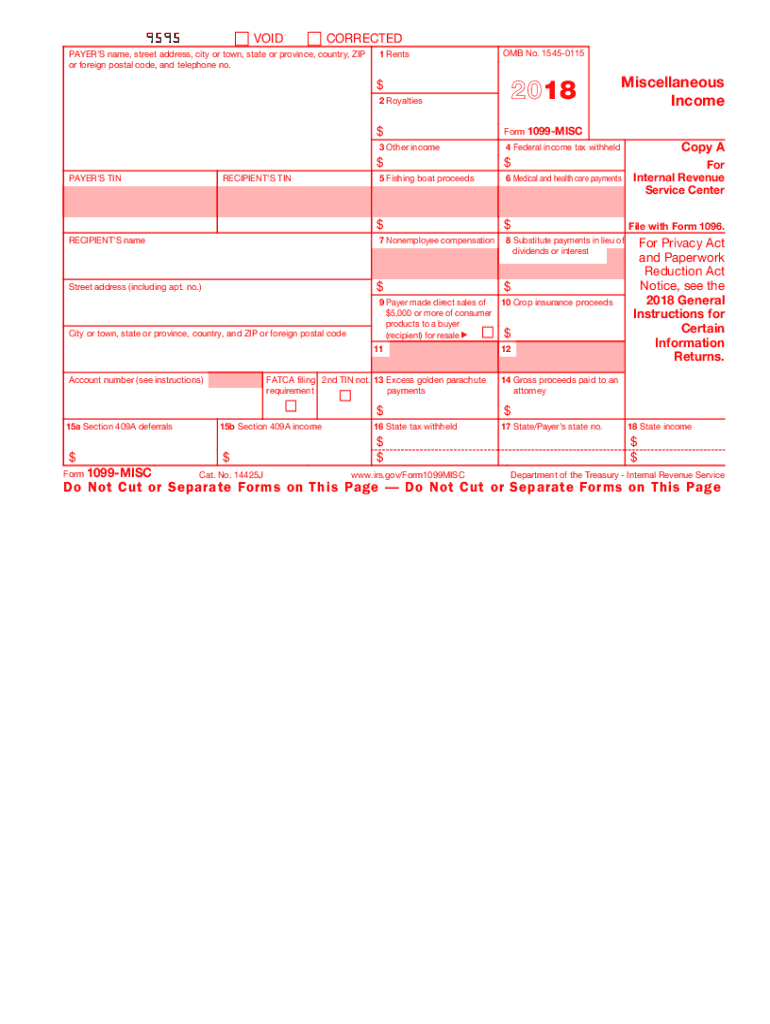

The Misc 1099 form, officially known as the 1099-MISC, is a tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is primarily utilized by businesses and individuals who have paid independent contractors, freelancers, or other non-employees for services rendered. The 1099-MISC form captures essential information such as the recipient's name, address, taxpayer identification number, and the total amount paid during the tax year.

How to use the Misc 1099 Form

To effectively use the Misc 1099 form, it is crucial to gather all necessary information about the payments made to non-employees. This includes the total amount paid, the nature of the services provided, and the recipient's tax identification number. Once this information is compiled, the payer must accurately fill out the form, ensuring that all details are correct. After completing the 1099-MISC, it must be distributed to the recipient and submitted to the IRS by the appropriate deadline.

Steps to complete the Misc 1099 Form

Completing the Misc 1099 form involves several key steps:

- Gather the necessary information about the recipient, including their name, address, and taxpayer identification number.

- Determine the total amount paid to the recipient for the tax year.

- Fill out the 1099-MISC form accurately, ensuring that all information is correct and complete.

- Provide a copy of the completed form to the recipient by January 31 of the following year.

- Submit the form to the IRS by the appropriate deadline, which may vary depending on whether you file electronically or by mail.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Misc 1099 form. It is essential to report any payments made to non-employees that exceed the threshold amount of six hundred dollars during the tax year. Additionally, the IRS requires that the form be filed accurately and on time to avoid penalties. Familiarizing oneself with the IRS guidelines ensures compliance and helps prevent issues during tax season.

Filing Deadlines / Important Dates

Filing deadlines for the Misc 1099 form are crucial for compliance. The form must be provided to recipients by January 31 of the year following the tax year in which payments were made. The deadline for filing with the IRS is also January 31 if submitting paper forms. However, if filing electronically, the deadline extends to March 31. It is important to adhere to these deadlines to avoid potential penalties.

Penalties for Non-Compliance

Failure to comply with the IRS requirements for the Misc 1099 form can result in significant penalties. These penalties can vary based on the length of the delay in filing and the size of the business. For example, if the form is filed late, the penalties can range from fifty dollars to over five hundred dollars per form, depending on how late the form is submitted. Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete misc 1099 form

Effortlessly Prepare Misc 1099 Form on Any Device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly without issues. Manage Misc 1099 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and electronically sign Misc 1099 Form without hassle

- Obtain Misc 1099 Form and click on Get Form to commence.

- Utilize the tools we offer to finalize your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you wish to share your form, either by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign Misc 1099 Form while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the misc 1099 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 form 1099 and who needs to fill it out?

The 2018 form 1099 is a tax document used to report various types of income other than wages, salaries, and tips. Businesses and individuals who have made payments to independent contractors, freelancers, or other service providers totaling $600 or more during the year need to fill out this form. Ensuring accurate completion of the 2018 form 1099 is essential for compliance with IRS regulations.

-

How can airSlate SignNow help me with my 2018 form 1099?

airSlate SignNow streamlines the process of eSigning and sending your 2018 form 1099. Our platform allows you to upload your form, send it for signatures, and securely store it, all in one easy interface. This helps you save time and ensures your forms are sent and completed efficiently.

-

Is airSlate SignNow cost-effective for filing the 2018 form 1099?

Yes, airSlate SignNow offers a cost-effective solution for handling your 2018 form 1099 needs. With flexible pricing plans, you can choose the one that best fits your business size and requirements. This affordability allows businesses of all sizes to manage their document signing more effectively without breaking the bank.

-

Can I integrate airSlate SignNow with my accounting software for the 2018 form 1099?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software like QuickBooks and Xero. This integration makes it easy to manage your 2018 form 1099s directly alongside your accounting processes, ensuring accuracy and efficiency in your financial reporting.

-

What features does airSlate SignNow offer that are suitable for handling the 2018 form 1099?

airSlate SignNow provides several features that simplify the process of preparing the 2018 form 1099. These include document templates, multi-party signing, and real-time tracking of signatures. These tools not only enhance efficiency but also help you maintain compliance with tax deadlines.

-

What are the benefits of using airSlate SignNow for the 2018 form 1099?

Using airSlate SignNow for your 2018 form 1099 allows you to enhance workflow efficiency and reduce processing time. The platform also offers secure document storage and access to comprehensive audit trails for each document. This promotes accountability and transparency in your financial operations.

-

How secure is airSlate SignNow when handling the 2018 form 1099?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure access protocols ensuring that your 2018 form 1099s and other sensitive documents are safe from unauthorized access. We are committed to keeping your information secure while you manage crucial tax documents.

Get more for Misc 1099 Form

- Articles of organization michigan form

- A to z teacher stuff name tracing form

- Affidavit of dissolution of corporation form

- Missouri united state form

- Genentech patient consent form

- Camper health history record form

- Set up package for limited liability companies form

- End of summer demolay estore flyer demolay international form

Find out other Misc 1099 Form

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed