Form R Service Tax

What is the Form R Service Tax

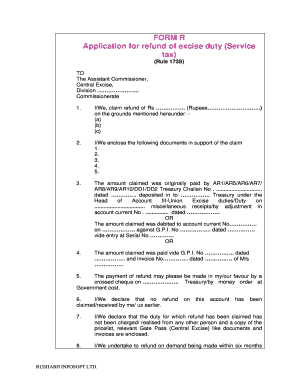

The Form R Service Tax is a specific document used for claiming refunds on service tax paid by businesses in the United States. This form serves as an application for a refund of excise duty, allowing taxpayers to recover amounts they have overpaid or erroneously paid. It is essential for businesses that have provided taxable services and seek to reclaim the tax they have already submitted to the government.

How to use the Form R Service Tax

To effectively use the Form R Service Tax, taxpayers must first ensure they meet the eligibility criteria for a refund. Once confirmed, the form should be filled out accurately, providing all required details regarding the services rendered and the tax paid. After completing the form, it can be submitted through the appropriate channels, either online or via traditional mail, depending on the guidelines provided by the tax authority.

Steps to complete the Form R Service Tax

Completing the Form R Service Tax involves several key steps:

- Gather all necessary documentation, including invoices and proof of tax payment.

- Access the form in the required format, such as PDF or Word.

- Fill out the form with accurate information, ensuring that all fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form through the designated method, ensuring you keep copies for your records.

Legal use of the Form R Service Tax

The legal use of the Form R Service Tax is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be completed in accordance with the guidelines set forth by the tax authority. This includes providing accurate information and submitting the form within the required timeframe. Additionally, electronic submissions must comply with eSignature laws to ensure they are recognized as valid.

Required Documents

When submitting the Form R Service Tax, several supporting documents are typically required. These may include:

- Invoices detailing the services provided.

- Proof of payment of the service tax.

- Any correspondence with the tax authority regarding the claim.

- Documentation supporting the eligibility for the refund.

Form Submission Methods (Online / Mail / In-Person)

The Form R Service Tax can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the tax authority. Common submission methods include:

- Online submission through the tax authority's official website.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Eligibility Criteria

To qualify for a refund using the Form R Service Tax, businesses must meet specific eligibility criteria. Generally, these criteria include having paid service tax on services rendered, providing evidence of overpayment, and ensuring that the claim is made within the stipulated time frame. It is crucial for businesses to review these criteria carefully to avoid any delays or rejections in their refund applications.

Quick guide on how to complete form r service tax

Easily Prepare Form R Service Tax on Any Device

Online document management has gained signNow traction among businesses and individuals alike. It offers a superb eco-conscious option to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and eSign your documents promptly without any hold-ups. Manage Form R Service Tax on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The Easiest Method to Modify and eSign Form R Service Tax Effortlessly

- Obtain Form R Service Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose how you wish to share your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Alter and eSign Form R Service Tax while ensuring exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form r service tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the service tax form r and why is it important?

The service tax form r is a signNow document that businesses must file to comply with service tax regulations. It provides details about the services provided and the tax collected, ensuring transparency and regulatory compliance. Filing this form correctly is crucial for avoiding penalties and maintaining good standing with tax authorities.

-

How does airSlate SignNow facilitate the completion of the service tax form r?

airSlate SignNow streamlines the process of completing the service tax form r by allowing users to easily eSign and send documents without the hassle of traditional paperwork. Our platform offers templates and automated workflows that simplify data entry and ensure accuracy. This efficiency helps businesses stay compliant and saves valuable time.

-

Can I integrate airSlate SignNow with my existing accounting software to manage the service tax form r?

Yes, airSlate SignNow offers seamless integrations with various accounting software, enabling you to manage your service tax form r efficiently. This integration allows for automatic data transfer, reducing the risk of errors and ensuring all information is captured accurately. Our platform is designed to work with your existing systems for a smoother workflow.

-

What are the pricing options for using airSlate SignNow for the service tax form r?

airSlate SignNow provides flexible pricing plans to accommodate different business needs. Depending on the features and number of users, you can choose a plan that best suits your requirements for managing the service tax form r. Our pricing is designed to be budget-friendly, providing an excellent value for the capabilities we offer.

-

Are there any benefits to using airSlate SignNow for managing the service tax form r?

Absolutely! Using airSlate SignNow for your service tax form r offers numerous benefits, including enhanced security for your documents, faster processing times, and easy access from anywhere. Additionally, our platform improves collaboration among team members, ensuring that the necessary stakeholders can review and approve documents seamlessly.

-

How does eSigning the service tax form r work with airSlate SignNow?

eSigning the service tax form r with airSlate SignNow is straightforward. Once your template is set up, simply send the document to the required signatories, who can eSign it from any device. Our platform ensures that signatures are legally binding and securely stored, making the process quick and efficient.

-

Is customer support available if I have questions about the service tax form r?

Yes, airSlate SignNow provides excellent customer support to assist you with any questions related to the service tax form r. Our knowledgeable team is available via chat, email, and phone to ensure you receive the assistance you need. We are committed to helping you navigate any challenges you might face.

Get more for Form R Service Tax

Find out other Form R Service Tax

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple