It Fee Challan Form Pnb

What is the IT Fee Challan Form PNB?

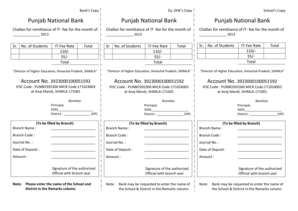

The IT Fee Challan Form PNB is a document used for the payment of income tax fees at Punjab National Bank (PNB). This form serves as a receipt for payments made towards income tax obligations, ensuring that taxpayers can fulfill their financial responsibilities in a structured manner. The form is essential for individuals and businesses alike, as it provides a formal record of payment that may be required for future reference or compliance purposes.

How to Use the IT Fee Challan Form PNB

Using the IT Fee Challan Form PNB involves a few straightforward steps. First, ensure you have the correct form, which can be obtained from the PNB website or at any branch. Next, fill out the necessary details, including your name, address, and the amount being paid. After completing the form, you can submit it at a PNB branch or use online banking services to process your payment. Retain a copy of the completed form for your records, as it serves as proof of payment.

Steps to Complete the IT Fee Challan Form PNB

Completing the IT Fee Challan Form PNB requires attention to detail. Follow these steps:

- Obtain the form from the PNB website or a local branch.

- Fill in your personal information, including your name, address, and PAN (Permanent Account Number).

- Specify the amount you are paying and the relevant tax period.

- Choose the payment method: cash, cheque, or online transfer.

- Review the form for accuracy before submission.

Legal Use of the IT Fee Challan Form PNB

The IT Fee Challan Form PNB is legally recognized as a valid payment receipt for income tax fees. It must be filled out accurately to ensure compliance with tax regulations. The form holds significance in tax audits and assessments, as it provides evidence of payments made to the government. Therefore, it is crucial to maintain the integrity of the information provided on the form.

Required Documents for the IT Fee Challan Form PNB

When filling out the IT Fee Challan Form PNB, certain documents may be required to support your payment. These typically include:

- Your PAN (Permanent Account Number) card.

- Proof of income, such as salary slips or business income statements.

- Any previous challan receipts, if applicable.

Having these documents ready can facilitate a smoother process when submitting your payment.

Form Submission Methods

The IT Fee Challan Form PNB can be submitted through various methods, providing flexibility for users. You can choose to:

- Submit the form in person at any PNB branch.

- Utilize online banking services to complete the payment electronically.

- Mail the completed form along with payment details if required.

Each method has its advantages, and users should select the one that best suits their needs.

Quick guide on how to complete it fee challan form pnb

Complete It Fee Challan Form Pnb effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a seamless eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents rapidly without hindrances. Manage It Fee Challan Form Pnb on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign It Fee Challan Form Pnb with ease

- Obtain It Fee Challan Form Pnb and click on Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign It Fee Challan Form Pnb and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it fee challan form pnb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IT fee challan HP?

An IT fee challan HP is a payment voucher utilized for various government fees and taxes in Himachal Pradesh, India. It serves as an official document for processing payments related to IT services, ensuring that all transactions are documented and verified. Using airSlate SignNow can simplify the creation and signing of these challans.

-

How can airSlate SignNow help with IT fee challan HP management?

airSlate SignNow provides businesses with a streamlined platform to create, send, and eSign IT fee challan HP documents. This reduces the time and effort needed for paperwork, facilitating quick and secure payments. Additionally, it offers templates specifically designed for various challan types, enhancing efficiency.

-

Are there any fees associated with using airSlate SignNow for IT fee challan HP?

While airSlate SignNow offers affordable pricing plans, specific costs related to using the platform for IT fee challan HP may vary based on usage. A free trial is available, allowing users to assess key features before committing to a paid plan. Consider evaluating different pricing tiers to find the best fit for your needs.

-

What features does airSlate SignNow offer for processing IT fee challan HP?

airSlate SignNow includes features such as document templates, cloud storage, and mobile access for IT fee challan HP processing. The platform also allows for secure electronic signatures and customizable workflows, making it easy for users to manage their challenging documents efficiently. With these tools, users can expedite the signing and submission process.

-

Can I integrate airSlate SignNow with other systems for IT fee challan HP?

Yes, airSlate SignNow provides a variety of integration options that can be used with other software systems for the management of IT fee challan HP. Whether it's linking to payment gateways, CRM systems, or custom applications, the integrations enhance productivity and ensure a seamless process. This feature is particularly useful for organizations already utilizing existing workflows.

-

Is airSlate SignNow secure for handling IT fee challan HP documents?

Absolutely! airSlate SignNow prioritizes security with robust encryption and compliant storage options, making it a safe choice for handling IT fee challan HP documents. The platform also adheres to various industry regulations, ensuring that all data remains confidential and secure throughout the signing and payment processes.

-

What are the benefits of using airSlate SignNow for IT fee challan HP?

Using airSlate SignNow for IT fee challan HP offers several benefits, such as enhanced efficiency, reduced paperwork, and improved accuracy. The platform's user-friendly interface makes it easy for businesses to manage their documents while ensuring that all signatures are legally binding. Clients can also save time and resources, focusing on their core activities.

Get more for It Fee Challan Form Pnb

Find out other It Fee Challan Form Pnb

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT