Debt Schedule Template Excel Form

What is the debt schedule template excel?

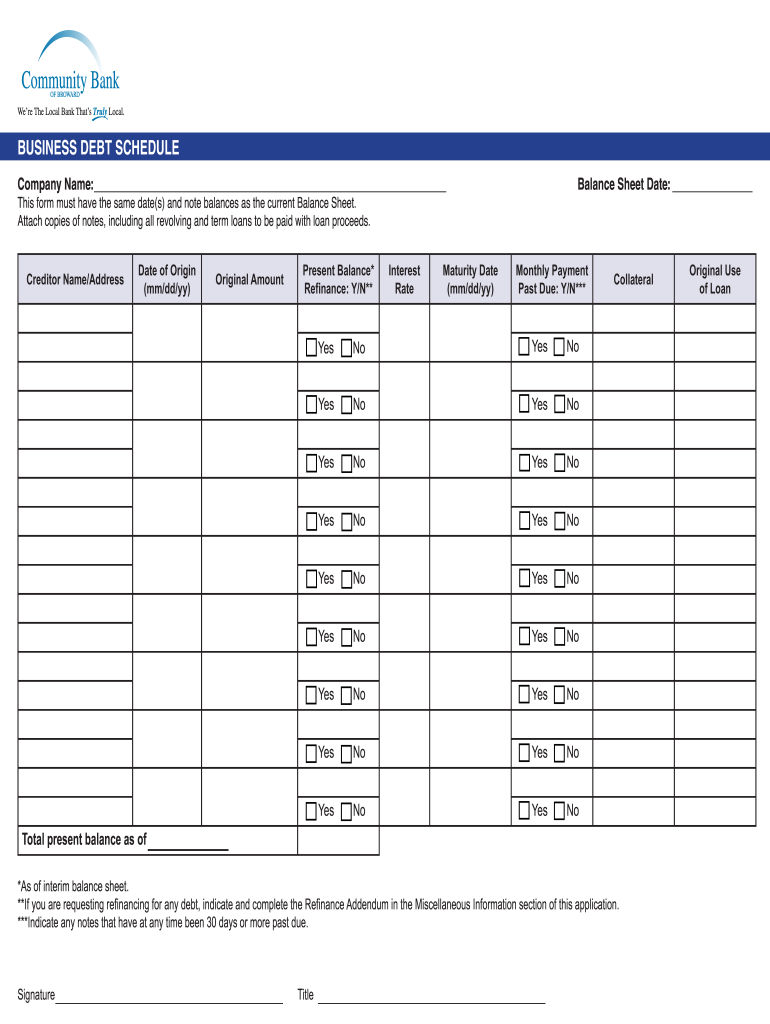

The debt schedule template excel is a structured spreadsheet designed to help individuals and businesses manage and track their outstanding debts. This template typically includes key information such as the creditor's name, outstanding balance, interest rate, payment terms, and due dates. By organizing this information in an accessible format, users can gain a clearer understanding of their financial obligations and plan their repayments effectively. The use of Excel allows for easy calculations and updates, making it a practical tool for both personal and business finance management.

How to use the debt schedule template excel

Using the debt schedule template excel involves several straightforward steps. First, download or create a template that suits your needs. Next, input the relevant details for each debt, including the creditor's name, total amount owed, interest rate, and payment frequency. Ensure that you also include the due dates for each payment. Once the information is entered, you can utilize Excel's formulas to calculate total debt, monthly payments, and remaining balances. Regularly update the template as payments are made or new debts are incurred to maintain an accurate overview of your financial situation.

Steps to complete the debt schedule template excel

Completing the debt schedule template excel involves a systematic approach:

- Download or open the template: Start with a pre-made template or create a new spreadsheet in Excel.

- Enter creditor information: Fill in the name of each creditor and the corresponding debt amount.

- Add financial details: Include the interest rate, payment terms, and due dates for each debt.

- Calculate totals: Use Excel formulas to sum total debt and determine monthly payments.

- Review and update regularly: Keep the template current by updating it with payments made and any new debts.

Key elements of the debt schedule template excel

Several key elements are essential for an effective debt schedule template excel. These include:

- Creditor Name: The name of the institution or individual to whom the debt is owed.

- Outstanding Balance: The total amount remaining to be paid on the debt.

- Interest Rate: The percentage charged on the outstanding balance, which affects total repayment costs.

- Payment Terms: Details on how often payments are due (e.g., monthly, quarterly).

- Due Dates: Specific dates when payments must be made to avoid penalties.

Legal use of the debt schedule template excel

The debt schedule template excel can be used legally to document and manage debts, provided it is filled out accurately and kept up to date. While the template itself is not a legally binding document, it can serve as a useful record in case of disputes or financial assessments. It is important to ensure that all entries are truthful and reflect actual financial obligations. For businesses, maintaining a clear debt schedule can also support compliance with financial reporting regulations.

Examples of using the debt schedule template excel

There are various scenarios in which the debt schedule template excel can be beneficial:

- Personal Finance Management: Individuals can use the template to track personal loans, credit card debts, and mortgages.

- Small Business Debt Tracking: Small business owners can manage loans, supplier credit, and other financial obligations.

- Debt Consolidation Planning: Users can assess their debts to create a strategy for consolidating multiple loans into a single payment.

Quick guide on how to complete debt schedule template excel

Easily Manage Debt Schedule Template Excel on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle Debt Schedule Template Excel on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Effortlessly Edit and eSign Debt Schedule Template Excel

- Find Debt Schedule Template Excel and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the features that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the issues of lost files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Debt Schedule Template Excel to ensure smooth communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the debt schedule template excel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a debt schedule template excel?

A debt schedule template excel is a structured spreadsheet designed to help individuals and businesses manage their debt obligations. It allows users to track loan payments, interest rates, and remaining balances in a clear and organized manner. Utilizing this template can simplify financial planning and enhance overall debt management.

-

How can a debt schedule template excel benefit my business?

Using a debt schedule template excel can provide several benefits, including clearer visibility into your debt obligations and payment schedules. It helps you maintain a systematic approach to managing loans, which can reduce stress and prevent missed payments. Additionally, it aids in budgeting and financial forecasting by highlighting upcoming payment dates.

-

Is there a cost associated with using the debt schedule template excel?

The debt schedule template excel is typically available for free or at a low cost, depending on the source. Many websites and software tools offer downloadable versions with customizable features. Choosing an effective and budget-friendly option is key to enhancing your financial organization without straining your resources.

-

Can I customize the debt schedule template excel to fit my needs?

Yes, the debt schedule template excel is highly customizable to fit your specific financial situation. You can add, remove, or modify columns and rows to effectively track different types of debts, interest rates, and payment periods. This flexibility ensures the template meets your unique financial management requirements.

-

Does the debt schedule template excel integrate with other financial tools?

Many debt schedule template excel options are designed to easily integrate with other financial applications, such as accounting or budgeting software. This integration can streamline your financial tracking process and provide holistic insights into your overall financial health. Be sure to choose a template that supports the specific tools you are using.

-

How do I use a debt schedule template excel step by step?

To effectively use a debt schedule template excel, start by inputting your debt details, including loan amounts, interest rates, and payment frequencies. Next, set up a schedule for payments and utilize formula features to calculate remaining balances and totals. Regularly update the template as payments are made to maintain accuracy and oversight.

-

Are there any features that come with the debt schedule template excel?

Common features of a debt schedule template excel include pre-filled formulas for calculating interest and remaining balances, customizable fields for different debt types, and visual graphs to track payments over time. These features enhance usability and help users quickly grasp their financial positions. Look for a template that fits your functional needs.

Get more for Debt Schedule Template Excel

- Unit 3 parallel and perpendicular lines answer key form

- Proof of surviving legal heirs sample with fill up form

- Form 735 226 100592945

- Kateofgaia form

- Club agreement contract form

- Sbcusd office referral revised 7 09doc form

- Huntington bank wire transfer form

- Safety rest area coffee program agreement form

Find out other Debt Schedule Template Excel

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online