1099 G Form

What is the 1099 G

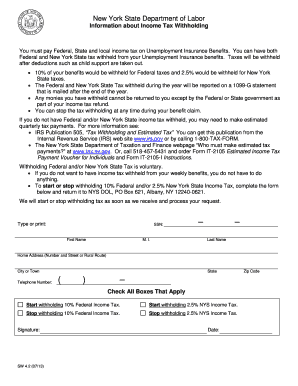

The 1099 G form is a tax document used in the United States to report certain types of income received by individuals. This form is primarily associated with government payments, such as unemployment benefits or state tax refunds. When you receive a 1099 G, it indicates that you have received income that may be taxable. It is essential to understand the details provided on this form to accurately report your income during tax filing.

How to obtain the 1099 G

To obtain your 1099 G form, you typically need to contact the relevant state agency or department that issued the payments. For example, if you received unemployment benefits, you would reach out to your state’s Department of Labor. Many states provide the option to access this form online through their official websites. You may need to provide personal identification information to verify your identity before accessing the document.

Steps to complete the 1099 G

Completing the 1099 G form involves a few straightforward steps. First, ensure you have all necessary information, such as your Social Security number and details of the payments received. Next, accurately fill in the form by entering the amounts reported to you, ensuring that you include any state tax refunds or unemployment benefits. Review the completed form for accuracy before submitting it to the IRS or including it with your tax return.

Legal use of the 1099 G

The 1099 G form serves a legal purpose in reporting income to the IRS. It is crucial to use this form correctly to avoid potential penalties or issues with your tax return. The information reported on the 1099 G must be consistent with your tax filings. If the IRS finds discrepancies, it may lead to audits or penalties, making it essential to keep accurate records and file the form properly.

Key elements of the 1099 G

Several key elements are included in the 1099 G form. These elements typically consist of the payer's information, the recipient's information, and the amounts paid. Specific boxes on the form will indicate the type of payment received, such as unemployment compensation or state tax refunds. Understanding these elements helps ensure that you report your income accurately and comply with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 G form are crucial for compliance. Generally, the form must be issued to recipients by January 31 of the year following the tax year in which payments were made. Additionally, the IRS requires that copies of the 1099 G be filed by the end of February if submitting by mail, or by March 31 if filing electronically. Staying aware of these deadlines helps ensure timely and accurate tax reporting.

Who Issues the Form

The 1099 G form is typically issued by state and local government agencies. For instance, if you received unemployment benefits, your state’s Department of Labor would be responsible for issuing the form. It is important to know the issuing agency, as this will help you contact them for any questions or issues related to your 1099 G form.

Quick guide on how to complete 1099 g

Prepare 1099 G effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents quickly without delays. Handle 1099 G on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and eSign 1099 G without hassle

- Locate 1099 G and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 1099 G and guarantee effective communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1099 g

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1099g form meaning?

The 1099g form meaning refers to a tax document used to report certain types of income from government units, such as unemployment benefits or tax refunds. Understanding the 1099g form meaning is crucial for accurate tax filing, as it helps individuals maintain compliance with IRS regulations.

-

How does airSlate SignNow help with signing 1099g forms?

With airSlate SignNow, you can easily eSign your 1099g forms electronically, ensuring a swift and secure process. The platform simplifies document management, allowing you to efficiently send and receive signed forms, which can save you time and reduce paper clutter.

-

Is there a cost associated with using airSlate SignNow for 1099g forms?

Yes, airSlate SignNow offers several pricing plans that cater to different business needs, including options for signing 1099g forms. The cost-effective solution ensures that you only pay for the features you need, making it accessible for both small businesses and larger enterprises.

-

Can I integrate airSlate SignNow with other software for managing 1099g forms?

Absolutely! airSlate SignNow supports various integrations with popular software applications, allowing you to streamline the management of your 1099g forms. This means you can work seamlessly with your existing tools, enhancing overall productivity and document flow.

-

What are the benefits of using airSlate SignNow for 1099g forms?

Using airSlate SignNow to manage 1099g forms offers numerous benefits, including increased efficiency, reduced errors, and improved security. By electronic signing and document tracking, businesses can ensure their forms are completed quickly and accurately, minimizing delays during tax season.

-

How secure is airSlate SignNow when handling 1099g forms?

Security is a priority for airSlate SignNow, especially when handling sensitive documents like 1099g forms. The platform uses advanced encryption and security protocols to protect your data, ensuring that your eSigned documents remain confidential and secure.

-

How quickly can I eSign a 1099g form with airSlate SignNow?

You can eSign a 1099g form with airSlate SignNow in just a matter of minutes. The intuitive interface allows users to quickly navigate through the signing process, making it easy to complete forms without unnecessary delays.

Get more for 1099 G

Find out other 1099 G

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online