Sworn Application for Tax Clearance Form

What is the sworn application for tax clearance?

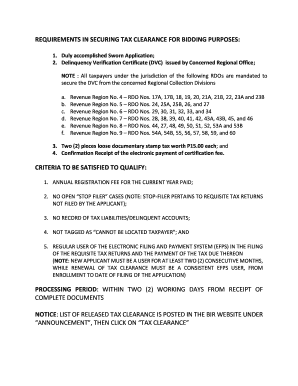

The sworn application for tax clearance is a formal document that individuals or businesses submit to verify their tax compliance status. This document is often required when applying for licenses, permits, or contracts, particularly in bidding situations. It serves as a declaration that all tax obligations have been met, ensuring that the applicant is in good standing with tax authorities. The sworn affidavit aspect emphasizes the legal commitment to the truthfulness of the information provided.

Steps to complete the sworn application for tax clearance

Completing the sworn application for tax clearance involves several key steps:

- Gather necessary information: Collect all relevant tax documents, including previous tax returns, payment receipts, and any correspondence with tax authorities.

- Fill out the application: Provide accurate information in the required fields, ensuring that all data reflects your current tax status.

- Sign the affidavit: Affix your signature to the document, affirming that the information is true and correct.

- Submit the application: Follow the submission guidelines, ensuring it is sent to the appropriate tax authority or agency.

Legal use of the sworn application for tax clearance

The sworn application for tax clearance is legally binding, meaning that false statements can lead to serious consequences, including penalties or legal action. It must be completed with utmost accuracy and honesty, as it is often used in official capacities, such as bidding for government contracts or applying for business licenses. Compliance with local, state, and federal regulations is crucial when using this form.

Required documents for the sworn application for tax clearance

To successfully complete the sworn application for tax clearance, applicants typically need to provide the following documents:

- Recent tax returns

- Payment receipts for any outstanding taxes

- Correspondence with tax authorities

- Identification documents, such as a driver's license or Social Security number

Who issues the sworn application for tax clearance?

The sworn application for tax clearance is usually issued by state or local tax authorities. Each jurisdiction may have its own version of the form, which can vary in requirements and submission processes. It is essential to obtain the correct form from the relevant authority to ensure compliance and acceptance.

Penalties for non-compliance with the sworn application for tax clearance

Failure to comply with the requirements of the sworn application for tax clearance can result in significant penalties. These may include fines, denial of permits or licenses, or even legal action. It is important to understand the implications of submitting false information or failing to submit the application altogether, as these actions can adversely affect an individual's or business's reputation and operational capabilities.

Quick guide on how to complete sworn application for tax clearance

Complete Sworn Application For Tax Clearance effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Sworn Application For Tax Clearance on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Sworn Application For Tax Clearance without hassle

- Locate Sworn Application For Tax Clearance and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Revise and eSign Sworn Application For Tax Clearance and maintain seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sworn application for tax clearance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sworn affidavit for tax clearance?

A sworn affidavit for tax clearance is a legal document declaring that an individual or business has fulfilled all tax obligations. It is often required by financial institutions or government entities to confirm tax compliance before processing loans or other financial actions.

-

How does airSlate SignNow facilitate the creation of a sworn affidavit for tax clearance?

AirSlate SignNow provides an easy-to-use platform where you can create, edit, and sign a sworn affidavit for tax clearance. With customizable templates and intuitive tools, users can streamline the document creation process without extensive legal knowledge.

-

What are the pricing options for using airSlate SignNow for sworn affidavits?

AirSlate SignNow offers several pricing plans designed to accommodate various business needs. You can choose from monthly or annual subscriptions to access features that simplify the creation and signing of sworn affidavits for tax clearance.

-

Can airSlate SignNow integrate with other software for sworn affidavit management?

Yes, airSlate SignNow integrates seamlessly with various software systems to enhance your workflow. Whether you are using CRM tools, cloud storage, or accounting platforms, you can easily manage sworn affidavits for tax clearance alongside your existing applications.

-

What benefits can businesses expect from using airSlate SignNow for sworn affidavits?

Using airSlate SignNow for your sworn affidavit for tax clearance provides numerous benefits, including time savings, enhanced security, and cost-effectiveness. Businesses can signNowly reduce paperwork and time spent on manual document management.

-

Is there customer support available for help with sworn affidavits?

Absolutely! AirSlate SignNow offers robust customer support to assist users in navigating the creation and signing process for sworn affidavits for tax clearance. You can access help through live chat, email, or an extensive knowledge base.

-

How secure is airSlate SignNow when handling sworn affidavits for tax clearance?

AirSlate SignNow prioritizes security with industry-standard encryption and compliance with data protection regulations. When you create and sign your sworn affidavit for tax clearance, you can trust that your sensitive information is well-protected.

Get more for Sworn Application For Tax Clearance

Find out other Sworn Application For Tax Clearance

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement