Vantagecare Retirement Health Savings Plan Reimbursement Request Form

What is the Vantagecare Retirement Health Savings Plan Reimbursement Request Form

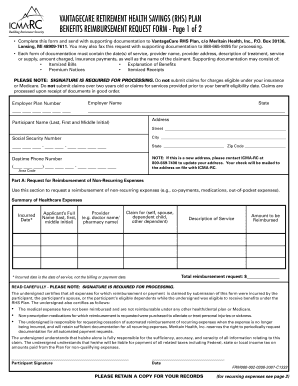

The Vantagecare Retirement Health Savings Plan Reimbursement Request Form is a crucial document designed for individuals participating in the Vantagecare retirement health savings plan. This form allows participants to request reimbursement for qualified medical expenses incurred during their retirement. By submitting this form, participants can ensure that they receive the financial support they need for eligible healthcare costs, thus maximizing the benefits of their retirement health savings plan.

How to use the Vantagecare Retirement Health Savings Plan Reimbursement Request Form

Using the Vantagecare Retirement Health Savings Plan Reimbursement Request Form involves several straightforward steps. First, gather all necessary documentation related to your medical expenses, including receipts and invoices. Next, complete the form by providing accurate personal information, details of the expenses, and any required signatures. Finally, submit the form through the designated method, whether online, by mail, or in person, ensuring that all supporting documents are included to avoid delays in processing your request.

Steps to complete the Vantagecare Retirement Health Savings Plan Reimbursement Request Form

Completing the Vantagecare Retirement Health Savings Plan Reimbursement Request Form requires careful attention to detail. Begin by entering your personal information, including your name, address, and contact details. Then, list the medical expenses for which you are seeking reimbursement, specifying the type of service, date of service, and the amount paid. Ensure that you attach copies of all relevant receipts. Review the form for accuracy, sign it, and submit it according to the instructions provided. Following these steps will help facilitate a smooth reimbursement process.

Legal use of the Vantagecare Retirement Health Savings Plan Reimbursement Request Form

The legal use of the Vantagecare Retirement Health Savings Plan Reimbursement Request Form is governed by specific regulations that ensure compliance with federal and state laws. To be considered valid, the form must be filled out completely and accurately, with all required signatures. Additionally, it is essential to adhere to the guidelines set forth by the plan administrators and relevant legal frameworks, such as the Employee Retirement Income Security Act (ERISA), which regulates retirement plans in the United States. Ensuring compliance will help protect your rights and facilitate the reimbursement process.

Eligibility Criteria

Eligibility for submitting the Vantagecare Retirement Health Savings Plan Reimbursement Request Form is generally determined by the specific provisions of the retirement health savings plan. Typically, participants must be enrolled in the plan and have incurred eligible medical expenses that meet the criteria outlined in the plan documents. It is important to review the plan details to confirm your eligibility and understand what expenses qualify for reimbursement. This knowledge will help you effectively utilize the reimbursement request form.

Required Documents

When submitting the Vantagecare Retirement Health Savings Plan Reimbursement Request Form, certain documents are required to support your request. These typically include detailed receipts for all medical expenses, invoices from healthcare providers, and any other documentation that verifies the services rendered. Providing complete and accurate documentation is crucial, as it helps ensure that your reimbursement request is processed efficiently and without unnecessary delays.

Quick guide on how to complete vantagecare retirement health savings plan reimbursement request form

Complete Vantagecare Retirement Health Savings Plan Reimbursement Request Form effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and without holdups. Handle Vantagecare Retirement Health Savings Plan Reimbursement Request Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and electronically sign Vantagecare Retirement Health Savings Plan Reimbursement Request Form with ease

- Find Vantagecare Retirement Health Savings Plan Reimbursement Request Form and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information carefully and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Vantagecare Retirement Health Savings Plan Reimbursement Request Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vantagecare retirement health savings plan reimbursement request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VantageCare Retirement Health Savings Plan?

The VantageCare Retirement Health Savings Plan is a financial product designed to help individuals save for healthcare expenses in retirement. It allows participants to set aside pre-tax dollars, reducing their taxable income while preparing for future medical costs. This plan is essential for those looking to secure their financial health in retirement.

-

How does the VantageCare Retirement Health Savings Plan benefit employees?

The VantageCare Retirement Health Savings Plan offers signNow tax savings, as contributions are made with pre-tax dollars. Employees also gain the flexibility to use their funds for various qualified medical expenses, which can help alleviate financial burdens in retirement. This plan ultimately promotes better long-term financial wellness.

-

What are the key features of the VantageCare Retirement Health Savings Plan?

Key features of the VantageCare Retirement Health Savings Plan include tax-deferred growth on savings, customizable contribution options, and the ability to roll over unused funds from year to year. Additionally, it provides an easy way for participants to manage their healthcare budget as they approach retirement. Its user-friendly interface makes tracking expenses straightforward.

-

What is the cost of enrolling in the VantageCare Retirement Health Savings Plan?

Enrollment in the VantageCare Retirement Health Savings Plan generally involves minimal fees, making it a cost-effective solution for employees and employers alike. Costs can vary based on specific employer offerings, but the potential tax savings and benefits often outweigh these initial expenses. To get precise pricing, it is advisable to consult with your employer or the plan provider.

-

Can the VantageCare Retirement Health Savings Plan integrate with other retirement plans?

Yes, the VantageCare Retirement Health Savings Plan can integrate seamlessly with other retirement plans, such as 401(k)s and traditional IRAs. This allows participants to manage their retirement savings efficiently under one cohesive strategy. Easy integration enhances overall financial planning for healthcare expenses.

-

How can participants access their funds in the VantageCare Retirement Health Savings Plan?

Participants can access their funds in the VantageCare Retirement Health Savings Plan through various methods, including online withdrawals for qualified medical expenses. Additionally, many plans offer debit cards to simplify the payment process at the point of service. This accessibility helps users quickly manage their healthcare expenses.

-

What types of expenses can be covered by the VantageCare Retirement Health Savings Plan?

The VantageCare Retirement Health Savings Plan allows participants to use their funds for a wide range of qualified healthcare expenses, including doctor visits, prescription medications, and preventive care. It can also cover long-term care services, which are often essential in retirement. This flexibility ensures that participants can address various healthcare needs as they arise.

Get more for Vantagecare Retirement Health Savings Plan Reimbursement Request Form

- Pre shift meeting template excel form

- Nnooc 38112784 form

- Upper extremity impairment evaluation record part 1 hand colorado form

- Disciplinary action summary oral or written warnings client name date employee information required last name first name

- Are you a professional license holder form

- Schedule nec form 1040 nr sp tax on income not effectively connected with a u s trade or business spanish version 590041439

- Initial application for certification pennsylvania state police form

- Form 12 900e

Find out other Vantagecare Retirement Health Savings Plan Reimbursement Request Form

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document