Ssuta Form

What is the Ssuta Form

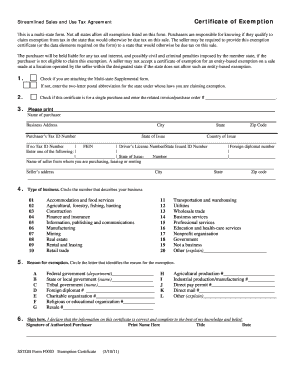

The Ssuta form is a specific document used for tax purposes, particularly in relation to sales and use tax compliance in the United States. This form is essential for businesses that engage in sales transactions across different states, ensuring they adhere to the Streamlined Sales and Use Tax Agreement (SSUTA). The form helps in reporting sales tax accurately and facilitates the collection of taxes owed to various jurisdictions.

How to Use the Ssuta Form

Using the Ssuta form involves a few straightforward steps. First, businesses must gather all necessary sales data for the reporting period. This includes details about sales transactions, tax rates applied, and any exemptions claimed. Once the data is compiled, the form can be filled out, ensuring that all required fields are accurately completed. After filling out the form, it should be submitted to the appropriate state tax authority, either electronically or via mail, depending on the state’s requirements.

Steps to Complete the Ssuta Form

Completing the Ssuta form requires careful attention to detail. Here are the essential steps:

- Gather sales data for the reporting period, including total sales and tax collected.

- Identify any exemptions or deductions applicable to your business.

- Fill out the form, ensuring all fields are completed accurately.

- Review the information for accuracy to avoid penalties.

- Submit the form to the relevant state tax authority by the deadline.

Legal Use of the Ssuta Form

The Ssuta form is legally binding when completed correctly and submitted on time. It complies with the legal frameworks established under the Streamlined Sales and Use Tax Agreement. This ensures that businesses are meeting their tax obligations while also protecting them from potential audits or penalties. Proper use of the form helps maintain transparency and accountability in tax reporting.

Key Elements of the Ssuta Form

Key elements of the Ssuta form include:

- Business identification information, such as name and address.

- Details of sales transactions, including gross sales and taxable sales.

- Tax rates applied and total tax collected.

- Exemptions claimed, if any.

- Signature of the authorized representative, affirming the accuracy of the information provided.

Form Submission Methods

The Ssuta form can be submitted through various methods, depending on the state’s regulations. Common submission methods include:

- Online submission via the state’s tax portal.

- Mailing a physical copy to the designated tax office.

- In-person submission at local tax authority offices.

Quick guide on how to complete ssuta form

Complete Ssuta Form effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly and without hiccups. Manage Ssuta Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and electronically sign Ssuta Form with ease

- Obtain Ssuta Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, a process that takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ssuta Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ssuta form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SSUTA form and how can it benefit my business?

An SSUTA form is a document that allows businesses to comply with the Streamlined Sales and Use Tax Agreement. Utilizing the SSUTA form can streamline tax reporting and compliance, ultimately saving time and reducing errors. By implementing airSlate SignNow to manage your SSUTA forms, you can enhance the efficiency of your business operations.

-

How does airSlate SignNow simplify the process of completing an SSUTA form?

airSlate SignNow offers an intuitive platform that allows users to easily create, edit, and sign SSUTA forms online. The platform reduces the complexities associated with traditional paper forms, enabling faster turnaround times and improved accuracy. With templates and automated workflows, your team can focus on what really matters—growing your business.

-

Is there a cost associated with using airSlate SignNow for SSUTA forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes access to features designed specifically for managing SSUTA forms efficiently. By choosing a plan that fits your requirements, you can leverage a cost-effective solution to handle your document signing needs.

-

Can I integrate airSlate SignNow with other software for processing SSUTA forms?

Absolutely! airSlate SignNow supports a range of integrations with popular software applications, making it easy to sync your SSUTA forms with existing systems. Integrations can enhance your workflow, reduce manual data entry, and ensure that your document processes run smoothly across platforms.

-

What features of airSlate SignNow assist in managing SSUTA forms?

airSlate SignNow provides several features for managing SSUTA forms, including user-friendly templates, e-signature capabilities, and secure cloud storage. These tools help streamline your document workflow and ensure that your SSUTA forms are always accessible and compliant with regulatory standards. This increases efficiency and minimizes delays in tax compliance.

-

Is it safe to store SSUTA forms with airSlate SignNow?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to safeguard your SSUTA forms. Your data remains protected while in storage and during transactions. Moreover, airSlate SignNow adheres to industry best practices for data privacy, giving you peace of mind.

-

How long does it take to set up my account for using SSUTA forms on airSlate SignNow?

Setting up your account on airSlate SignNow is quick and straightforward, typically taking just a few minutes. After registration, you can begin creating and managing your SSUTA forms immediately. The user-friendly interface and guided walkthroughs help ensure that you can maximize your experience from day one.

Get more for Ssuta Form

Find out other Ssuta Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document