1 Form

What is the 2019 Schedule 1?

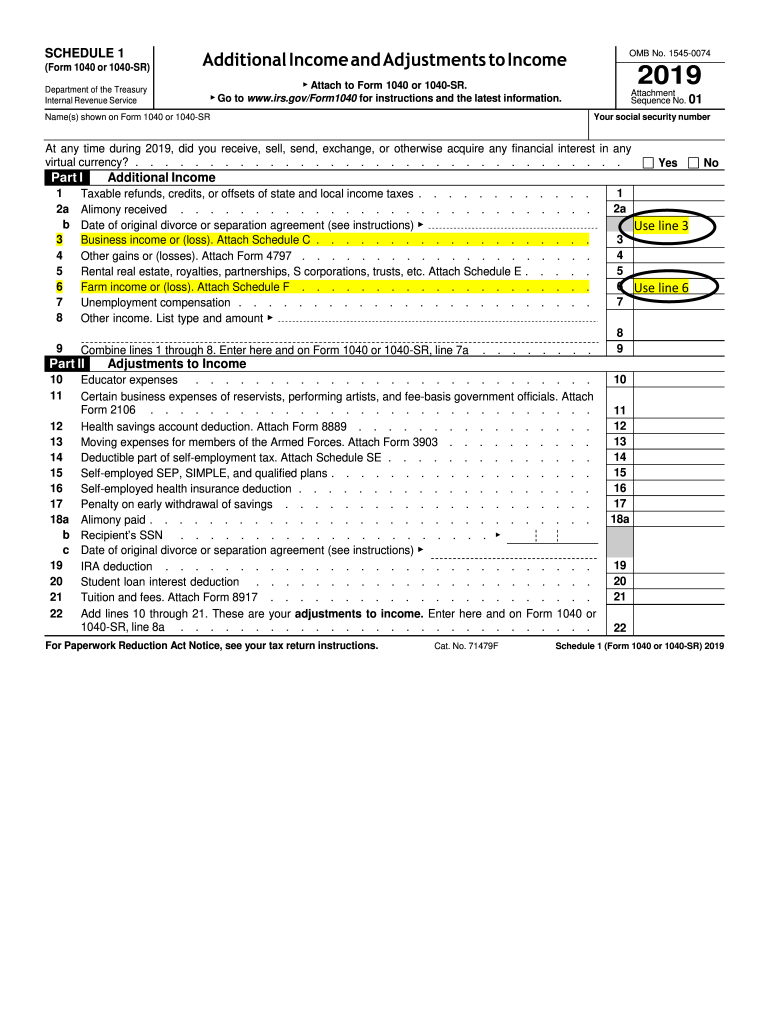

The 2019 Schedule 1 is a supplemental tax form used by individuals to report additional income or adjustments to income that are not included directly on the main Form 1040. This form is particularly important for taxpayers who have income from sources such as rental properties, unemployment compensation, or business income. It also allows for adjustments related to educator expenses, student loan interest, and other specific deductions that can affect the overall tax liability.

How to Use the 2019 Schedule 1

To effectively use the 2019 Schedule 1, taxpayers should first gather all necessary documentation related to additional income and adjustments. This includes records of any unemployment benefits received, rental income, or business earnings. Once all information is compiled, the taxpayer can fill out the form, ensuring that all relevant sections are completed accurately. After completing the Schedule 1, it should be attached to the main Form 1040 when filing taxes, whether electronically or by mail.

Steps to Complete the 2019 Schedule 1

Completing the 2019 Schedule 1 involves several key steps:

- Gather Documentation: Collect all relevant income and deduction documents.

- Fill Out Personal Information: Enter your name and Social Security number at the top of the form.

- Report Additional Income: Complete the sections for any additional income, such as unemployment compensation or business income.

- Claim Adjustments: Fill in any adjustments to income, such as educator expenses or student loan interest.

- Review for Accuracy: Double-check all entries for accuracy and completeness.

- Attach to Form 1040: Include the completed Schedule 1 with your main tax return.

IRS Guidelines for the 2019 Schedule 1

The IRS provides specific guidelines for completing the 2019 Schedule 1. Taxpayers should refer to the official IRS instructions for the Schedule 1 to ensure compliance. Key points include understanding which types of income must be reported, how to calculate adjustments, and the importance of accurate record-keeping. The IRS also emphasizes the need for all forms to be submitted by the tax filing deadline to avoid penalties.

Filing Deadlines for the 2019 Schedule 1

The filing deadline for the 2019 Schedule 1 aligns with the due date for Form 1040, which is typically April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of this timeline to ensure timely submission and avoid potential late fees or penalties.

Legal Use of the 2019 Schedule 1

The 2019 Schedule 1 is legally binding when completed and submitted according to IRS regulations. It is essential for taxpayers to provide accurate information, as any discrepancies can lead to audits or penalties. Furthermore, using a reliable eSignature solution, such as airSlate SignNow, can enhance the legal validity of the submitted documents by ensuring compliance with eSignature laws, thus providing an additional layer of security and authenticity.

Quick guide on how to complete 1

Complete 1 effortlessly on any device

Digital document management has become increasingly prevalent among enterprises and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Control 1 on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric procedure today.

How to modify and eSign 1 with ease

- Obtain 1 and click on Get Form to commence.

- Utilize the tools we provide to finalize your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal value as a standard wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your requirements in document management with just a few clicks from your preferred device. Edit and eSign 1 and guarantee outstanding communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 Schedule 1 form used for?

The 2019 Schedule 1 form is used to report additional income and adjustments to income on your federal tax return. It helps you to accurately reflect your financial situation and ensures compliance with tax regulations. Using airSlate SignNow can streamline the signing process for these documents, making it easier to manage your tax filings.

-

How can airSlate SignNow assist with submitting the 2019 Schedule 1?

With airSlate SignNow, you can easily electronically sign the 2019 Schedule 1 form and send it directly to your tax professional or the IRS. The platform provides a user-friendly interface to manage document workflows, ensuring your tax forms are submitted promptly and securely. This feature helps to reduce errors and speeds up the filing process.

-

What are the pricing options for using airSlate SignNow for the 2019 Schedule 1?

AirSlate SignNow offers various pricing plans suitable for businesses of different sizes, making it affordable to manage your 2019 Schedule 1 submissions. The plans include features like unlimited signing, templates, and integrations, ensuring you get full value. You can choose a monthly or annual subscription based on your needs.

-

Are there any integrations available with airSlate SignNow for handling the 2019 Schedule 1?

Yes, airSlate SignNow integrates with a variety of applications, making it easier to manage your 2019 Schedule 1 and other financial documents. Whether you use cloud storage services, CRM systems, or email clients, airSlate SignNow can enhance your workflow. This seamless integration helps you streamline tax document management.

-

What features does airSlate SignNow offer for editing the 2019 Schedule 1 form?

AirSlate SignNow provides powerful editing tools that allow you to modify the 2019 Schedule 1 form as needed before signing. You can add fields for signatures, dates, and initials, ensuring that all necessary information is included. This flexibility helps to reduce the time spent on preparing your tax documents.

-

How does airSlate SignNow ensure the security of the 2019 Schedule 1 documents?

AirSlate SignNow utilizes advanced encryption methods to secure your 2019 Schedule 1 forms throughout the signing process and storage. The platform adheres to strict compliance standards, providing peace of mind that your sensitive information is protected. Their secure system means you can confidently manage your tax documents online.

-

Can I track the status of my 2019 Schedule 1 document with airSlate SignNow?

Absolutely! AirSlate SignNow offers real-time tracking for your 2019 Schedule 1 documents, allowing you to monitor the signing status of each file. You will receive notifications when the document is viewed and signed, helping you stay informed throughout the process. This feature enhances visibility and accountability in document management.

Get more for 1

Find out other 1

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document