What is a New Hire Reporting Firm 2012-2026

Understanding the New Hire Reporting Form

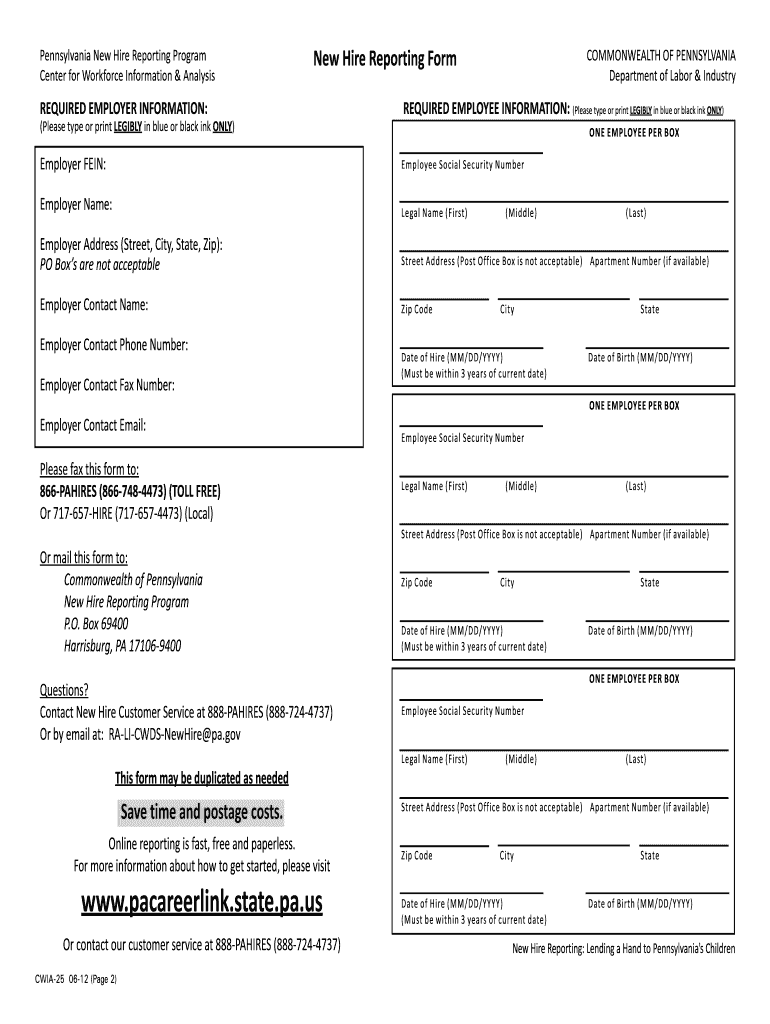

The new hire reporting form is a crucial document that employers in Pennsylvania must complete when hiring new employees. This form serves to notify the state of the new hire's employment status, which is essential for various administrative purposes, including child support enforcement and tax compliance. By submitting this form, employers help ensure that new employees are registered correctly in the state’s employment system, facilitating the tracking of wages and benefits.

Steps to Complete the New Hire Reporting Form

Completing the new hire reporting form involves several straightforward steps:

- Gather necessary information about the new hire, including their full name, address, Social Security number, and date of hire.

- Access the official new hire reporting form, ensuring it is the latest version for 2024.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form via the chosen method, whether online, by mail, or in person.

Legal Use of the New Hire Reporting Form

The new hire reporting form must be used in compliance with federal and state laws. In Pennsylvania, employers are required to submit this form within 20 days of the new hire's start date. Failure to comply with this requirement can result in penalties, including fines. Additionally, using a compliant electronic signature solution, such as signNow, ensures that the form is legally binding and meets all necessary legal standards.

Required Documents for New Hire Reporting

When completing the new hire reporting form, employers should have the following documents ready:

- Employee’s Social Security card or number.

- Proof of identity, such as a driver’s license or state ID.

- Employment offer letter or contract specifying the start date.

Having these documents on hand will streamline the process and ensure that all necessary information is accurately reported.

Form Submission Methods

Employers can submit the new hire reporting form through various methods:

- Online: Many states, including Pennsylvania, offer online submission through their official websites.

- By Mail: Employers can print the completed form and send it to the designated state office.

- In-Person: Some employers may choose to deliver the form directly to a local office.

Choosing the right submission method can depend on the employer’s preference and the urgency of the reporting.

Penalties for Non-Compliance

Employers who fail to submit the new hire reporting form on time may face significant penalties. In Pennsylvania, fines can accrue for each instance of late reporting. Additionally, non-compliance can lead to complications in child support enforcement and other legal obligations. It is essential for employers to understand these potential consequences and prioritize timely reporting.

Quick guide on how to complete pennsylvania new hire reporting form

Simplify Your HR Procedures with What Is A New Hire Reporting Firm Template

All HR specialists recognize the importance of keeping employee information neat and structured. With airSlate SignNow, you gain access to a comprehensive selection of state-specific labor documents that considerably streamline the placement, management, and storage of work-related papers in one centralized location. airSlate SignNow supports you in handling What Is A New Hire Reporting Firm management from start to finish, with extensive editing and eSignature capabilities available whenever you need them. Enhance your precision, document safety, and eliminate minor manual errors in just a few clicks.

How to Edit and eSign What Is A New Hire Reporting Firm:

- Locate the appropriate state and search for the necessary form.

- Access the form page and click Get Form to start working on it.

- Allow What Is A New Hire Reporting Firm to load in our editor and follow the prompts indicating required fields.

- Enter your information or insert additional fillable fields into the form.

- Utilize our tools and features to modify your form as needed: annotate, redact sensitive information, and create an eSignature.

- Review your document for mistakes before proceeding with its submission.

- Click Done to save changes and download your form.

- Alternatively, send your document directly to your recipients to collect signatures and information.

- Safely store completed forms in your airSlate SignNow account and access them whenever necessary.

Employing a versatile eSignature solution is crucial when managing What Is A New Hire Reporting Firm. Simplify even the most intricate workflow with airSlate SignNow. Start your free trial today to see what you can accomplish with your department.

Create this form in 5 minutes or less

FAQs

-

How do I fill out the New Zealand visa form?

Hi,Towards the front of your Immigration Form there is a check list. This check list explains the documents you will need to include with your form (i.e. passport documents, proof of funds, medical information etc). With any visa application it’s important to ensure that you attach all the required information or your application may be returned to you.The forms themselves will guide you through the process, but you must ensure you have the correct form for the visa you want to apply for. Given that some visa applications can carry hefty fees it may also be wise to check with an Immigration Adviser or Lawyer as to whether you qualify for that particular visa.The form itself will explain which parts you need to fill out and which parts you don’t. If you don’t understand the form you may wish to get a friend or a family member to explain it to you. There is a part at the back of the form for them to complete saying that they have assisted you in the completion of it.If all else fails you may need to seek advice from a Immigration Adviser or Lawyer. However, I always suggest calling around so you can ensure you get the best deal.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Does filling out these forms mean that I am hired?

You have met the basic federal requirements to become an employee, but until they actually have you do some work, you are not counted as an employee.

-

What tax forms do I need to fill out for reporting bitcoin gains and loses?

IRS1040 and 1099 forms.“For instance, there is no long-term capital gains tax to pay if you are in the lower two tax brackets (less than $36,900 single income or less than $73,800 married income). The capital gains rate is only 15% for other tax brackets (less than $405,100 single income) with 20% for the final bracket.”Reference: Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule DOther References:IRS Virtual Currency Guidance : Virtual Currency Is Treated as Property for U.S. Federal Tax Purposes; General Rules for Property Transactions ApplyHow do I report taxes?Filing Bitcoin Taxes Capital Gains Losses 1040 Schedule Dhttps://www.irs.gov/pub/irs-drop...

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania new hire reporting form

How to generate an eSignature for the Pennsylvania New Hire Reporting Form online

How to generate an electronic signature for your Pennsylvania New Hire Reporting Form in Chrome

How to create an electronic signature for signing the Pennsylvania New Hire Reporting Form in Gmail

How to create an eSignature for the Pennsylvania New Hire Reporting Form from your smart phone

How to create an electronic signature for the Pennsylvania New Hire Reporting Form on iOS

How to make an electronic signature for the Pennsylvania New Hire Reporting Form on Android devices

People also ask

-

What is the new hire reporting form 2024?

The new hire reporting form 2024 is a crucial document that employers must fill out when hiring a new employee. It helps comply with state and federal requirements, ensuring that new hires are reported for tax withholding and other employment purposes. Utilizing airSlate SignNow simplifies this process, making it easier to complete and submit the form electronically.

-

How does airSlate SignNow streamline the new hire reporting process?

airSlate SignNow streamlines the new hire reporting process by allowing you to create, send, and electronically sign forms seamlessly. With an easy-to-use interface, you can set up your new hire reporting form 2024 quickly, reducing the time spent on paperwork. The platform's automation features also help in tracking submissions and reminders for compliance.

-

What are the benefits of using airSlate SignNow for new hire reporting forms?

Using airSlate SignNow for your new hire reporting forms offers several benefits, including enhanced efficiency and reduced human error. The ability to eSign documents saves time, while the secure cloud storage ensures that all information is easily accessible. Additionally, the platform provides compliance tracking to avoid potential penalties.

-

Can airSlate SignNow integrate with other HR systems for new hire reporting?

Yes, airSlate SignNow can integrate with various HR systems to facilitate the new hire reporting process. This integration allows for seamless data transfer, eliminating the need for manual entry and enhancing overall efficiency. With compatible HR tools, managing new hires becomes a unified process.

-

Is there a free trial available for the new hire reporting form 2024 feature?

airSlate SignNow offers a free trial that allows users to explore features, including the new hire reporting form 2024 functionality. This trial gives prospective customers the opportunity to test the platform and evaluate its effectiveness for their business needs. You can sign up directly on the website to start using the trial.

-

What security measures does airSlate SignNow use for handling new hire forms?

airSlate SignNow implements robust security measures to ensure the safety of your new hire reporting forms. This includes data encryption, secure cloud storage, and compliance with industry standards. With these security protocols in place, you can rest assured that sensitive employee information is protected.

-

What pricing plans are available for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options ideal for small businesses and enterprises. Each plan includes access to essential features like the new hire reporting form 2024. You can review detailed pricing on the airSlate SignNow website to find the best fit for your organization.

Get more for What Is A New Hire Reporting Firm

Find out other What Is A New Hire Reporting Firm

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now