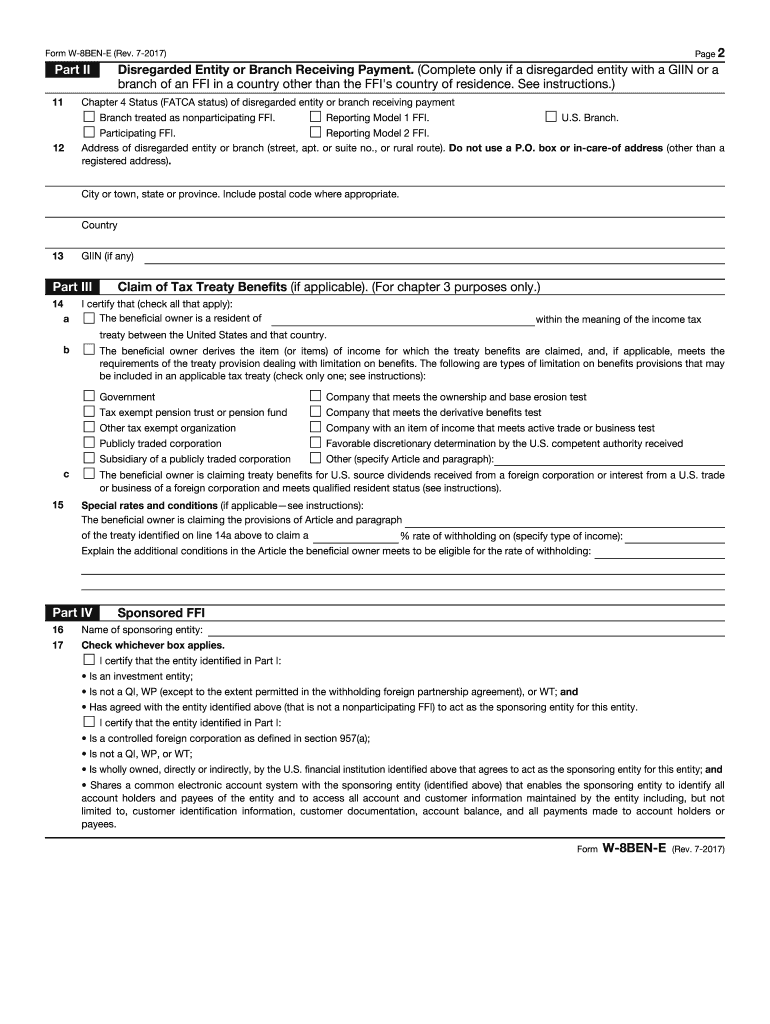

Irs Form

What is the IRS?

The Internal Revenue Service (IRS) is the federal agency responsible for administering and enforcing the internal revenue laws of the United States. It oversees the collection of taxes, the issuance of tax refunds, and the enforcement of tax regulations. The IRS plays a crucial role in ensuring compliance with tax laws and providing guidance to taxpayers on their obligations. Understanding the IRS is essential for individuals and businesses alike, as it impacts financial planning and legal compliance.

How to Use the IRS

Using the IRS effectively involves understanding its various functions and resources. Taxpayers can access forms, instructions, and guidelines directly from the IRS website. Individuals can file their tax returns online, check the status of their refunds, and make payments through the IRS portal. For businesses, the IRS provides resources for payroll tax management and compliance with employment tax regulations. Familiarizing oneself with these tools can streamline the tax process and ensure adherence to legal requirements.

Steps to Complete the IRS Form

Completing an IRS form requires careful attention to detail. Here are key steps to follow:

- Gather necessary documents, such as W-2s, 1099s, and other income statements.

- Choose the appropriate IRS form based on your tax situation, such as the 1040 for individual income tax.

- Fill out the form accurately, ensuring all information is correct and complete.

- Review the form for any errors or omissions before submission.

- Submit the form electronically or via mail, depending on your preference and the specific form requirements.

Legal Use of the IRS

The legal use of IRS forms is governed by federal tax laws. It is essential to ensure that all information provided on the forms is truthful and accurate, as providing false information can lead to penalties or legal consequences. The IRS requires that taxpayers maintain records supporting their claims and deductions for a specified period. Understanding the legal implications of IRS forms helps taxpayers avoid issues with compliance and ensures that they meet their obligations under the law.

Filing Deadlines / Important Dates

Filing deadlines are critical for taxpayers to avoid penalties. Generally, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Businesses may have different deadlines based on their entity type and tax year. It is important to stay informed about these dates to ensure timely filing and compliance with IRS regulations.

Required Documents

When preparing to file an IRS form, certain documents are essential. Commonly required documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous tax returns for reference

- Social Security numbers for all dependents

Having these documents ready can facilitate a smoother filing process and help ensure accuracy.

Form Submission Methods

IRS forms can be submitted through various methods, including:

- Online filing through the IRS e-file system or authorized software

- Mailing paper forms to the appropriate IRS address

- In-person submission at designated IRS offices, if applicable

Choosing the right submission method can depend on personal preference, the complexity of the tax situation, and the specific form being filed.

Quick guide on how to complete irs

Prepare Irs seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without delays. Manage Irs on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to edit and eSign Irs effortlessly

- Locate Irs and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your adjustments.

- Select how you wish to submit your form, via email, text (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your preference. Edit and eSign Irs and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the IRS?

airSlate SignNow is a powerful eSignature platform that enables businesses to send and sign documents efficiently. When dealing with any documents related to the IRS, the platform ensures compliance with eSignature laws, making it easier for users to submit tax forms electronically.

-

How does airSlate SignNow help with IRS documentation?

airSlate SignNow streamlines the process of preparing and signing IRS documents, ensuring they are filled out correctly and submitted on time. This helps businesses avoid penalties and ensures compliance with IRS regulations, simplifying the tax filing process.

-

Is airSlate SignNow cost-effective for small businesses needing IRS forms?

Yes, airSlate SignNow offers competitive pricing plans that are designed to accommodate small businesses. By choosing airSlate SignNow, small companies can save time and resources when managing and signing IRS-related documentation, ensuring cost efficiency.

-

What features does airSlate SignNow offer that are beneficial for handling IRS forms?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage. These features specifically assist users in managing IRS forms efficiently, reducing errors, and ensuring quick processing.

-

Can I integrate airSlate SignNow with other tools for IRS-related tasks?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including accounting software popular for IRS tasks. This integration enhances productivity, allowing users to handle documents related to IRS more effectively.

-

Is airSlate SignNow legally compliant for IRS document submissions?

Yes, airSlate SignNow complies with all necessary laws and regulations regarding digital signatures, making it a valid option for IRS document submissions. Users can confidently sign IRS forms knowing they are following legal standards.

-

How secure is airSlate SignNow for submitting IRS documents?

airSlate SignNow utilizes high-level security protocols to protect documents, including IRS submissions. With encryption and secure access, businesses can trust that their sensitive information is safe when using the platform.

Get more for Irs

Find out other Irs

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile