Form as 22

What is the Form As 22

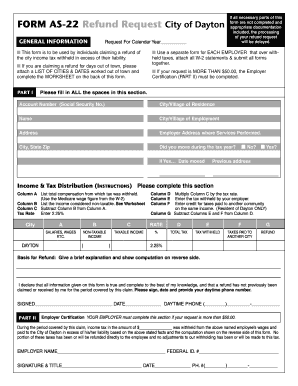

The Form As 22 is a specific tax form utilized by residents of the city of Dayton for various financial and tax-related purposes. This form is typically used to request refunds or adjustments related to local taxes. Understanding the purpose of the Form As 22 is crucial for ensuring compliance with local tax regulations and for effectively managing personal or business finances. It is essential for individuals and businesses to familiarize themselves with this form to navigate their tax obligations accurately.

How to use the Form As 22

Using the Form As 22 involves several straightforward steps. First, ensure that you have the correct version of the form, which can usually be obtained from the city of Dayton's official website or local tax office. Next, fill out the form with accurate information, including personal details, tax identification numbers, and any relevant financial data. Once completed, review the form for accuracy before submission. It is also advisable to keep a copy for your records. This form can help facilitate tax refunds or adjustments when used correctly.

Steps to complete the Form As 22

Completing the Form As 22 requires careful attention to detail. Here is a step-by-step guide:

- Obtain the Form As 22 from the appropriate source.

- Fill in your personal information, including your name, address, and tax identification number.

- Provide details regarding the tax year and the specific refund or adjustment you are requesting.

- Attach any necessary documentation that supports your request, such as previous tax returns or payment receipts.

- Review the completed form for accuracy and ensure that all required fields are filled out.

- Submit the form according to the instructions provided, whether online, by mail, or in person.

Legal use of the Form As 22

The legal use of the Form As 22 is governed by local tax laws and regulations. To be considered valid, the form must be completed accurately and submitted within the designated timeframes. Compliance with these regulations ensures that the requests made through the Form As 22 are recognized and processed by the city of Dayton. It is important to understand the legal implications of using this form, as any inaccuracies or omissions could lead to delays or denials of requests.

Filing Deadlines / Important Dates

Filing deadlines for the Form As 22 are critical to ensure timely processing of tax refunds or adjustments. Typically, the form must be submitted by a specific date following the end of the tax year. Residents should check the city of Dayton's official resources for the exact deadlines, as these dates can vary annually. Missing the deadline may result in the inability to claim refunds or make necessary adjustments, emphasizing the importance of timely submission.

Required Documents

When completing the Form As 22, certain documents may be required to support your request. These can include:

- Previous tax returns

- Payment receipts or proof of tax payments

- Identification documents, such as a driver's license or social security card

- Any additional documentation that substantiates your claim for a refund or adjustment

Gathering these documents in advance can streamline the process and enhance the likelihood of a successful submission.

Quick guide on how to complete form as 22

Complete Form As 22 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form As 22 on any device using airSlate SignNow applications for Android or iOS and enhance any document-related task today.

How to modify and electronically sign Form As 22 effortlessly

- Obtain Form As 22 and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Form As 22 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form as 22

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an AS 22 form?

An AS 22 form is a document used for electronic signatures that streamlines signing processes. airSlate SignNow provides a user-friendly platform to create, send, and eSign your AS 22 forms efficiently. This helps reduce paperwork and enhances productivity.

-

How much does it cost to use airSlate SignNow for AS 22 forms?

airSlate SignNow offers various pricing plans that cater to different needs when it comes to AS 22 forms. Depending on the features and scale of usage, businesses can choose a plan that best fits their budget. A free trial is also available for users to explore the platform's capabilities.

-

What features does airSlate SignNow offer for AS 22 forms?

airSlate SignNow provides essential features for AS 22 forms, including customizable templates, real-time notifications, and secure storage. Users can also take advantage of advanced options such as bulk sending and personalized branding to enhance their document workflow. This comprehensive feature set makes managing AS 22 forms easy and efficient.

-

Can I integrate airSlate SignNow with other applications for AS 22 forms?

Yes, airSlate SignNow allows seamless integration with numerous applications for managing AS 22 forms. Connect with tools such as Google Drive, Dropbox, and CRM platforms to enhance your workflow. These integrations simplify document management and ensure that your AS 22 forms fit into your existing processes effortlessly.

-

What are the benefits of using airSlate SignNow for AS 22 forms?

Using airSlate SignNow for AS 22 forms offers several benefits, including faster turnaround times and improved accuracy. The platform minimizes the risk of errors associated with manual signing processes. Additionally, it ensures compliance with legal standards for electronic signatures, providing you peace of mind.

-

Is airSlate SignNow secure for signing AS 22 forms?

Absolutely! airSlate SignNow prioritizes security and compliance when managing AS 22 forms. It incorporates industry-standard encryption and audit trails to ensure that your documents remain confidential and tamper-proof. This commitment to security makes it a reliable choice for businesses.

-

How can I track the status of my AS 22 forms in airSlate SignNow?

airSlate SignNow provides features for tracking the status of your AS 22 forms in real-time. Users can easily view who has signed, who is yet to sign, and when the document was accessed. This transparency helps manage document workflow efficiently and keeps everyone informed.

Get more for Form As 22

- Form 13 519415422

- Dd form 1380

- Physical activity readiness questionnaire form

- Family intake form

- Schedule or asc oregon adjustments for form or 40 filers

- Oracle forms servicesusing run report object to call

- Oregon tax forms printable state form or 40 and

- Fillable online home loan application form pdf 412kb

Find out other Form As 22

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement