Gst Pct 05 in Word Format

What is the Gst Pct 05 In Word Format

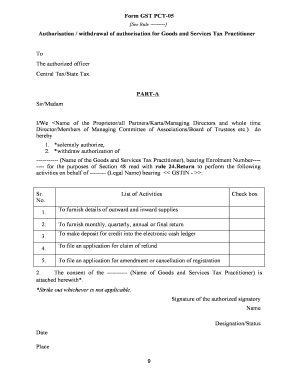

The Gst Pct 05 in word format is a specific document used for various administrative purposes, often related to tax or compliance within business operations. This form allows users to input necessary information in a structured manner, ensuring that all required fields are addressed. The word format facilitates easy editing and customization, making it accessible for individuals and businesses alike. Understanding the purpose and structure of the Gst Pct 05 is essential for accurate completion and submission.

How to use the Gst Pct 05 In Word Format

Utilizing the Gst Pct 05 in word format involves several straightforward steps. First, download the form from a reliable source. Open the document in a word processing application, such as Microsoft Word or Google Docs. Carefully read through the instructions provided within the form to ensure compliance with all requirements. Fill in the necessary fields, ensuring accuracy in the information provided. Once completed, save the document securely, and prepare it for submission according to the guidelines specified by the relevant authority.

Steps to complete the Gst Pct 05 In Word Format

Completing the Gst Pct 05 in word format requires attention to detail. Follow these steps for a successful submission:

- Download the Gst Pct 05 form in word format.

- Open the form in a compatible word processor.

- Review the form's instructions carefully.

- Enter all required information accurately.

- Double-check for any errors or omissions.

- Save the completed document in a secure location.

- Submit the form as per the specified method (online, by mail, or in person).

Legal use of the Gst Pct 05 In Word Format

The Gst Pct 05 in word format holds legal significance when completed correctly. To ensure its legal validity, it must adhere to established guidelines, including proper signatures and dates. Utilizing a reliable eSignature platform can enhance the document's legality by providing a digital certificate that verifies the signer's identity. Compliance with relevant laws such as the ESIGN Act and UETA is crucial for the document to be recognized in legal contexts.

Key elements of the Gst Pct 05 In Word Format

Understanding the key elements of the Gst Pct 05 in word format is vital for accurate completion. Important components typically include:

- Identification information of the individual or business submitting the form.

- Specific details related to the purpose of the form.

- Signature and date fields to validate the document.

- Instructions for submission and any required attachments.

Form Submission Methods (Online / Mail / In-Person)

The Gst Pct 05 can be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online: Many authorities allow electronic submission through their official websites, often requiring an account.

- Mail: Completed forms can be printed and sent via postal service to the designated address.

- In-Person: Some submissions may require personal delivery to a specific office or agency.

Quick guide on how to complete gst pct 05 in word format

Effortlessly Prepare Gst Pct 05 In Word Format on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documentation, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle Gst Pct 05 In Word Format on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Editing and eSigning Gst Pct 05 In Word Format Made Easy

- Locate Gst Pct 05 In Word Format and click Get Form to begin.

- Use the tools available to complete your form.

- Select essential sections of the documents or obscure sensitive information with the features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Gst Pct 05 In Word Format while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst pct 05 in word format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is included in the gst pct 05 in word format using airSlate SignNow?

The gst pct 05 in word format provided by airSlate SignNow includes all necessary fields and sections required for GST compliance. Our platform allows you to easily customize and fill out the document, ensuring that all your information is correct and ready for submission. Additionally, the document can be eSigned quickly and securely, streamlining your workflow.

-

How can I obtain the gst pct 05 in word format through airSlate SignNow?

To obtain the gst pct 05 in word format, simply sign up for an account on airSlate SignNow. Once you’re logged in, you can create or upload your document, convert it into the required format, and fill in the necessary details. The platform makes it intuitive and effortless to manage your GST documents.

-

Is there a cost associated with accessing the gst pct 05 in word format on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that typically include access to standard document formats like gst pct 05 in word format. Depending on the plan you choose, you may benefit from additional features such as advanced eSignature capabilities, integrations, and enhanced security, all designed to ensure you get the most value from your investment.

-

What are the key features of using airSlate SignNow for gst pct 05 in word format?

Using airSlate SignNow for your gst pct 05 in word format provides several key features including customizable templates, eSigning capabilities, and easy document sharing options. Additionally, our cloud storage ensures your documents are securely saved and accessible anytime, anywhere, facilitating efficient handling of your GST requirements.

-

Can I integrate airSlate SignNow with other tools for managing the gst pct 05 in word format?

Yes, airSlate SignNow offers seamless integrations with various business applications and tools. Whether you use accounting software, CRM systems, or cloud storage services, our platform allows you to easily incorporate the gst pct 05 in word format into your existing workflows. This enhances efficiency and reduces the time spent on document management.

-

What benefits do I get by using airSlate SignNow for the gst pct 05 in word format?

By using airSlate SignNow for the gst pct 05 in word format, you gain the benefits of speed, accuracy, and compliance. The platform simplifies the process of filling out and signing documents, reduces errors, and ensures that your submissions meet GST standards. Overall, this leads to a more organized and stress-free experience.

-

Is it possible to track the status of my gst pct 05 in word format documents?

Absolutely! airSlate SignNow includes tracking features that allow you to monitor the status of your gst pct 05 in word format documents. You can see who has signed, when they signed, and if there are any pending actions, ensuring you stay informed about your document flow at all times.

Get more for Gst Pct 05 In Word Format

- A rounding exercise form

- Citizenship in the world workbook form

- List of proposed witnesses form

- Tauhara north grants form

- Operating and maintenance manual of the tracklaying vehicle snow form

- Healthy living word search answer key form

- Pediatric patient intake form lighthouse chiropractic

- Creative service contract template form

Find out other Gst Pct 05 In Word Format

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later