Financial Planning Data Gathering Form

What is the financial planning data gathering form

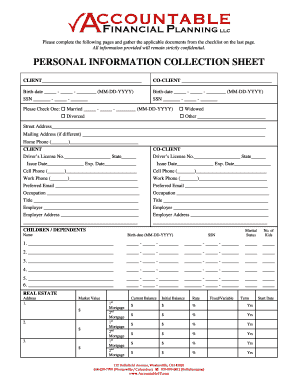

The financial planning data gathering form is a structured document designed to collect essential information from clients seeking financial advice or services. This form typically includes sections for personal details, financial goals, income sources, expenses, assets, and liabilities. By providing a comprehensive overview of a client's financial situation, the form enables financial advisors to tailor their recommendations and strategies. It is an essential tool for ensuring that both the advisor and the client are aligned on objectives and expectations.

Key elements of the financial planning data gathering form

Several critical components make up the financial planning data gathering form. These elements include:

- Personal Information: Name, contact details, and demographic information.

- Financial Goals: Short-term and long-term objectives, such as retirement planning or purchasing a home.

- Income Details: Sources of income, including salary, investments, and other revenue streams.

- Expenses: Monthly and annual expenditures, including fixed and variable costs.

- Assets and Liabilities: A comprehensive list of owned assets, such as real estate and investments, alongside any outstanding debts.

These elements provide a holistic view of a client's financial landscape, allowing for informed decision-making.

Steps to complete the financial planning data gathering form

Completing the financial planning data gathering form involves several straightforward steps:

- Gather Documentation: Collect necessary financial documents, such as pay stubs, tax returns, and bank statements.

- Fill Out Personal Information: Provide accurate personal details, ensuring all contact information is up to date.

- Detail Financial Goals: Clearly outline both short-term and long-term financial objectives.

- List Income Sources: Include all sources of income, ensuring to specify amounts and frequency.

- Outline Expenses: Record all monthly and annual expenses to provide a complete financial picture.

- Document Assets and Liabilities: List all assets and liabilities, including their current values.

Once completed, the form can be submitted to the financial advisor for review and discussion.

Legal use of the financial planning data gathering form

For the financial planning data gathering form to be legally valid, it must comply with relevant regulations and standards. This includes ensuring that the information collected is handled in accordance with privacy laws such as the Gramm-Leach-Bliley Act and the Fair Credit Reporting Act. Additionally, obtaining the client's consent for data collection and sharing is crucial. By following these legal guidelines, financial advisors can protect both their clients' information and their own practice.

How to use the financial planning data gathering form

The financial planning data gathering form serves as a foundational tool for financial advisors. To use it effectively:

- Initial Consultation: Introduce the form during the first meeting with the client to establish a comprehensive understanding of their financial situation.

- Review Together: Go through the form with the client, ensuring clarity and accuracy in the information provided.

- Follow Up: Use the completed form as a basis for follow-up discussions and to develop personalized financial strategies.

This approach fosters transparency and builds trust between the advisor and the client, enhancing the overall advisory relationship.

Examples of using the financial planning data gathering form

Financial advisors utilize the financial planning data gathering form in various scenarios, including:

- Retirement Planning: Assessing a client's readiness for retirement by evaluating their current savings and future income needs.

- Investment Strategy Development: Understanding a client's risk tolerance and investment goals to create a tailored portfolio.

- Debt Management: Identifying liabilities and expenses to devise a strategy for reducing debt and improving financial health.

These examples illustrate how the form can facilitate targeted financial planning and advice.

Quick guide on how to complete financial planning data gathering form

Complete Financial Planning Data Gathering Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow supplies all the resources you require to create, edit, and eSign your documents quickly without delays. Manage Financial Planning Data Gathering Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Financial Planning Data Gathering Form with ease

- Obtain Financial Planning Data Gathering Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Financial Planning Data Gathering Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the financial planning data gathering form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a financial data gathering form?

A financial data gathering form is a structured document that helps organizations collect critical financial information from clients or stakeholders efficiently. With airSlate SignNow, you can create customizable financial data gathering forms to streamline data collection, ensuring accuracy and compliance in your financial processes.

-

How does airSlate SignNow improve the financial data gathering process?

airSlate SignNow enhances the financial data gathering process by providing an intuitive platform that simplifies document creation and eSigning. This efficient solution allows businesses to collect responses quickly, ensuring that all necessary financial data is accurately captured and stored securely.

-

Are there any costs associated with using the financial data gathering form?

Yes, there are pricing tiers for using airSlate SignNow, with options tailored to fit various business needs. Depending on the features you require for your financial data gathering forms, you can choose a plan that provides the necessary functionality at an affordable price.

-

Can I customize my financial data gathering form?

Absolutely! airSlate SignNow offers extensive customization options for your financial data gathering forms. You can add specific fields, branding elements, and choose templates that best suit your organization's needs, allowing for a tailored experience.

-

What are the benefits of using airSlate SignNow for financial data gathering?

Using airSlate SignNow for your financial data gathering forms offers numerous benefits, including increased efficiency, improved accuracy, and enhanced security. The solution also facilitates seamless communication between users and clients, reducing the turnaround time for important financial information.

-

Does airSlate SignNow integrate with other software for financial data collection?

Yes, airSlate SignNow provides integrations with various third-party applications such as CRM and accounting systems. This allows you to sync data collected through your financial data gathering forms directly into your existing workflows for better management and tracking.

-

Is technical support available for users of financial data gathering forms?

Yes, airSlate SignNow offers comprehensive technical support for users of its platform. Whether you have questions about creating financial data gathering forms or need assistance with other features, their support team is available to help you resolve any issues.

Get more for Financial Planning Data Gathering Form

- Security exemption affidavit form

- Gateway b1 workbook answers pdf form

- California roseville medical center form

- Pnc payoff request form

- Form dv4 30193080

- Recommended accident evacuation and emergency plan azdhs form

- Worksheet helpful and harmful bacteria answer key form

- Partnership separation agreement template form

Find out other Financial Planning Data Gathering Form

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast