City of San Diego Tax Exempt Form

What is the City of San Diego Tax Exempt Form

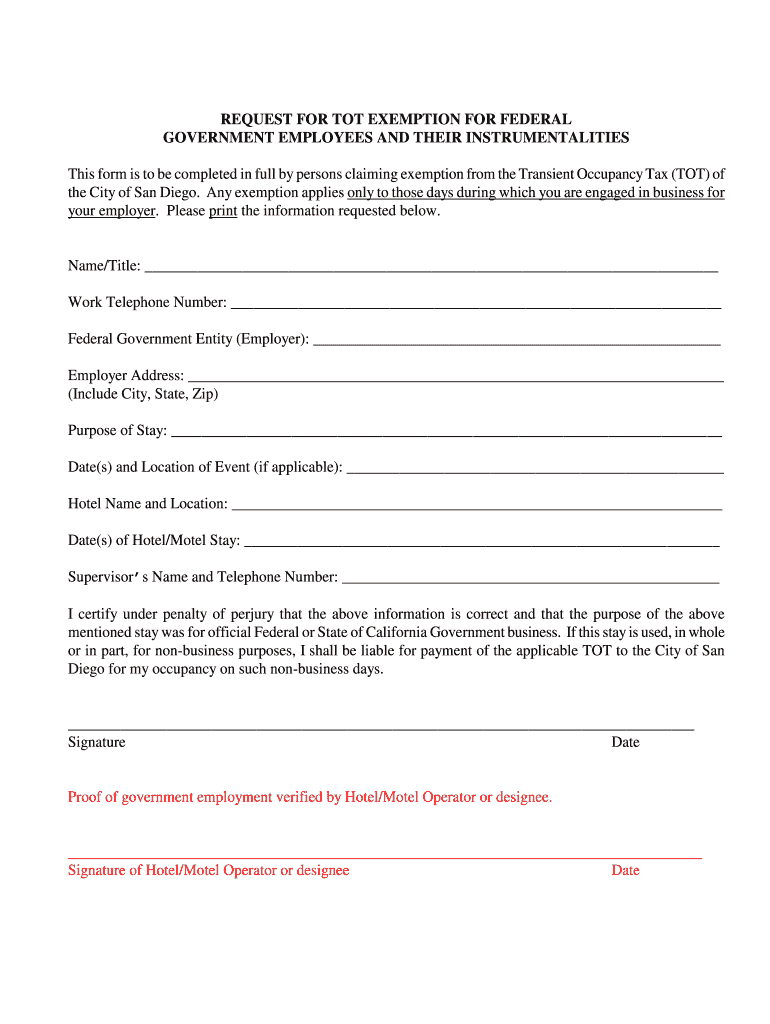

The City of San Diego Tax Exempt Form is a document used by eligible entities to claim exemption from certain taxes, including the Transient Occupancy Tax (TOT). This form is essential for organizations such as non-profits, government agencies, and educational institutions that qualify for tax relief under specific conditions. By submitting this form, eligible entities can avoid paying taxes on accommodations and other related expenses, thereby supporting their operational budgets.

How to use the City of San Diego Tax Exempt Form

To use the City of San Diego Tax Exempt Form, individuals or organizations must first ensure they meet the eligibility criteria. Once confirmed, they should fill out the form accurately, providing all required information, including the name of the entity, tax identification number, and details about the transaction. After completing the form, it must be submitted to the appropriate tax authority, either electronically or in paper format, depending on the submission guidelines provided by the city.

Steps to complete the City of San Diego Tax Exempt Form

Completing the City of San Diego Tax Exempt Form involves several key steps:

- Gather necessary information: Collect all relevant details about your organization, including tax ID and contact information.

- Fill out the form: Enter the required information accurately in the designated fields.

- Review for accuracy: Double-check all entries to ensure there are no errors or omissions.

- Submit the form: Choose your preferred submission method, either online or by mail, and ensure it is sent to the correct address.

Eligibility Criteria

Eligibility for the City of San Diego Tax Exempt Form typically includes non-profit organizations, government entities, and educational institutions. To qualify, the entity must demonstrate that it operates under specific guidelines that warrant tax exemption. This may include providing proof of non-profit status or documentation that supports the claim for exemption based on the nature of the services provided.

Required Documents

When applying for tax exemption using the City of San Diego Tax Exempt Form, certain documents may be required to support the application. These can include:

- Proof of tax-exempt status, such as a 501(c)(3) designation letter.

- Identification documents, including the entity's tax identification number.

- Any relevant contracts or agreements that relate to the transaction for which exemption is being claimed.

Form Submission Methods

The City of San Diego Tax Exempt Form can be submitted through various methods, including:

- Online submission: Many forms can be completed and submitted electronically through the city’s official website.

- Mail: Completed forms can be printed and mailed to the designated tax authority.

- In-person: Some entities may choose to submit the form in person at local government offices.

Quick guide on how to complete san diego exemption tax form

Your assistance manual on how to prepare your City Of San Diego Tax Exempt Form

If you’re looking to understand how to assemble and transmit your City Of San Diego Tax Exempt Form, here are some straightforward instructions on how to simplify tax filing considerably.

To begin, you just need to set up your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, and return to amend information as necessary. Optimize your tax management with sophisticated PDF editing, eSigning, and seamless sharing.

Follow the steps below to complete your City Of San Diego Tax Exempt Form in no time:

- Create your account and start working on PDFs in just a few minutes.

- Explore our catalog to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your City Of San Diego Tax Exempt Form in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and rectify any inaccuracies.

- Save your modifications, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to submit your taxes electronically with airSlate SignNow. Please remember that filing in writing can increase errors in returns and delay reimbursements. Before e-filing your taxes, be sure to verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

FAQs

-

How long should we expect to wait until California’s gas tax money is used to fill potholes in San Diego?

It will probably get worse before it gets better. The gas tax and registration monies are going down that black hole called CALPERS. CALSTRS is also in the red and monies from the taxes go into the General Fund so they aren’t well tracked. The City of San Diego has it’s own pension deficit and they tried to solve it by putting new employees on a 401k. But the new employees are suing to reinstate fixed pensions which are the big reason people line up to work for goverment anyway. But your smaller cities can’t afford to set up pension plans so they join CALPERS and many of these cities are having problem with street lights and potholes paying pension contributions. After the legislature passed SB400 in 2000, the CALPERS pensions were essentially doubled. And the catch-up in contributions is a bitch because it gets very political. The solution since 2000 is more small taxes and fees like gas tax and registration but the state constitution allows raising property taxes to pay for pensions. So far, only Oakland has considered it but it hasn’t been implemented. Another thrust is to repeal Prop 13, first on commercial properties, then on residences. But this is a hot potato as I think most Californians, if they knew about the super-generous pensions already, would not support a growing super-class of citizens. Bring on the next recession, and I think you will see a real battle between this privileged class and the starving regular folk. I have a client who was a Physics prof at SDSU that gets 14k a month. And it’s guaranteed. Most teachers get around 8k a month. Not even big executives score that type of money. And the state employees also have other special plans for additional retirement.So to answer your question in a short manner, you have to let this go to when the fireworks start. It’s going to make for very interesting political fireworks when the politicians use it to get elected and the public wakes up.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the san diego exemption tax form

How to generate an eSignature for the San Diego Exemption Tax Form online

How to create an eSignature for your San Diego Exemption Tax Form in Chrome

How to create an electronic signature for signing the San Diego Exemption Tax Form in Gmail

How to make an eSignature for the San Diego Exemption Tax Form from your smart phone

How to make an electronic signature for the San Diego Exemption Tax Form on iOS devices

How to create an eSignature for the San Diego Exemption Tax Form on Android

People also ask

-

What is a San Diego tax exempt form and why do I need it?

The San Diego tax exempt form is a document that allows eligible organizations to conduct tax-exempt transactions in the local area. This form is essential for businesses looking to save on sales tax when purchasing goods and services. By submitting the San Diego tax exempt form, your organization can streamline expenses and improve fiscal efficiency.

-

How can airSlate SignNow help with my San Diego tax exempt form processing?

airSlate SignNow simplifies the process of signing and sending your San Diego tax exempt form. With our easy-to-use platform, you can quickly eSign documents and share them securely. This ensures faster processing and reduces the chances of errors, allowing your organization to utilize its tax-exempt status efficiently.

-

Is airSlate SignNow a cost-effective solution for managing tax exempt forms?

Yes, airSlate SignNow is a cost-effective solution for managing your San Diego tax exempt form. Our pricing plans cater to businesses of all sizes, allowing you to choose a package that fits your budget. By reducing the time and costs associated with traditional paperwork, airSlate SignNow ultimately saves your organization money.

-

Can I integrate airSlate SignNow with other software to handle my San Diego tax exempt forms?

Absolutely! airSlate SignNow offers seamless integration with various software platforms, enhancing your workflow when managing San Diego tax exempt forms. Whether you use CRM systems or project management tools, our integrations can streamline document tasks and improve overall efficiency.

-

What features does airSlate SignNow offer for managing San Diego tax exempt forms?

airSlate SignNow includes a variety of features tailored for managing your San Diego tax exempt forms effectively. Key features include customizable templates, easy eSigning, document tracking, and secure cloud storage. These tools help ensure that your forms are completed accurately and stored safely.

-

How secure is the processing of San Diego tax exempt forms with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure servers to protect your San Diego tax exempt forms and sensitive information. You can trust that your documents are handled with the utmost care and confidentiality.

-

Can I use airSlate SignNow to collaborate with team members on my San Diego tax exempt forms?

Yes, airSlate SignNow allows for easy collaboration among team members when handling San Diego tax exempt forms. You can share documents, request signatures, and comment directly within the platform. This collaborative approach ensures that everyone stays informed and up to date on the form's status.

Get more for City Of San Diego Tax Exempt Form

- License agreement use form

- Explanation bankruptcy form

- Sample application form

- Employee damages form

- Advertising services contract form

- Food truck parking lease agreement form

- Waiver and release with regard to installation of indoor and ourdoor christmas decorations form

- Trademark use agreement form

Find out other City Of San Diego Tax Exempt Form

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now