Citibankbranchkyc Citi Com Form

Understanding the Citibank KYC Form

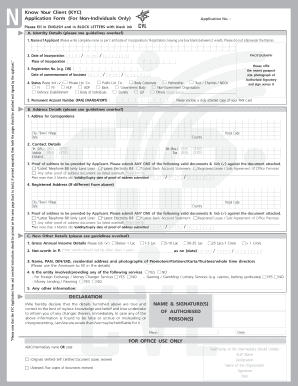

The Citibank KYC form, also known as the Know Your Customer form, is a crucial document that financial institutions, including Citibank, require to verify the identity of their customers. This form is designed to prevent fraud, money laundering, and other illegal activities by ensuring that the bank knows who its clients are. The KYC process involves collecting personal information, including your name, address, date of birth, and identification documents. By completing this form, customers help Citibank comply with regulatory requirements and maintain the integrity of their banking services.

Steps to Complete the Citibank KYC Form

Filling out the Citibank KYC form can be done online, making the process convenient and efficient. Here are the steps to complete the form:

- Visit the Citibank website or access the mobile app.

- Navigate to the KYC section, where you will find the form.

- Enter your personal details accurately, including your full name, address, and contact information.

- Upload the required identification documents, such as a government-issued ID or utility bill for address verification.

- Review all entered information for accuracy before submitting the form.

Once submitted, you will receive a confirmation of your KYC submission, and Citibank will process your information accordingly.

Required Documents for the Citibank KYC Form

To successfully complete the Citibank KYC form, you will need to provide specific documents that verify your identity and address. Commonly required documents include:

- A government-issued photo ID, such as a passport or driver's license.

- Proof of address, which can be a recent utility bill, bank statement, or lease agreement.

- Social Security Number (SSN) or Tax Identification Number (TIN) for tax purposes.

Having these documents ready can streamline the submission process and ensure compliance with KYC regulations.

Legal Use of the Citibank KYC Form

The Citibank KYC form is legally binding and must be completed accurately to comply with federal and state regulations. Financial institutions are required by law to implement KYC processes to prevent financial crimes. The information provided in the KYC form must be true and verifiable, as any discrepancies can lead to penalties, including account restrictions or legal action. By submitting this form, customers affirm that they understand the importance of providing accurate information for their banking relationship.

Form Submission Methods

Customers can submit the Citibank KYC form through various methods, ensuring flexibility and convenience:

- Online Submission: Complete and submit the form directly through the Citibank website or mobile app.

- In-Person Submission: Visit a local Citibank branch to fill out and submit the form with assistance from bank staff.

- Mail Submission: Print the completed form and send it to the designated Citibank address for processing.

Choosing the right submission method can depend on personal preference and accessibility to Citibank services.

Key Elements of the Citibank KYC Form

The Citibank KYC form consists of several key elements that are essential for identity verification. These include:

- Personal Information: Full name, date of birth, and contact details.

- Identification Details: Information from your government-issued ID.

- Address Verification: Documentation that confirms your residential address.

- Signature: Your signature to authenticate the information provided.

Each of these elements plays a vital role in ensuring that Citibank can accurately verify your identity and comply with regulatory standards.

Quick guide on how to complete citibankbranchkyc citi com

Manage Citibankbranchkyc Citi Com effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can obtain the proper format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Citibankbranchkyc Citi Com on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Citibankbranchkyc Citi Com with ease

- Find Citibankbranchkyc Citi Com and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, monotonous form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Citibankbranchkyc Citi Com and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the citibankbranchkyc citi com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Citibank KYC form and why is it important?

The Citibank KYC form is a document used to collect information about a client's identity, ensuring compliance with anti-money laundering regulations. Completing this form is crucial for maintaining a secure banking relationship and helps Citibank assess risk. Properly filling out the Citibank KYC form can also facilitate smoother transactions and banking operations.

-

How can airSlate SignNow assist with filling out the Citibank KYC form?

airSlate SignNow streamlines the process of filling out the Citibank KYC form by allowing users to electronically sign and send the document efficiently. With our user-friendly platform, you can easily upload the form and share it with clients or team members for fast completion. This not only saves time but also enhances the accuracy of the information provided.

-

What are the costs associated with using airSlate SignNow for the Citibank KYC form?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, ensuring you can manage the Citibank KYC form without breaking the bank. Our pricing structure includes various tiers to accommodate different usage levels, so you can select a plan that best meets your needs. We also provide a free trial, allowing you to experience our features before committing.

-

Are there any features specifically designed for compliance when using the Citibank KYC form?

Yes, airSlate SignNow includes robust compliance features that ensure the Citibank KYC form is handled securely and in accordance with regulatory requirements. Our platform offers secure document storage, audit trails, and customizable templates that assist in maintaining compliance. This helps businesses avoid potential legal issues and enhances trust with their clients.

-

Can I integrate airSlate SignNow with other software when handling the Citibank KYC form?

Absolutely! airSlate SignNow seamlessly integrates with various popular business applications, allowing users to incorporate the Citibank KYC form into their existing workflows. Whether it's CRM systems, document management software, or other tools, our integrations enhance productivity and ensure that all documents work together harmoniously.

-

What are the benefits of using airSlate SignNow for the Citibank KYC form over traditional methods?

Using airSlate SignNow for the Citibank KYC form offers numerous advantages over traditional paper methods, including faster processing times and reduced errors. Electronic signatures streamline the approval process, while digital storage eliminates the need for physical filing. Overall, our solution improves efficiency and helps your business operate more effectively.

-

Is it possible to track the status of the Citibank KYC form once sent out?

Yes, airSlate SignNow provides real-time tracking for documents, allowing you to monitor the status of the Citibank KYC form after it has been sent out. You will receive notifications when the form is viewed and signed, giving you peace of mind and valuable insights into your document's progress. This feature is particularly useful for managing deadlines and ensuring compliance.

Get more for Citibankbranchkyc Citi Com

- City of radcliff ky occupational tax form

- Using a dichotomous key gwisdesc2net form

- Motion to compel florida pdf form

- Arkansas cdl skills test score sheet form

- Phonics screener for intervention psi form

- Cliffs pavilion disabled tickets form

- As2124 download form

- China visa application form filled sample

Find out other Citibankbranchkyc Citi Com

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document