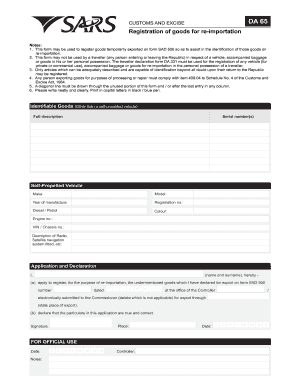

Da 65 Form

What is the Da 65 Form

The Da 65 form, also known as the SARS Da65, is a critical document used for tax purposes in South Africa. It is primarily utilized by individuals and businesses to declare their income and calculate their tax liabilities. This form is essential for ensuring compliance with tax regulations and is often required when filing annual tax returns. Understanding the specific requirements and implications of the Da 65 form is vital for accurate tax reporting.

How to use the Da 65 Form

Using the Da 65 form involves several key steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the form, providing detailed information about your income, deductions, and any applicable credits. It is crucial to review the form for accuracy before submission, as errors can lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines set by the tax authority.

Steps to complete the Da 65 Form

Completing the Da 65 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial information, including income sources and deductible expenses.

- Obtain the latest version of the Da 65 form from the appropriate tax authority.

- Fill out personal information, including your name, address, and taxpayer identification number.

- Report your total income, ensuring to include all sources of revenue.

- List any deductions and credits you are eligible for, as these can significantly reduce your taxable income.

- Double-check all entries for accuracy and completeness.

- Submit the form according to the specified guidelines, either online or by mail.

Legal use of the Da 65 Form

The legal use of the Da 65 form is governed by tax regulations that require accurate reporting of income and expenses. Submitting this form correctly ensures compliance with tax laws and helps avoid potential penalties. It is important to understand that any misrepresentation or errors in the form can lead to legal consequences, including audits or fines. Therefore, using a reliable platform for electronic submission can enhance security and compliance.

Required Documents

To complete the Da 65 form accurately, several documents are required. These typically include:

- Income statements from employers or clients.

- Receipts for deductible expenses.

- Bank statements to verify income and expenditures.

- Any prior tax returns that may provide useful information.

Having these documents readily available will streamline the completion process and ensure accurate reporting.

Form Submission Methods

The Da 65 form can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online submission through the tax authority's electronic filing system.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, where assistance may be available.

Choosing the right submission method can depend on personal preference, the complexity of the tax situation, and the resources available.

Quick guide on how to complete da 65 form

Execute Da 65 Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Da 65 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Da 65 Form with ease

- Locate Da 65 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or hide sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Da 65 Form to ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the da 65 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DA 65 form and why is it important?

The DA 65 form is a vital document used by the U.S. Army for processing specific transactions related to military personnel. Understanding the DA 65 form is crucial for ensuring timely and accurate documentation, which can signNowly impact service members' benefits and entitlements.

-

How can airSlate SignNow help with managing DA 65 forms?

airSlate SignNow streamlines the process of sending and eSigning DA 65 forms. With its user-friendly interface, businesses can quickly upload, sign, and manage these documents, ensuring efficiency and compliance throughout the process.

-

Is there a cost associated with using airSlate SignNow for DA 65 form management?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including features to manage DA 65 forms effectively. The pricing is competitive, and the platform provides excellent value given the efficiencies gained in document management.

-

What features does airSlate SignNow offer for handling DA 65 forms?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure eSignatures for DA 65 forms. These capabilities enhance both the speed and security of document transactions, making it easier for businesses to stay organized.

-

Can airSlate SignNow integrate with other software to manage DA 65 forms?

Absolutely! airSlate SignNow offers robust integration options with various software systems. This means that you can seamlessly manage DA 65 forms alongside your existing workflows and applications.

-

What are the benefits of using airSlate SignNow for the DA 65 form?

Utilizing airSlate SignNow for the DA 65 form brings signNow benefits such as reduced processing time and enhanced document security. Furthermore, the platform streamlines the signing process, allowing for faster approvals and improved workflow efficiency.

-

Is airSlate SignNow easy to use for submitting DA 65 forms?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to submit a DA 65 form. The straightforward interface reduces the learning curve, enabling users to navigate the platform effortlessly.

Get more for Da 65 Form

- Medical clearance form 1 14 14 pages joseph walrath md

- Qantas damaged baggage claim form

- Obm approval no 2529 0013 form

- Invokana rebate form

- Transmath placement test form

- Multifamily inspection checklist form

- Contractor asbestos notification statement brevard county form

- Blanket purchase agreement template form

Find out other Da 65 Form

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter