City of Toledo Individual Tax Return Form

What is the City Of Toledo Individual Tax Return

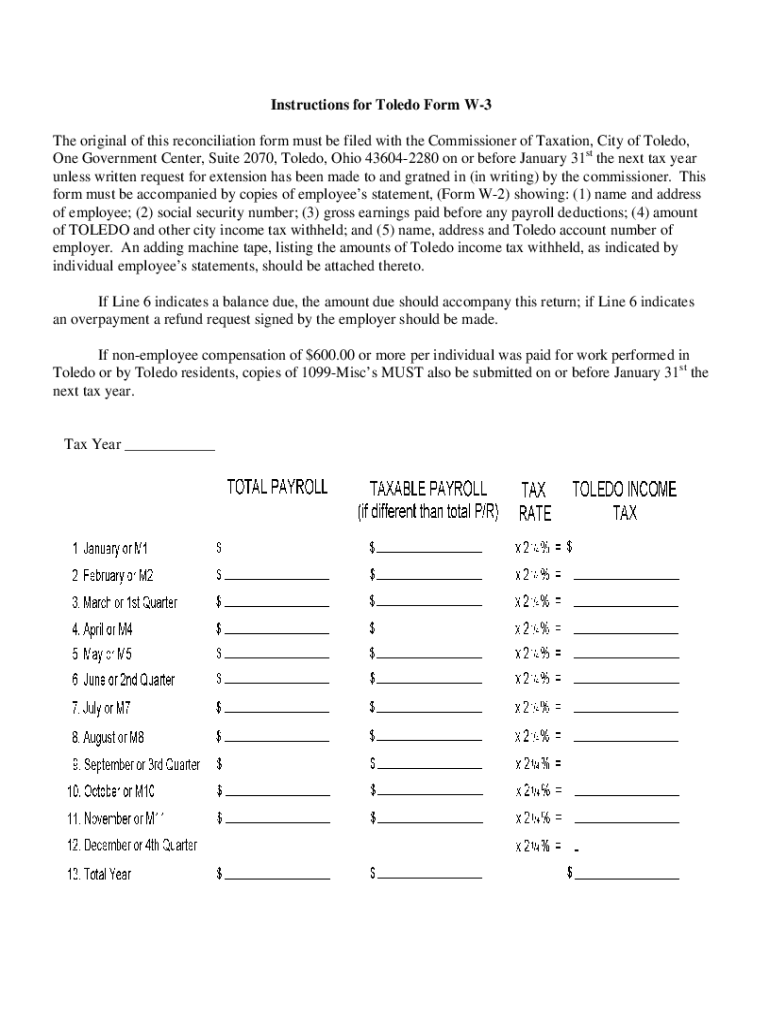

The City of Toledo Individual Tax Return is a document that residents and non-residents must complete to report their income and calculate their tax obligations to the city. This form is essential for ensuring compliance with local taxation laws and is used to assess the amount of income tax owed based on an individual's earnings within the city limits. The return typically includes information on wages, salaries, and other sources of income, as well as any applicable deductions or credits that may reduce the overall tax liability.

Steps to complete the City Of Toledo Individual Tax Return

Completing the City of Toledo Individual Tax Return involves several key steps:

- Gather necessary documents, such as W-2 forms, 1099s, and any other income statements.

- Obtain the correct tax form from the Toledo Division of Taxation, ensuring you have the most current version.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, including wages, interest, and dividends.

- Apply any eligible deductions or credits to calculate your taxable income.

- Determine the tax amount owed based on the city’s tax rates.

- Review the completed form for accuracy before submission.

How to obtain the City Of Toledo Individual Tax Return

The City of Toledo Individual Tax Return can be obtained through the Toledo Division of Taxation. Residents can access the form online through the official city website, or they may request a physical copy by visiting the tax department in person. Additionally, tax forms may be available at local government offices or libraries. It is important to ensure that you are using the correct tax year form, as different years may have different requirements.

Required Documents

To complete the City of Toledo Individual Tax Return, several documents are typically required:

- W-2 forms from employers, detailing annual earnings and tax withheld.

- 1099 forms for any freelance or contract work, reporting additional income.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, such as receipts for business expenses or charitable contributions.

- Previous year’s tax return, which can be helpful for reference.

Form Submission Methods

Individuals can submit the City of Toledo Individual Tax Return through various methods:

- Online: Many taxpayers prefer to file electronically using secure online platforms that comply with city regulations.

- By Mail: Completed forms can be mailed to the Toledo Division of Taxation at the designated address provided on the form.

- In-Person: Taxpayers may also choose to submit their returns in person at the tax department’s office during business hours.

Penalties for Non-Compliance

Failing to file the City of Toledo Individual Tax Return or submitting it late can result in penalties. The city imposes fines based on the amount owed and the duration of the delay. Additionally, interest may accrue on any unpaid taxes. It is crucial for taxpayers to be aware of filing deadlines and to ensure timely submission to avoid these penalties.

Quick guide on how to complete city of toledo individual tax return

Effortlessly Prepare City Of Toledo Individual Tax Return on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delay. Handle City Of Toledo Individual Tax Return on any device using the airSlate SignNow apps for Android or iOS and streamline any document-based task today.

A Simple Approach to Modify and eSign City Of Toledo Individual Tax Return

- Locate City Of Toledo Individual Tax Return and click Obtain Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Finish button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and eSign City Of Toledo Individual Tax Return to ensure outstanding communication throughout every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of toledo individual tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Toledo city tax forms?

Toledo city tax forms are official documents required for filing local taxes in Toledo. These forms may vary based on the type of tax, such as income tax or business tax. airSlate SignNow simplifies the process of filling out and submitting your Toledo city tax forms digitally.

-

How can airSlate SignNow help with Toledo city tax forms?

airSlate SignNow provides a user-friendly platform to eSign and submit your Toledo city tax forms quickly and securely. With our service, you can easily upload, fill out, and send your tax documents without the hassle of printing and mailing. This streamlined process ensures your forms are submitted on time.

-

Is airSlate SignNow cost-effective for handling Toledo city tax forms?

Yes, airSlate SignNow offers competitive pricing that makes it an affordable solution for managing your Toledo city tax forms. We provide various pricing plans that cater to different business sizes and needs, ensuring you only pay for the features you will use. A cost-effective solution helps businesses save time and money on tax-related paperwork.

-

What features does airSlate SignNow offer for Toledo city tax forms?

airSlate SignNow offers several features that enhance the management of Toledo city tax forms, including eSigning, customizable templates, and document analytics. Our platform also allows for secure storage and easy sharing of documents, ensuring your tax forms are protected and accessible. These features make the tax filing process smoother and more efficient.

-

Can I integrate airSlate SignNow with other software for Toledo city tax forms?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications to enhance your workflow related to Toledo city tax forms. Whether you are using accounting software, CRMs, or project management tools, our integrations allow for better data management and collaboration. This ensures you have all necessary information at your fingertips when dealing with tax documents.

-

How secure is my information when using airSlate SignNow for Toledo city tax forms?

Security is a top priority for airSlate SignNow when handling your Toledo city tax forms. We employ advanced encryption protocols to protect your documents during transmission and storage. Additionally, we comply with industry regulations, ensuring that your sensitive tax information remains confidential and secure.

-

Can I access airSlate SignNow from mobile devices for Toledo city tax forms?

Yes, airSlate SignNow is fully compatible with mobile devices, allowing you to manage your Toledo city tax forms on the go. Our mobile application enables you to eSign documents, access templates, and track your submissions easily from your smartphone or tablet. This flexibility ensures you can handle your tax obligations anytime, anywhere.

Get more for City Of Toledo Individual Tax Return

Find out other City Of Toledo Individual Tax Return

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation