How to Cancel Tin Number Online Form

What is the process for canceling a tin number online?

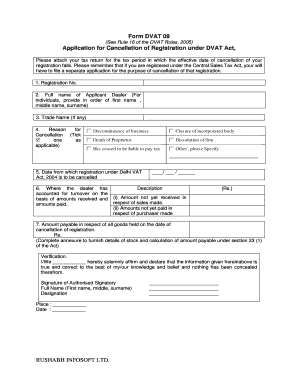

The process for canceling a tin number online involves several key steps to ensure that the cancellation is executed correctly. First, you need to gather all necessary information related to the tin number you wish to cancel. This includes your personal identification details and any relevant documentation that supports your request for cancellation. Once you have this information, you can access the appropriate online platform that facilitates the cancellation process. Follow the prompts to fill out the required forms accurately, ensuring that all information is complete and correct. After submitting the form, you should receive a confirmation of your cancellation request.

Steps to complete the cancellation of a tin number online

To successfully cancel your tin number online, follow these steps:

- Gather necessary documents, including your current tin number and identification.

- Visit the official website that provides the cancellation service.

- Locate the section dedicated to tin number cancellation.

- Fill out the online cancellation form with accurate information.

- Submit the form and wait for a confirmation email or message.

Make sure to keep a copy of your submission for your records. This will serve as proof of your cancellation request.

Required documents for tin number cancellation

When preparing to cancel your tin number, certain documents are typically required to facilitate the process. These may include:

- Your current tin number.

- Government-issued identification, such as a driver's license or passport.

- Any relevant tax documents that may support your cancellation request.

- A signed statement indicating your request for cancellation.

Having these documents ready will help streamline the cancellation process and ensure compliance with any legal requirements.

IRS guidelines for tin number cancellation

The IRS provides specific guidelines regarding the cancellation of a tin number. It is important to follow these guidelines to avoid any potential issues. Generally, the IRS requires that you formally notify them of your intention to cancel your tin number. This can often be done through the online portal or by submitting a written request. Ensure that you comply with any deadlines set by the IRS for cancellation requests, as failing to do so may result in complications or penalties.

Legal use of a canceled tin number

Once a tin number has been officially canceled, it is important to understand its legal implications. A canceled tin number cannot be used for any tax-related purposes, including filing tax returns or applying for credit. Any transactions or agreements made using a canceled tin number may be considered invalid. It is advisable to consult with a tax professional if you have questions about the legal ramifications of canceling your tin number.

Penalties for non-compliance with tin number cancellation

Failing to properly cancel a tin number can lead to several penalties. These may include:

- Incurred tax liabilities if the number is used after cancellation.

- Potential legal action for fraudulent use of a canceled number.

- Increased scrutiny from the IRS regarding your tax filings.

To avoid these penalties, it is crucial to follow the proper procedures for cancellation and ensure that all necessary notifications are made to the relevant authorities.

Quick guide on how to complete tin number example

Process tin number example effortlessly on any device

Digital document management has become widely accepted among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the required form and securely store it online. airSlate SignNow provides all the features necessary to create, modify, and electronically sign your documents swiftly without delays. Manage tin number on any device with the airSlate SignNow apps for Android or iOS and enhance any document-focused procedure today.

The simplest way to modify and eSign tin document with ease

- Find tin number document and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Modify and eSign tin registration form and ensure excellent communication at every step of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to tin number cancellation online

Create this form in 5 minutes!

How to create an eSignature for the cancellation of tin number

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask cancel tin number online

-

What is a TIN number and why is it important?

A TIN number, or Taxpayer Identification Number, is essential for individuals and businesses to report taxes and verify their identity. It helps streamline the tax process and ensures compliance with IRS regulations. Understanding the significance of a TIN number is vital for effective financial management.

-

How does airSlate SignNow help with TIN number documentation?

airSlate SignNow provides a seamless platform for securely signing and sending documents that may require TIN numbers. Our electronic signature solution ensures that all documentation is properly completed and legally binding. With advanced features, you can manage TIN number-related documents efficiently.

-

Can I integrate airSlate SignNow with accounting software that uses TIN numbers?

Yes, airSlate SignNow offers integrations with various accounting and financial software that often require the use of TIN numbers. This allows for more streamlined workflows where TIN numbers are needed in your documentation. You can easily connect our platform to your preferred apps for optimal efficiency.

-

What are the pricing options for using airSlate SignNow for TIN number-related services?

airSlate SignNow provides flexible pricing plans that cater to different business needs, including those handling documents requiring TIN numbers. Whether you're a small business or a large organization, we have a plan that fits your budget. You can choose from monthly or annual subscriptions based on your usage.

-

What features does airSlate SignNow offer for managing TIN number documents?

airSlate SignNow includes features such as templates, automated workflows, and secure cloud storage for managing documents that involve TIN numbers. These features enhance the user experience by simplifying the signing process and ensuring compliance. Your TIN number documentation is kept secure and easily accessible.

-

Is airSlate SignNow suitable for businesses needing to collect TIN numbers from clients?

Absolutely! airSlate SignNow is designed to help businesses efficiently collect TIN numbers and related information from clients through secure forms. Our user-friendly platform makes it easy for clients to provide their TIN numbers and sign documents from any device. This increases accuracy and reduces processing time.

-

How does airSlate SignNow ensure the security of TIN number documents?

Security is a top priority at airSlate SignNow, especially for sensitive information like TIN numbers. We utilize advanced encryption protocols and secure servers to protect your documents. Additionally, we comply with global security standards to ensure that your TIN number data is safe and confidential.

Get more for tin number form

- Fhps health history form

- Locations cardiology associates of michigan michigans form

- Npi dissemination form for bcbsm

- Allergy skin ampampamp ear clinic for pets 441 photos form

- Bcn e referral form

- Blue cross blue shield of michigan southfield member application for payment consideration form

- Oakland county medical control authority table of contents form

- Disabled dependent application for state health plan bcbsm and blue care network members disabled dependent application for form

Find out other tin no format

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself