Andres Sevtsuk Form

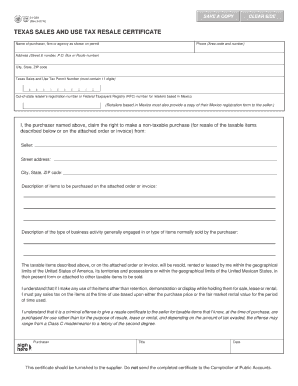

Understanding the Texas Sales Tax Certificate

The Texas sales tax certificate is a crucial document for businesses operating in Texas. It allows them to purchase goods and services without paying sales tax, provided those items are intended for resale. This certificate is essential for maintaining compliance with Texas tax laws and ensuring that businesses can operate effectively without incurring unnecessary costs. The Texas sales tax certificate is often referred to as a resale certificate and is recognized by the Texas Comptroller of Public Accounts.

How to Obtain a Texas Sales Tax Certificate

To obtain a Texas sales tax certificate, businesses must first register for a Texas sales and use tax permit. This process involves completing an application form, which can typically be done online through the Texas Comptroller's website. Once the application is approved, the business will receive a sales tax permit number, which is necessary for issuing a sales tax certificate. It is important to ensure that all information provided is accurate and up to date to avoid delays in processing.

Steps to Complete the Texas Sales Tax Certificate Form

Completing the Texas sales tax certificate form requires careful attention to detail. Here are the steps to follow:

- Begin by entering your business name and address accurately.

- Provide your Texas sales and use tax permit number.

- List the items you intend to purchase tax-exempt, ensuring they are for resale.

- Include the name and address of the seller from whom you are purchasing the items.

- Sign and date the certificate to validate it.

After completing the form, it is advisable to keep a copy for your records and provide the original to the seller when making purchases.

Legal Use of the Texas Sales Tax Certificate

The Texas sales tax certificate must be used in accordance with state laws. It is intended solely for purchases of items that will be resold in the regular course of business. Misuse of the certificate, such as using it for personal purchases or items not intended for resale, can lead to penalties and legal repercussions. Businesses should maintain accurate records of all transactions involving the use of the sales tax certificate to ensure compliance with Texas regulations.

Required Documents for the Texas Sales Tax Certificate

To successfully complete the Texas sales tax certificate, certain documents may be required. These typically include:

- A valid Texas sales and use tax permit number.

- Identification of the business entity, such as an Employer Identification Number (EIN).

- Contact information for the business owner or authorized representative.

Having these documents ready will streamline the process of obtaining and using the sales tax certificate effectively.

Penalties for Non-Compliance with Texas Sales Tax Regulations

Failure to comply with Texas sales tax regulations can result in significant penalties. Businesses that misuse the sales tax certificate may face fines, interest on unpaid taxes, and potential audits by the Texas Comptroller. It is essential for businesses to understand their responsibilities regarding the sales tax certificate to avoid these consequences. Regular training and updates on compliance can help mitigate risks associated with non-compliance.

Quick guide on how to complete andres sevtsuk

Complete Andres Sevtsuk effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to acquire the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without hassle. Manage Andres Sevtsuk on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign Andres Sevtsuk without any stress

- Locate Andres Sevtsuk and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Choose your preferred delivery method for your form, be it via email, SMS, invite link, or download to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Andres Sevtsuk to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the andres sevtsuk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas sales tax certificate?

A Texas sales tax certificate is a document that allows businesses to purchase goods without paying sales tax, provided the goods will be resold. This certificate is essential for retailers in Texas to ensure compliance with state tax laws and streamline the purchasing process.

-

How can I obtain a Texas sales tax certificate?

To obtain a Texas sales tax certificate, businesses must complete an application through the Texas Comptroller's Office. After providing the necessary information and submitting the form, you will receive your certificate, which is essential for tax-exempt purchases in Texas.

-

Can airSlate SignNow help with Texas sales tax certificates?

Yes, airSlate SignNow provides an efficient platform for businesses to manage and store their Texas sales tax certificates electronically. Our solution ensures easy access and secure sharing of documents, helping you maintain compliance with tax regulations.

-

Are there any costs associated with acquiring a Texas sales tax certificate?

There are no fees associated with applying for a Texas sales tax certificate from the state. However, businesses should consider potential costs related to document management solutions like airSlate SignNow that can help manage these important tax documents effectively.

-

What features does airSlate SignNow offer for managing Texas sales tax certificates?

airSlate SignNow offers features such as electronic signing, secure storage, and easy sharing options for Texas sales tax certificates. This ensures that all documents are legally binding and easily accessible for audits or compliance checks.

-

How does airSlate SignNow integrate with other platforms for managing sales tax documents?

airSlate SignNow seamlessly integrates with various business software, allowing for streamlined management of Texas sales tax certificates alongside your existing workflows. This integration enhances productivity by automating document handling and ensuring compliance effortlessly.

-

What are the benefits of using airSlate SignNow for Texas sales tax certificates?

Using airSlate SignNow for Texas sales tax certificates simplifies the process of obtaining and managing these important documents. With user-friendly features, secure storage, and ease-of-use, businesses can focus on growth while staying compliant with tax laws.

Get more for Andres Sevtsuk

Find out other Andres Sevtsuk

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template