Al8453 Form

What is the AL8453?

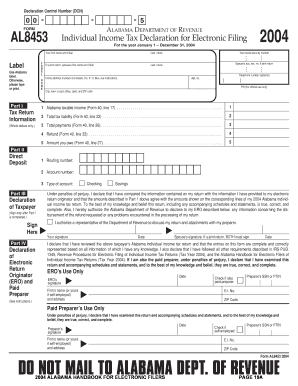

The AL8453 is a specific form used in Alabama for tax purposes, primarily related to individual income tax filings. This form serves to report various income types and deductions, ensuring compliance with state tax regulations. Understanding the purpose and requirements of the AL8453 is crucial for individuals looking to accurately file their taxes and avoid potential penalties.

How to Use the AL8453

Using the AL8453 involves several steps to ensure accurate completion. First, gather all necessary documents, including income statements and deduction records. Next, fill out the form with the relevant information, ensuring that all entries are accurate and complete. Once filled, the form can be submitted either electronically or via mail, depending on the preferences and requirements set by the Alabama Department of Revenue.

Steps to Complete the AL8453

Completing the AL8453 requires careful attention to detail. Here are the essential steps:

- Collect all relevant financial documents, such as W-2s and 1099s.

- Begin filling out the form by entering personal information, including your name and Social Security number.

- Report all sources of income, ensuring that you include any applicable deductions.

- Review the form for accuracy, making sure all calculations are correct.

- Submit the completed form either electronically or by mailing it to the appropriate address.

Legal Use of the AL8453

The AL8453 is legally recognized as a valid document for tax reporting in Alabama. To ensure its legal standing, it must be completed accurately and submitted within the designated deadlines. Compliance with state tax laws is essential, as failure to do so can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the AL8453 are typically aligned with the federal tax filing schedule. Generally, individual taxpayers must submit their forms by April fifteenth of each year. It is important to stay informed about any changes to these deadlines, as extensions may be available under certain circumstances.

Form Submission Methods

The AL8453 can be submitted using various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Alabama Department of Revenue's e-filing system.

- Mailing a physical copy of the completed form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Who Issues the Form

The AL8453 is issued by the Alabama Department of Revenue, which oversees tax collection and compliance within the state. This agency provides resources and guidance for individuals completing the form, ensuring that taxpayers have access to the necessary information for accurate filing.

Quick guide on how to complete al8453 17180936

Complete Al8453 effortlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to craft, modify, and electronically sign your files swiftly without any hold-ups. Manage Al8453 on any device through airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest way to alter and electronically sign Al8453 with ease

- Find Al8453 and click Get Form to initiate.

- Utilize the tools we offer to finalize your document.

- Emphasize essential parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and bears the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require creating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Al8453 while ensuring outstanding communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the al8453 17180936

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the al al8453 printable and how does it work?

The al al8453 printable is a versatile document format offered by airSlate SignNow that allows users to easily create, send, and eSign documents. This format ensures that your documents maintain their integrity and are easily accessible, making it a reliable choice for digital signatures. Whether you're in a corporate setting or a small business, using the al al8453 printable can streamline your document management process.

-

What are the pricing options for the al al8453 printable?

airSlate SignNow offers flexible pricing plans tailored to fit a range of business needs. The al al8453 printable is included in all subscription tiers, ensuring that every user has access to this feature regardless of their budget. You can choose from monthly or annual billing, with options that provide the best value for your organization.

-

What features does the al al8453 printable offer?

The al al8453 printable comes with various features designed to enhance your document workflow. These include customizable templates, advanced security options, and real-time tracking of document statuses. By leveraging these features, users can efficiently manage their eSigning process and improve collaboration.

-

How can the al al8453 printable benefit my business?

Utilizing the al al8453 printable can signNowly increase your business's productivity by reducing the time spent on traditional paperwork. It provides a seamless way to eSign documents digitally, ensuring quicker transactions and improved customer satisfaction. Moreover, its eco-friendly nature reduces paper waste, aligning with sustainable business practices.

-

Can I integrate the al al8453 printable with other tools?

Yes, the al al8453 printable can be easily integrated with many popular apps and services, enhancing your workflow. airSlate SignNow supports integrations with CRM systems, cloud storage platforms, and other business software to ensure a smooth flow of information. This connectivity allows you to maximize efficiency and minimize manual data entry.

-

Is it easy to create an al al8453 printable document?

Creating an al al8453 printable document is straightforward with airSlate SignNow's intuitive interface. Users can easily upload existing documents or start from scratch using customizable templates, making it suitable for all skill levels. Within minutes, you can have your document ready for eSigning or sharing.

-

What security measures are in place for al al8453 printable documents?

airSlate SignNow ensures that all al al8453 printable documents are protected with top-notch security features. This includes encryption, secure cloud storage, and user authentication to safeguard sensitive information. These security measures help you maintain compliance with industry standards while ensuring your documents are safe from unauthorized access.

Get more for Al8453

- Ct 100691825 form

- Wells fargo account closure letter form

- Corporation document filing request form california secretary sos ca 17348619

- Lindenberg seeds catalogue form

- Mssi sa 100383540 form

- Nhep educationtraining activities verification form new

- Wreq 0089 99 form

- Form ca dmv dl 410 fo fill online printable

Find out other Al8453

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple