LIC6 General Contractor Registration Form Home Nyc

What is the LIC6 General Contractor Registration Form?

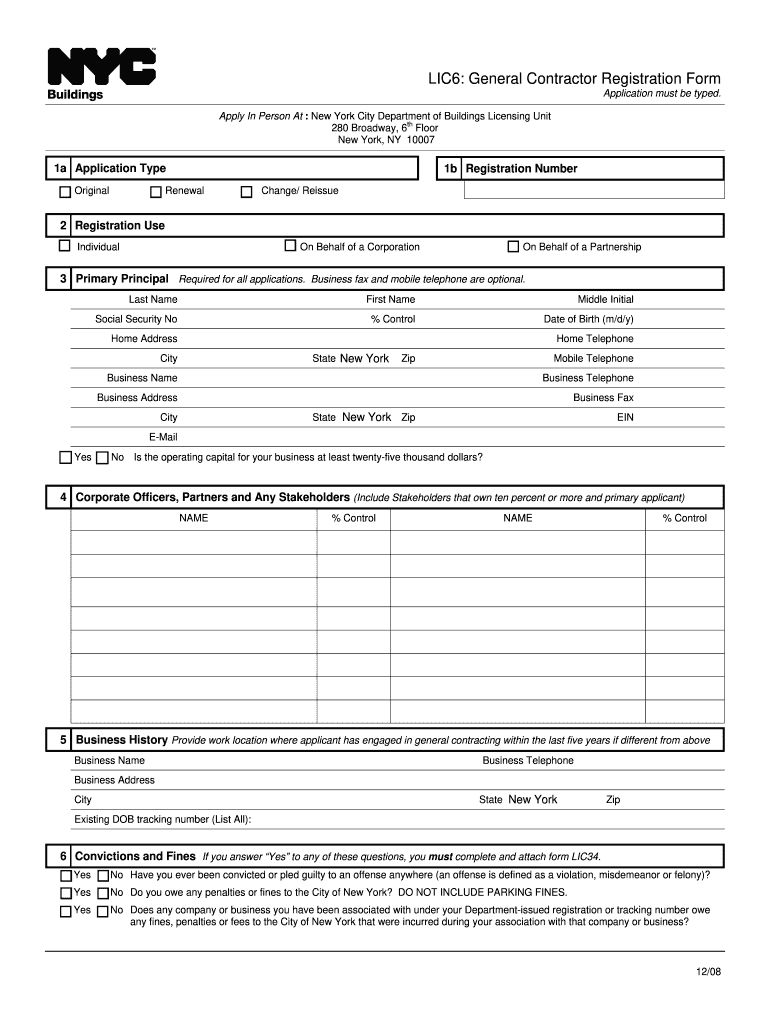

The LIC6 General Contractor Registration Form is a crucial document for individuals or businesses seeking to operate as general contractors in New York City. This form is essential for obtaining the necessary licensing from the New York City Department of Buildings (DOB). The LIC6 form ensures that contractors meet the legal requirements set forth by the city, including proof of experience, financial responsibility, and compliance with safety regulations. Completing the LIC6 form accurately is vital for the approval of a contractor's license, allowing them to undertake construction projects legally within the city.

Steps to Complete the LIC6 General Contractor Registration Form

Completing the LIC6 form involves several important steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of identity, business registration, and any relevant experience in the construction field. Next, fill out the form with accurate information regarding your business structure, ownership, and financial details. It is essential to review the form carefully to avoid any errors that could delay processing. Once completed, submit the form along with any required fees to the New York City Department of Buildings. Keeping a copy of the submitted form for your records is also advisable.

Required Documents for the LIC6 Form

When applying for a general contractor license using the LIC6 form, specific documents are required to support your application. These typically include:

- Proof of identity, such as a government-issued ID.

- Business registration documents, including a Certificate of Incorporation if applicable.

- Evidence of relevant work experience in the construction industry.

- Financial statements or proof of financial responsibility.

- Any additional documentation as specified by the NYC Department of Buildings.

Ensuring that all required documents are included with your application can help expedite the review process.

Legal Use of the LIC6 General Contractor Registration Form

The LIC6 form serves a legal purpose in the registration of general contractors in New York City. By submitting this form, contractors affirm their compliance with local laws and regulations governing construction practices. The legal use of the form protects both the contractor and the public by ensuring that only qualified individuals are licensed to perform construction work. Additionally, the form must be filled out in accordance with the guidelines provided by the NYC Department of Buildings to maintain its validity.

How to Obtain the LIC6 General Contractor Registration Form

The LIC6 General Contractor Registration Form can be obtained directly from the New York City Department of Buildings website or their physical office. It is available in a downloadable PDF format, allowing applicants to fill it out electronically or print it for manual completion. Additionally, the form may be available at various city offices that handle business licensing and permits. Ensuring that you have the most current version of the form is essential, as outdated forms may not be accepted.

Application Process & Approval Time for the LIC6 Form

The application process for the LIC6 General Contractor Registration Form involves several key steps. After gathering all required documents and completing the form, applicants must submit it to the NYC Department of Buildings. The approval time can vary based on several factors, including the completeness of the application and the current workload of the department. Typically, applicants can expect a processing time of several weeks. Staying informed about the status of your application can help ensure a smooth licensing process.

Quick guide on how to complete lic6 general contractor registration form home nyc

Complete LIC6 General Contractor Registration Form Home Nyc effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed forms, as you can access the necessary documents and securely keep them online. airSlate SignNow provides all the resources required to create, modify, and eSign your documents quickly without waiting. Manage LIC6 General Contractor Registration Form Home Nyc on any device with the airSlate SignNow apps available for Android or iOS and simplify any document-related process today.

How to alter and eSign LIC6 General Contractor Registration Form Home Nyc with ease

- Find LIC6 General Contractor Registration Form Home Nyc and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant portions of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click the Done button to save your changes.

- Select your preferred method of sending the form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign LIC6 General Contractor Registration Form Home Nyc and guarantee excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

-

If I am living in UK with T2 General visa and work as a contractor for a US company with W-8BEN form filled out, do I still need to pay income tax to the UK government?

Yes.Every country in the world taxes people who live there. The US (which claims global jurisdiction over its citizens) taxes you because you are a citizen, the UK (which accepts that its jurisdiction stops at its own border, like every other country except the US) taxes you because you are present and earning money.But you don’t pay tax twice.The UK gets the first bite of the cherry - you’re living there, so you should pay towards public services. If you’re resident, you are taxed like the British taxpayers alongside whom you work, except if you have US investment or rental income that you don’t transfer or remit to the UK, special rules for ‘non-domiciled’ visitors may mean there’s no UK tax on this non-UK income (this is a complex area - take proper advice).You then report all your income to Uncle Sam too. The IRS lets you exclude a certain amount of foreign earned income for US tax purposes (up to $103,900 for 2018). If, even with the exclusion, you still owe US income taxes on your UK compensation, you should be able to claim a credit for UK taxes paid that reduces your US tax liability.Again, this is a complex area - take proper advice.It’s actually even more complex, because social security taxes operate under different rules. You should pay in only the UK or the US, but which country’s rules apply depends on the exact circumstances and how they fit with the US-UK bilateral social security treaty.Take advice (I hope that is clear by now!).

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How likely are you to win a car from filling out a form at a mall? Who drives the new car home? What are your chances to win another car again?

I am going to get pretty literal here. Please forgive meHow likely are you to win a car from filling out a form at a mall? In the US, at least, this is usually spelled out somewhere on the form or on a website listed on the form. If it is not, you could ask (and may or may not get a truthful answer). If none of this works, you could probably be able to guess using a few factors: * How many people take the time to stop and enter (what percentage of passers-by, multiplied by amount of typical or expected foot-traffic)?* Are multiple entries allowed? * How long will entries be accepted before the drawing? As a rule of thumb, if the odds aren’t stated (and usually, even if they are) the odds are probably staggering. If you multiply the amount of time it takes to fill out the form by the amount of forms you would have to fill-out before you had an even 1% chance of winning the car, you would likely do better using that time to get a second job. Oh, and lastly, realize that the reason they are enticing you with the chance to win a car is that they are collecting your personal information on the form. It usually is quite a cheap way to generate a LOT of personal data, add you to mailing/dialing lists, etc. They folks running the drawing often gather another great bit of psychology about you: person who fills out form likes to enter “something for nothing” type contests (the drawing itself). This can be valuable to advertisers.Who drives the new car home? By definition of “home” the owner (presumably the winner) would drive the car “home”. If the car is driven to your house by an employee of the company running the lottery, they would just be driving the car to the winners residence…not their “home”.Frankly, I am not sure of what is meant by this question. I would assume that any winner of the drawing would either pick up the vehicle and drive it themselves away from the drawing or other site where the prize was moved to, possibly prepped for delivery tot he winner, or someone would deliver it to the winner’s home by driving it or trucking it there.What are your chances to win another car again? Your chances of winning the next drawing you entered would be EXACTLY the same as they would be had you lost the previous one, as specified in item number one. The odds of winning/losing do not change based on previous outcome. Think about it this way: If I just flipped a coin and it landed on “heads” 50 times in a row, what are the chances that it will be “heads” on the 51st attempt? EXACTLY (assuming there is nothing about the coin or flip that favors one side over the other) 1 in 2 or 50%, just as it was the first flip, just as it will be on the 51st millionth.Now the probability of winning 2 drawings, each with 1 million entries is staggeringly small. But they are two separate events, each governed independently by their own set of probabilities. Landing on heads 51 times in a row or winning 2 cars in consecutive drawings would be matters of remarkable coincidence: respectively 50 1 in 2 or 2 one in a million events happening to share the same outcome.Good luck

-

How can I change CA firms if I filled out an articleship form in February but did not submit it to the ICAI? Can the principal have restrictions in registration?

If the article ship registration has not been done, the principal can generally not restrict you.However, if there are any serious mis conduct on your end, then he can place his views to the Institute, so that the Institute can take appropriate action in such a way that you are not enrolled as an articled clerk under ICAI rules. But this is very rare, and exceptional circumstances.In general, and if you have conducted yourselves professionally, then there is no need to worry.

Create this form in 5 minutes!

How to create an eSignature for the lic6 general contractor registration form home nyc

How to create an electronic signature for your Lic6 General Contractor Registration Form Home Nyc online

How to create an electronic signature for the Lic6 General Contractor Registration Form Home Nyc in Google Chrome

How to make an electronic signature for signing the Lic6 General Contractor Registration Form Home Nyc in Gmail

How to generate an electronic signature for the Lic6 General Contractor Registration Form Home Nyc right from your smartphone

How to make an electronic signature for the Lic6 General Contractor Registration Form Home Nyc on iOS devices

How to create an electronic signature for the Lic6 General Contractor Registration Form Home Nyc on Android

People also ask

-

What is the lic6 form and how can airSlate SignNow help?

The lic6 form is a specific document often required in business transactions. With airSlate SignNow, you can easily eSign, send, and manage your lic6 form digitally, ensuring a seamless and secure process.

-

Is there a cost associated with using airSlate SignNow for the lic6 form?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs. You can choose a plan that allows you to efficiently handle your lic6 form with competitive pricing options.

-

What features does airSlate SignNow offer for signing the lic6 form?

airSlate SignNow provides features like customizable templates, reminders, and authentication options, making it ideal for signing the lic6 form. These tools streamline the signing process and enhance user experience.

-

Are there any integration options for managing the lic6 form using airSlate SignNow?

Absolutely! airSlate SignNow integrates with various applications to help you manage your lic6 form more efficiently. These integrations allow for seamless workflow automation and data transfer.

-

Can I track the status of my lic6 form once it’s sent through airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your lic6 form. You'll receive notifications when the document is viewed, signed, or completed, giving you full visibility throughout the process.

-

Is airSlate SignNow secure for signing sensitive documents like the lic6 form?

airSlate SignNow employs robust security measures to protect your documents, including the lic6 form. Your data is encrypted and secured, ensuring confidentiality and compliance with industry standards.

-

How does airSlate SignNow improve the efficiency of processing the lic6 form?

By using airSlate SignNow, you can automate repetitive tasks and eliminate the need for paper-based processes for your lic6 form. This not only saves time but also reduces costs and increases productivity.

Get more for LIC6 General Contractor Registration Form Home Nyc

- Jury instruction false claims against the government form

- Jury instruction lesser offense form

- Instruction entrapment form

- Fillable online omega psi phi fraternity inc form

- Sanctuary psycho education manual domuskidsorg form

- Nsa umpire evaluation form nsa california umpires

- Application for a residency and employment rights form

- Cat eye enduro 2 form

Find out other LIC6 General Contractor Registration Form Home Nyc

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document