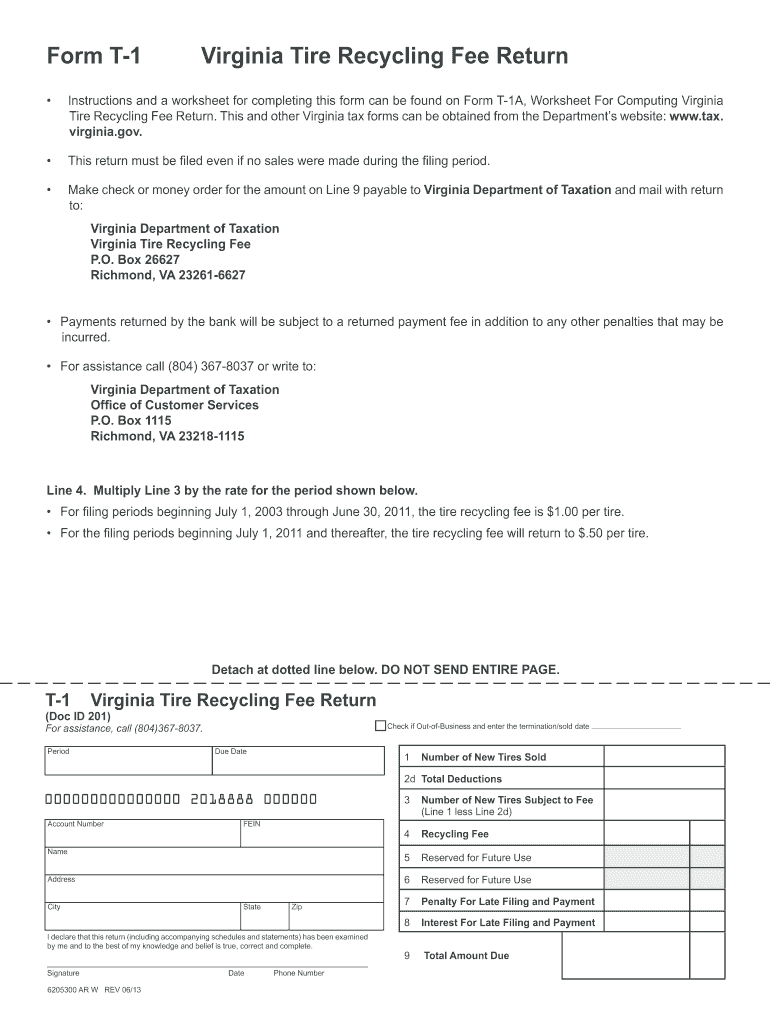

Virginia Tire Tax Form

What is the Virginia Tire Tax

The Virginia Tire Tax is a fee imposed on the purchase of new tires in the state of Virginia. This tax is designed to fund the recycling and proper disposal of used tires, promoting environmental sustainability. The tax is typically assessed at a rate of $0.50 per tire and applies to both passenger and commercial vehicles. Understanding this tax is essential for vehicle owners and businesses that sell tires, as it contributes to state efforts in managing waste and protecting natural resources.

How to complete the Virginia Tire Tax

Completing the Virginia Tire Tax form involves several steps. First, gather all necessary information, including the number of tires purchased and the total cost. Next, obtain the Virginia fillable tire fee form, which can be accessed digitally. Fill out the form accurately, ensuring all required fields are completed. After filling out the form, review it for any errors before submitting it. This process ensures compliance with state regulations and helps avoid potential penalties.

Required Documents for the Virginia Tire Tax

When completing the Virginia Tire Tax form, specific documents are required to ensure proper filing. These typically include:

- Proof of tire purchase, such as an invoice or receipt.

- The completed Virginia fillable tire fee form.

- Any additional documentation requested by the state, which may vary based on the type of vehicle.

Having these documents ready will streamline the submission process and help ensure compliance with state requirements.

Form Submission Methods

The Virginia Tire Tax form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Many users opt to submit the form electronically through designated state platforms.

- Mail: The completed form can be printed and mailed to the appropriate state office.

- In-Person: Taxpayers may also choose to submit the form in person at local tax offices.

Each method has its advantages, and users should select the one that best fits their needs.

Penalties for Non-Compliance

Failing to comply with the Virginia Tire Tax requirements can result in penalties. These may include fines or additional fees, which can accumulate over time. It is crucial for vehicle owners and businesses to understand their responsibilities regarding this tax to avoid any legal issues. Staying informed about filing deadlines and ensuring timely submissions can help mitigate the risk of penalties.

Legal Use of the Virginia Tire Tax

The Virginia Tire Tax is legally mandated, and its proper use is essential for maintaining compliance with state laws. Funds collected from this tax are allocated to tire recycling programs and environmental initiatives. Understanding the legal framework surrounding the tax helps taxpayers recognize its importance and the role it plays in promoting sustainable practices in Virginia.

Quick guide on how to complete virginia tire tax

Complete Virginia Tire Tax effortlessly on any device

Digital document administration has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without any holdups. Manage Virginia Tire Tax on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Virginia Tire Tax with ease

- Obtain Virginia Tire Tax and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to retain your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Virginia Tire Tax and guarantee outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the virginia tire tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia tire tax and how does it apply to businesses?

The Virginia tire tax is a tax levied on the purchase of new tires sold in Virginia. Businesses must collect this tax at the point of sale and report it to the state. Understanding this tax is crucial for compliance and avoiding potential penalties in your operations.

-

How can airSlate SignNow help with managing Virginia tire tax documentation?

airSlate SignNow provides an efficient way to send and eSign documents related to the Virginia tire tax. Our platform allows businesses to streamline the creation and management of tax-related documents, ensuring all necessary forms are signed and stored securely for compliance purposes.

-

Are there any fees associated with the airSlate SignNow service for handling Virginia tire tax?

airSlate SignNow offers a cost-effective solution with transparent pricing plans. The fees vary based on the features you choose, but you can efficiently manage all your documentation needs, including those related to the Virginia tire tax, without hidden costs.

-

What features does airSlate SignNow offer that align with Virginia tire tax requirements?

Our platform includes features like document templates, real-time tracking, and audit trails that help you manage Virginia tire tax documentation effectively. These functionalities ensure compliance and simplify the filing process, saving you valuable time and resources.

-

Is airSlate SignNow compliant with Virginia tire tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those related to the Virginia tire tax. We prioritize user compliance by providing tools that keep your documentation in order and ensure all legal requirements are met.

-

Can airSlate SignNow integrate with other accounting software for Virginia tire tax management?

Absolutely! airSlate SignNow seamlessly integrates with numerous accounting software platforms, helping you manage the Virginia tire tax and other financial documents in one place. This integration streamlines your workflow and enhances accuracy in financial reporting.

-

What are the benefits of using airSlate SignNow for Virginia tire tax documentation?

Utilizing airSlate SignNow for Virginia tire tax documentation offers increased efficiency, enhanced security, and improved compliance. Our platform allows you to automate processes and reduce the risk of human error, making tax management more straightforward for your business.

Get more for Virginia Tire Tax

- Daily sign insign out record dssr form

- Dmv approved translators las vegas form

- Complete the text with the correct form of the verbs in brackets

- Missouri nursing home administrator license lookup form

- Cemetery survey form for individual grave markers

- Dhr cdc 1945 form 100073958

- Cbcnei sponsorship form

- Reiki session intake form confidential information

Find out other Virginia Tire Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors