Apply for Rent Rebate Online Form

Understanding the Maine Property Tax Refund

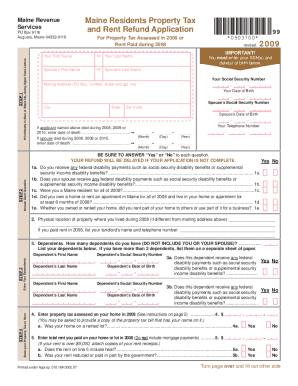

The Maine property tax refund program, often referred to as the renters rebate program, is designed to assist eligible residents. This program provides financial relief to those who pay property taxes or rent for their primary residence. Understanding the eligibility criteria is essential for applicants. Generally, individuals must meet income limits and have paid a certain amount in property taxes or rent during the tax year. The refund amount varies based on income and housing costs, making it crucial for applicants to gather relevant financial information before applying.

Eligibility Criteria for the Maine Property Tax Refund

To qualify for the Maine property tax refund, applicants must meet specific criteria. These include:

- Being a resident of Maine and occupying the property as a primary residence.

- Meeting income limits set by the state, which may change annually.

- Having paid property taxes or rent during the applicable tax year.

It is important for applicants to review the current income limits and requirements to ensure they qualify for the refund.

Steps to Complete the Maine Property Tax Refund Application

Completing the application for the Maine property tax refund involves several key steps:

- Gather necessary documentation, including proof of income and records of property tax payments or rent.

- Access the Maine property tax refund application form, which can be completed online or downloaded for submission.

- Fill out the form accurately, ensuring all required information is provided.

- Submit the completed application by the specified deadline, either online or via mail.

Following these steps carefully can help ensure a smooth application process.

Required Documents for the Application

Applicants must provide specific documentation to support their Maine property tax refund application. Key documents include:

- Proof of income, such as recent pay stubs or tax returns.

- Receipts or statements showing property tax payments or rent paid during the year.

- Identification documents, such as a driver's license or state ID, to verify residency.

Having these documents ready can expedite the application process and help avoid delays.

Form Submission Methods for the Maine Property Tax Refund

The Maine property tax refund application can be submitted through various methods, providing flexibility for applicants. These methods include:

- Online submission via the official state website, which allows for a quicker processing time.

- Mailing the completed paper application to the appropriate state office.

- In-person submission at designated state offices, which may offer assistance with the application process.

Choosing the right submission method can depend on individual preferences and access to technology.

Filing Deadlines for the Maine Property Tax Refund

Applicants should be aware of the filing deadlines for the Maine property tax refund to ensure timely submission. Generally, the application must be filed by a specific date each year, often falling in the spring months. It is advisable to check the current year's deadline as it may vary. Missing the deadline could result in disqualification from receiving the refund, making timely action essential.

Quick guide on how to complete apply for rent rebate online

Effortlessly Complete Apply For Rent Rebate Online on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly and without interruptions. Handle Apply For Rent Rebate Online on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to Edit and eSign Apply For Rent Rebate Online Effortlessly

- Find Apply For Rent Rebate Online and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as an ink signature.

- Verify all the details and then click the Done button to save your changes.

- Choose how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Apply For Rent Rebate Online and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the apply for rent rebate online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining a Maine property tax refund?

The process for obtaining a Maine property tax refund involves submitting the appropriate application form to the state tax department, along with proof of eligibility. You must provide documentation of your property tax payments and meet specific income requirements set by the state. Once submitted, applications are reviewed, and refunds are typically issued within a few weeks.

-

How can airSlate SignNow help with the Maine property tax refund process?

AirSlate SignNow provides businesses with the tools to electronically sign and send essential documents related to the Maine property tax refund process quickly and securely. With features like templates and automatic reminders, you can ensure timely submission of your application. This streamlines your workflow and reduces the risk of delays.

-

Are there any costs associated with using airSlate SignNow for the Maine property tax refund?

Yes, airSlate SignNow offers various pricing plans suitable for different business needs. You can choose a subscription that best fits your workflow and budget. By using airSlate SignNow, you will reduce operational costs by streamlining document management related to your Maine property tax refund.

-

What features does airSlate SignNow offer for managing tax refund documents?

AirSlate SignNow offers a range of features including customizable templates, advanced security options, and real-time tracking of document statuses. These features enable you to manage documents related to your Maine property tax refund efficiently, ensuring that nothing is overlooked during the filing process. This organized approach helps in preventing errors and facilitating a smoother submission experience.

-

Can I integrate airSlate SignNow with other tax software for my Maine property tax refund?

Yes, airSlate SignNow offers integrations with various third-party applications, including popular tax software. This allows you to manage your Maine property tax refund process from a single platform, enhancing productivity and ensuring all necessary documents are in sync. You can easily import and export documents, making your workflow efficient and straightforward.

-

What are the benefits of using airSlate SignNow for property tax refund management?

Using airSlate SignNow for managing property tax refund documents simplifies the signing and approval process. With its user-friendly interface, you can save time and avoid common pitfalls associated with paper documentation. This not only enhances your overall efficiency but also helps to ensure that your Maine property tax refund application is processed quickly.

-

Is customer support available for questions about my Maine property tax refund?

Yes, airSlate SignNow provides comprehensive customer support to assist with any queries you may have about managing your Maine property tax refund documents. Support is available through multiple channels, including chat and email, to ensure you get prompt assistance. Their team is experienced in helping users navigate the platform and optimizing their refund processes.

Get more for Apply For Rent Rebate Online

- Disdetta carta di credito postfinance form

- Barclays bank letterhead form

- Addendum format in word

- Sonora quest supply order form

- Iaea training courses form

- Dbpr form arb 6000 002

- Mycricket admin form

- The housing registry application form subsidized housing is long term housing where the rent is calculated based on total

Find out other Apply For Rent Rebate Online

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors