1092 Tax Form

What is the 1092 Tax Form

The 1092 tax form, also known as IRS Form 1092, is a document used primarily for reporting certain types of income and transactions. This form is typically utilized by businesses and organizations to report payments made to foreign persons or entities. Understanding what a 1092 tax form is used for is crucial for compliance with U.S. tax laws.

The form captures essential information, including the recipient's details, the amount paid, and the nature of the payment. It is important to ensure accuracy when filling out the 1092 form to avoid potential penalties or issues with the IRS.

How to Use the 1092 Tax Form

Using the 1092 tax form involves several steps to ensure proper reporting of income. First, gather all necessary information about the recipient, including their name, address, and taxpayer identification number. Next, determine the type of payment being reported, as this will dictate how the form is completed.

Once you have the required information, fill out the form accurately, ensuring that all fields are completed as per IRS guidelines. After completing the form, review it for any errors before submission. The 1092 form can be submitted electronically or via traditional mail, depending on your preference and the requirements of the IRS.

Steps to Complete the 1092 Tax Form

Completing the 1092 tax form requires attention to detail. Follow these steps:

- Gather recipient information, including name, address, and taxpayer identification number.

- Identify the type of payment being reported, such as interest, dividends, or royalties.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any mistakes or omissions.

- Submit the completed form to the IRS by the specified deadline.

Taking these steps carefully can help ensure compliance and avoid potential issues with the IRS.

Legal Use of the 1092 Tax Form

The legal use of the 1092 tax form is governed by IRS regulations. It is essential to use the form for its intended purpose, which is to report payments made to foreign entities or individuals. Misuse of the form can lead to penalties, including fines or audits.

To ensure legal compliance, it is advisable to familiarize yourself with IRS guidelines related to the 1092 form. This includes understanding who is required to file the form, the types of payments that must be reported, and the deadlines for submission.

Filing Deadlines / Important Dates

Filing deadlines for the 1092 tax form are critical to avoid penalties. Generally, the form must be submitted to the IRS by the end of February for paper filings and by the end of March for electronic submissions. It is important to keep track of these dates to ensure timely compliance.

Additionally, recipients of the form should receive their copies by the same deadlines. Staying organized and aware of these important dates can help streamline the filing process and maintain compliance with IRS regulations.

Who Issues the Form

The 1092 tax form is typically issued by businesses, organizations, or other entities that make payments to foreign individuals or entities. This includes corporations, partnerships, and other types of businesses that are required to report these payments to the IRS.

It is important for issuers to understand their responsibilities regarding the 1092 form, including when and how to issue the form to recipients and the IRS. Proper issuance helps ensure compliance and accurate reporting of income.

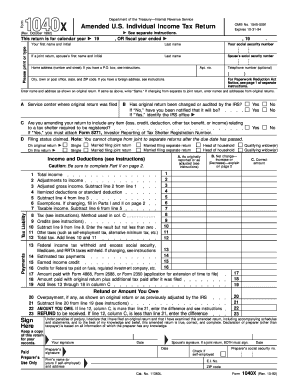

Quick guide on how to complete 1092 tax form

Effortlessly Prepare 1092 Tax Form on Any Gadget

Managing documents online has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without delays. Handle 1092 Tax Form on any gadget with airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The easiest method to modify and eSign 1092 Tax Form seamlessly

- Locate 1092 Tax Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and has the same legal validity as a conventional ink signature.

- Verify all the details and then select the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills your document management needs with just a few clicks from a device of your choosing. Modify and eSign 1092 Tax Form to ensure seamless communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1092 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1092 tax form and who needs to fill it out?

The 1092 tax form is used by certain entities to report information about specific types of insurance contracts. Typically, individuals or businesses that offer health insurance or report health coverage requirements need to fill out this form. Understanding the requirements for the 1092 tax form can help you maintain compliance and avoid penalties.

-

How can airSlate SignNow help me with my 1092 tax form?

AirSlate SignNow offers a streamlined eSigning process that can simplify the handling of your 1092 tax form. With its intuitive interface, you can quickly upload, send, and eSign your tax documents securely. This ensures that your 1092 tax form is completed accurately and efficiently.

-

What features does airSlate SignNow offer for managing the 1092 tax form?

AirSlate SignNow includes features such as document templates, customizable workflows, and electronic signatures that are essential for managing the 1092 tax form. These tools allow you to automate the process and reduce manual errors, making your tax form management both effective and easy.

-

Is there a specific pricing plan for services related to the 1092 tax form?

AirSlate SignNow offers various pricing plans that fit different business needs, including plans that cater specifically to managing documents like the 1092 tax form. You can choose a plan that meets your usage requirements, ensuring that you get value while handling your tax-related paperwork efficiently.

-

Can I integrate airSlate SignNow with my existing tax software for 1092 tax form management?

Yes, airSlate SignNow easily integrates with various tax software, allowing you to manage your 1092 tax form seamlessly. This integration ensures that you can transfer data smoothly between platforms, reducing discrepancies and enhancing your overall workflow.

-

What are the benefits of using airSlate SignNow for the 1092 tax form?

Using airSlate SignNow for the 1092 tax form provides numerous benefits, such as enhanced security, ease of access, and improved turnaround times. The electronic signature feature allows for quicker approvals, ensuring that you meet deadlines without the hassle of traditional methods.

-

Are there any compliance features to help with the 1092 tax form?

AirSlate SignNow incorporates compliance features that are crucial for correctly handling the 1092 tax form. These features help ensure that all signed documents are legally binding and adhere to the regulations, which can protect your business from potential legal issues.

Get more for 1092 Tax Form

- Prairie ecosystem gizmo answer key form

- Ri certified payroll form

- Florida vechs waiver form

- Employers wage claim response form iowa workforce iowaworkforce

- Publication 1854 form

- New mexico public regulation commission application for a nmprc state nm form

- Phy1600 microteaching evaluation form

- Database change request form in word

Find out other 1092 Tax Form

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself