Connecticut Quarterly Tax and Wage Withholdings Form

What is the Connecticut Quarterly Tax and Wage Withholdings

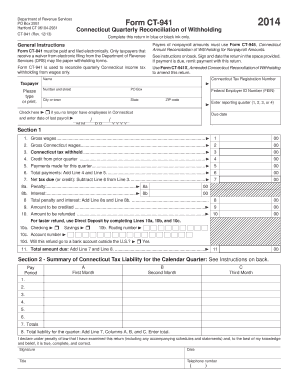

The Connecticut Quarterly Tax and Wage Withholdings, commonly referred to as CT-941, is a tax form used by employers to report income tax withheld from employees' wages. This form is essential for ensuring compliance with state tax laws and helps the Connecticut Department of Revenue Services track tax payments. Employers must file this form quarterly, detailing the amount of wages paid and the corresponding tax withheld for each employee. Understanding this form is crucial for maintaining accurate payroll records and fulfilling state tax obligations.

Steps to Complete the Connecticut Quarterly Tax and Wage Withholdings

Completing the Connecticut Quarterly Tax and Wage Withholdings form involves several key steps:

- Gather necessary information, including employee names, Social Security numbers, and total wages paid during the quarter.

- Calculate the total amount of Connecticut income tax withheld for each employee.

- Fill out the CT-941 form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Submit the form to the Connecticut Department of Revenue Services by the specified deadline.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Connecticut Quarterly Tax and Wage Withholdings. The due dates for filing are as follows:

- For the first quarter (January to March): April 30

- For the second quarter (April to June): July 31

- For the third quarter (July to September): October 31

- For the fourth quarter (October to December): January 31 of the following year

It is essential to file on time to avoid penalties and interest on unpaid taxes.

Legal Use of the Connecticut Quarterly Tax and Wage Withholdings

The Connecticut Quarterly Tax and Wage Withholdings form is legally binding when completed and submitted according to state regulations. Employers are required to maintain accurate records of wages and taxes withheld, as this information may be subject to audits by the Connecticut Department of Revenue Services. Proper use of this form helps ensure compliance with state tax laws and protects employers from potential legal issues related to tax withholding.

Required Documents

To complete the Connecticut Quarterly Tax and Wage Withholdings form, employers should have the following documents ready:

- Employee payroll records detailing wages paid and taxes withheld.

- Employer identification number (EIN) for tax reporting purposes.

- Previous quarter's CT-941 form for reference, if applicable.

- Any relevant tax withholding agreements or adjustments.

Penalties for Non-Compliance

Failure to file the Connecticut Quarterly Tax and Wage Withholdings form on time or to accurately report withheld taxes can result in significant penalties. These may include:

- Late filing penalties, which can accrue daily until the form is submitted.

- Interest on unpaid taxes, which compounds over time.

- Potential audits and additional scrutiny from the Connecticut Department of Revenue Services.

Employers are encouraged to stay informed about their filing responsibilities to avoid these consequences.

Quick guide on how to complete connecticut quarterly tax and wage withholdings

Handle Connecticut Quarterly Tax And Wage Withholdings effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed forms, as you can locate the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Connecticut Quarterly Tax And Wage Withholdings on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Connecticut Quarterly Tax And Wage Withholdings seamlessly

- Locate Connecticut Quarterly Tax And Wage Withholdings and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that reason.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Connecticut Quarterly Tax And Wage Withholdings and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut quarterly tax and wage withholdings

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Connecticut quarterly tax and wage withholdings?

Connecticut quarterly tax and wage withholdings refer to the taxes that employers must withhold from employee wages and report to the state on a quarterly basis. These withholdings include income tax and unemployment tax, among others. Understanding these obligations is critical for businesses to ensure compliance with state regulations.

-

How can airSlate SignNow help manage Connecticut quarterly tax and wage withholdings?

airSlate SignNow provides a streamlined solution for managing Connecticut quarterly tax and wage withholdings by allowing businesses to eSign and send relevant documents swiftly. This ensures that all paperwork related to tax withholdings is completed accurately and on time. The platform's user-friendly interface simplifies the entire process, leading to greater compliance.

-

Are there any costs involved with using airSlate SignNow for Connecticut quarterly tax and wage withholdings?

Yes, airSlate SignNow does have pricing plans that cater to businesses of different sizes. However, the investment can be considered cost-effective, especially when compared to the potential costs of errors in tax filings. By using airSlate SignNow, businesses can save time and avoid costly penalties associated with Connecticut quarterly tax and wage withholdings.

-

What features does airSlate SignNow offer for tax compliance?

airSlate SignNow offers several features that are beneficial for tax compliance, including secure eSigning, document tracking, and automated reminders. These features help ensure that all necessary documents related to Connecticut quarterly tax and wage withholdings are completed and submitted on time. Furthermore, the platform supports various document formats to cater to individual business needs.

-

Can airSlate SignNow integrate with existing accounting software for tax management?

Yes, airSlate SignNow integrates with many popular accounting software programs. This integration allows for seamless data transfer, which can enhance the accuracy and efficiency of managing Connecticut quarterly tax and wage withholdings. It simplifies the record-keeping process, ensuring that all tax-related documents are easily accessible.

-

What benefits can businesses expect from using airSlate SignNow for their tax processes?

By utilizing airSlate SignNow, businesses can experience improved efficiency in their tax processes, particularly concerning Connecticut quarterly tax and wage withholdings. The platform reduces manual errors, speeds up document turnaround times, and increases overall compliance with state tax regulations. Additionally, remote signing capabilities allow for greater flexibility in document management.

-

Is airSlate SignNow suitable for small businesses handling Connecticut quarterly tax and wage withholdings?

Absolutely! airSlate SignNow is designed to meet the needs of businesses of all sizes, including small businesses. Its cost-effective pricing and easy-to-use features make it an ideal choice for managing Connecticut quarterly tax and wage withholdings efficiently without overwhelming small business owners.

Get more for Connecticut Quarterly Tax And Wage Withholdings

Find out other Connecticut Quarterly Tax And Wage Withholdings

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors