Form 430

What is the Form 430

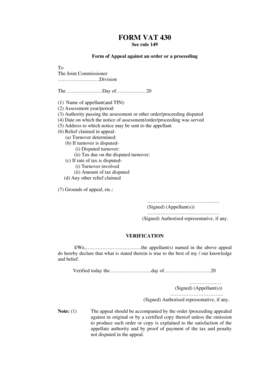

The Form 430 is a legal document utilized primarily for tax-related purposes in the United States. It is often associated with specific tax appeals, such as those related to value-added taxes. This form allows taxpayers to formally request a review or appeal regarding their tax assessments or obligations. Understanding the purpose and function of the Form 430 is essential for ensuring compliance with tax regulations and for effectively managing tax disputes.

How to use the Form 430

Using the Form 430 involves several steps to ensure that the document is completed accurately and submitted correctly. First, gather all necessary information related to your tax situation. This may include prior tax returns, assessment notices, and any relevant correspondence from tax authorities. Next, fill out the form thoroughly, ensuring that all sections are completed with accurate details. After completing the form, review it for any errors or omissions before submitting it to the appropriate tax authority.

Steps to complete the Form 430

Completing the Form 430 requires careful attention to detail. Follow these steps for successful completion:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Provide details regarding the tax assessment or issue you are appealing, including dates and amounts.

- Include any supporting documentation that substantiates your appeal, such as financial statements or previous correspondence.

- Sign and date the form to validate your submission.

- Make a copy of the completed form for your records before sending it to the relevant tax authority.

Legal use of the Form 430

The legal use of the Form 430 is governed by specific regulations that ensure its validity in tax appeals. To be considered legally binding, the form must be completed in accordance with the guidelines set forth by the Internal Revenue Service (IRS) or the relevant state tax authority. This includes adhering to deadlines for submission and providing accurate information. Utilizing a reliable electronic signature solution can enhance the legal standing of the form, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 430 can vary based on the type of appeal and the jurisdiction in which you are filing. It is crucial to be aware of these deadlines to avoid penalties or dismissal of your appeal. Typically, the deadline for filing an appeal is within a certain number of days from the date of the tax assessment notice. Check with the IRS or your state tax authority for specific deadlines related to your situation.

Required Documents

When submitting the Form 430, certain documents may be required to support your appeal. These documents can include:

- Previous tax returns relevant to the assessment.

- Notices received from the tax authority regarding the assessment.

- Financial statements or documentation that supports your position.

- Any correspondence exchanged with the tax authority related to the appeal.

Ensuring that all required documents are included can significantly enhance the chances of a successful appeal.

Quick guide on how to complete form 430

Complete Form 430 effortlessly on any gadget

Digital document management has become more prevalent among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly without hold-ups. Manage Form 430 on any gadget with airSlate SignNow Android or iOS applications and ease any document-related tasks today.

How to alter and eSign Form 430 with ease

- Locate Form 430 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Alter and eSign Form 430 and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 430

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 430 and how does airSlate SignNow help with it?

Form 430 is a critical document used in various industries to gather essential information. airSlate SignNow streamlines the process of filling out and eSigning Form 430, ensuring that it's both quick and legally binding. Our platform enhances efficiency by eliminating paper-based methods and offers templates for easy access.

-

Is there a cost associated with using airSlate SignNow for Form 430?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for managing Form 430. Our plans are cost-effective, allowing users to choose features that best suit their workflow. You can also benefit from a free trial to explore the platform before committing.

-

Can I customize Form 430 templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates for Form 430 to meet your unique requirements. You can add fields, branding elements, and instructions to make the form user-friendly and tailored to your business process.

-

What are the benefits of using airSlate SignNow for handling Form 430?

Using airSlate SignNow to manage Form 430 offers numerous benefits including faster turnaround times and enhanced security. Your documents are stored securely, while eSigning features help reduce the time spent on transactions. This results in a more efficient workflow and a better experience for both your team and clients.

-

Does airSlate SignNow integrate with other tools for managing Form 430?

Yes, airSlate SignNow integrates seamlessly with various business applications, making it easy to manage Form 430 alongside other processes. Whether you use CRM systems, cloud storage solutions, or productivity tools, our integrations streamline operations and enhance collaboration.

-

How secure is my data when using airSlate SignNow for Form 430?

Security is a top priority at airSlate SignNow. When handling Form 430, your data is protected with advanced encryption methods and secure cloud storage. We comply with industry standards to ensure your documents are safe, so you can eSign and store your forms with confidence.

-

Can I track the status of Form 430 once sent via airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Form 430 in real-time. You will receive notifications when the form is viewed, signed, or completed, giving you complete visibility and control over your document management process.

Get more for Form 430

Find out other Form 430

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online