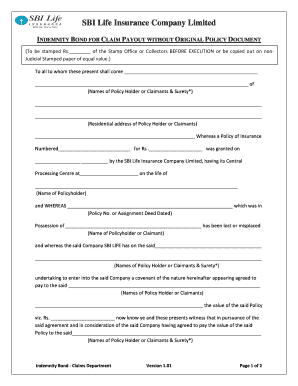

Indemnity Bond for Payout Without Original Policy Form

What is the indemnity bond for payout without original policy?

An indemnity bond for payout without original policy document serves as a legal assurance that a party will compensate another for any potential loss or damage incurred due to the absence of the original policy document. This bond is particularly relevant in situations where the original policy is lost or unavailable, allowing the claimant to proceed with their request for benefits or payouts. It essentially protects the insurer from any fraudulent claims that might arise in the absence of the original document while facilitating the claims process for the policyholder.

How to use the indemnity bond for payout without original policy

Using an indemnity bond for payout without original policy involves several steps. First, the claimant must fill out the indemnity bond form, providing necessary details such as the policy number, the reason for the absence of the original document, and personal identification information. Once completed, the form should be signed and dated. It is advisable to have the bond notarized to enhance its validity. Afterward, the completed bond can be submitted to the insurance company along with any additional required documentation to initiate the claims process.

Steps to complete the indemnity bond for payout without original policy

Completing the indemnity bond for payout without original policy requires careful attention to detail. Here are the essential steps:

- Obtain the indemnity bond form from your insurance provider or their website.

- Fill in personal details, including your name, address, and contact information.

- Provide the policy number and explain the circumstances surrounding the loss of the original document.

- Sign and date the form, ensuring all information is accurate.

- Consider having the document notarized to add a layer of authenticity.

- Submit the completed bond to your insurance company along with any additional documents they may require.

Legal use of the indemnity bond for payout without original policy

The legal use of the indemnity bond for payout without original policy is governed by specific regulations that ensure its enforceability. The bond must comply with state laws and insurance regulations, which may vary by jurisdiction. It is crucial to ensure that the bond clearly outlines the obligations of the parties involved, including the indemnitor's commitment to compensate for any losses incurred due to the absence of the original policy. Additionally, the bond should be executed in a manner that meets legal standards, such as proper signatures and notarization, to be recognized in a court of law.

Key elements of the indemnity bond for payout without original policy

Several key elements must be included in the indemnity bond for payout without original policy to ensure its validity and effectiveness:

- Identification of parties: Clearly state the names and addresses of the indemnitor (the party providing the bond) and the indemnitee (the party receiving the bond).

- Policy details: Include the policy number and relevant details about the insurance coverage.

- Reason for indemnity: Clearly outline the circumstances leading to the need for the indemnity bond, such as the loss of the original policy.

- Terms of indemnity: Specify the obligations of the indemnitor, including the amount of compensation and any conditions that must be met.

- Signatures: Ensure that the bond is signed by all relevant parties and, if necessary, notarized.

Required documents for the indemnity bond for payout without original policy

To successfully complete the indemnity bond for payout without original policy, several documents may be required. These typically include:

- The completed indemnity bond form.

- A copy of your identification, such as a driver's license or passport.

- Any documentation proving the loss of the original policy, such as a police report or a statement explaining the circumstances.

- Additional forms or documents as requested by your insurance provider.

Quick guide on how to complete indemnity bond for payout without original policy

Effortlessly Prepare Indemnity Bond For Payout Without Original Policy on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Indemnity Bond For Payout Without Original Policy on any device using airSlate SignNow's Android or iOS applications and enhance your document-based processes today.

The Easiest Way to Modify and eSign Indemnity Bond For Payout Without Original Policy with Ease

- Locate Indemnity Bond For Payout Without Original Policy and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Indemnity Bond For Payout Without Original Policy to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indemnity bond for payout without original policy

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an indemnity bond for payout without original policy?

An indemnity bond for payout without original policy is a legal document that guarantees payment to a third party when the original insurance policy is unavailable. This bond provides financial security, allowing businesses and individuals to process claims smoothly, ensuring that payouts can still occur despite the missing original document.

-

How does airSlate SignNow facilitate the indemnity bond process?

airSlate SignNow streamlines the creation and signing of documents like indemnity bonds for payout without original policy through its easy-to-use platform. Users can quickly compose bonds, collect eSignatures, and manage all necessary documentation electronically, reducing the hassle and time involved in traditional methods.

-

What are the benefits of using an indemnity bond for payout without original policy?

Using an indemnity bond for payout without original policy ensures that you can still receive funds despite not having the original documents. This approach protects your financial interests and provides a swift resolution to claims, allowing you to focus on what really matters in your business or personal matters.

-

What pricing options does airSlate SignNow offer for creating indemnity bonds?

airSlate SignNow provides flexible pricing plans tailored to suit different business needs, allowing you to create indemnity bonds for payout without original policy at a competitive rate. Whether you are a small business or a larger enterprise, you will find a plan that fits your budget while still delivering all the essential features.

-

Is it easy to integrate airSlate SignNow with other software for handling indemnity bonds?

Yes, airSlate SignNow seamlessly integrates with various third-party applications that can help manage indemnity bonds for payout without original policy. Whether you need to connect with CRM systems, contract management tools, or other document management applications, SignNow's flexible API makes integration a breeze.

-

Can I track the status of my indemnity bond documents with airSlate SignNow?

Absolutely! airSlate SignNow features robust tracking capabilities, allowing users to monitor the status of their indemnity bonds for payout without original policy in real-time. You'll receive notifications when documents are viewed, signed, and completed, ensuring you stay informed throughout the process.

-

Does airSlate SignNow provide customer support for indemnity bond-related queries?

Yes, airSlate SignNow offers dedicated customer support to assist with any questions regarding the process of creating or using indemnity bonds for payout without original policy. Whether you need technical help or guidance on best practices, our support team is here to help you navigate the platform with ease.

Get more for Indemnity Bond For Payout Without Original Policy

- 55 701 nc quitclaim deed 85 x 14qxd blumberg forms

- Lying in the county of state of north carolina to wit form

- Accordance with the applicable laws of the state of north carolina and form

- Control number nc 018 78 form

- Get the master pooled trust disbursement request form

- Acknowledgement of satisfaction individual 490184991 form

- Control number nc 020 77 form

- Full text of ampquoteighty paces forward a comprehensive study form

Find out other Indemnity Bond For Payout Without Original Policy

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip