Indiana State Form 962

What is the Indiana State Form 962

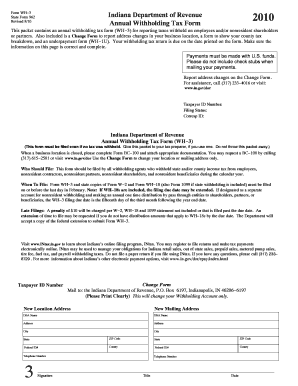

The Indiana State Form 962, commonly referred to as the WH-3, is a crucial document used for reporting withholding tax information for employers in the state of Indiana. This form is essential for businesses to report the total amount of state income tax withheld from employees' wages during a specific period. It ensures compliance with state tax regulations and provides the necessary information for the Indiana Department of Revenue to process tax returns accurately.

How to use the Indiana State Form 962

To effectively use the Indiana State Form 962, employers must gather all relevant payroll records for the reporting period. This includes the total wages paid and the state income tax withheld from each employee. Once the information is compiled, it should be accurately entered into the corresponding fields on the form. After completing the form, employers can submit it electronically or by mail, ensuring that they meet all filing deadlines to avoid penalties.

Steps to complete the Indiana State Form 962

Completing the Indiana State Form 962 involves several key steps:

- Gather all payroll records for the reporting period.

- Calculate the total wages paid to employees.

- Determine the total state income tax withheld.

- Fill out the form with the accurate totals in the designated fields.

- Review the form for any errors or omissions.

- Submit the completed form by the appropriate deadline.

Legal use of the Indiana State Form 962

The legal use of the Indiana State Form 962 is governed by state tax laws. Employers are required to file this form to report withholding tax accurately. Failure to submit the form or providing incorrect information can lead to penalties and interest charges. It is essential for businesses to understand their obligations under Indiana law to ensure compliance and avoid legal issues.

Form Submission Methods

The Indiana State Form 962 can be submitted through various methods, allowing flexibility for employers. The options include:

- Online Submission: Employers can file the form electronically through the Indiana Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Indiana Department of Revenue.

- In-Person: Businesses may also choose to submit the form in person at designated state offices.

Filing Deadlines / Important Dates

It is crucial for employers to be aware of the filing deadlines for the Indiana State Form 962 to avoid penalties. Generally, the form must be filed quarterly, with specific deadlines set by the Indiana Department of Revenue. Employers should keep track of these dates and ensure timely submissions to maintain compliance.

Quick guide on how to complete indiana state form 962

Complete Indiana State Form 962 effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources you require to create, amend, and eSign your documents swiftly without delays. Handle Indiana State Form 962 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The easiest way to modify and eSign Indiana State Form 962 with ease

- Locate Indiana State Form 962 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred delivery method for your form—by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your selected device. Edit and eSign Indiana State Form 962 and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana state form 962

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is state form 962?

State form 962 is an official document used for specific administrative purposes. It is crucial for ensuring compliance and proper documentation within certain state regulations. Using airSlate SignNow, completing and eSigning state form 962 becomes seamless and efficient.

-

How can airSlate SignNow help with state form 962?

AirSlate SignNow allows you to easily create, send, and eSign state form 962 digitally. This reduces the time and resources associated with traditional paper methods. Our platform ensures that your documents are signed securely and can be stored or shared effortlessly.

-

What features does airSlate SignNow offer for managing state form 962?

With airSlate SignNow, you can utilize features like templates, reminders, and document tracking specifically for state form 962. These tools streamline the completion process, ensuring that users stay updated on document status. Additionally, you can customize workflows to meet your specific needs.

-

Is airSlate SignNow cost-effective for handling state form 962?

Yes, airSlate SignNow offers competitive pricing plans that make it cost-effective to handle state form 962 and other documents. By digitizing your processes, you save money typically spent on paper, printing, and postage. Plus, the increased efficiency can lead to signNow savings over time.

-

Can I integrate airSlate SignNow with other software to manage state form 962?

Absolutely! AirSlate SignNow seamlessly integrates with various applications to help you manage state form 962 and other documents more effectively. Whether you’re using CRM systems or project management tools, our integrations ensure your workflow remains uninterrupted and efficient.

-

How secure is my data when using airSlate SignNow for state form 962?

Security is a top priority at airSlate SignNow, especially for sensitive documents like state form 962. We utilize industry-leading encryption and compliance standards to protect your data throughout the signing process. You can trust that your information remains secure and confidential.

-

What devices can I use to access airSlate SignNow for state form 962?

You can access airSlate SignNow on any device with internet connectivity, whether it's a desktop, tablet, or smartphone. This flexibility allows you to manage, complete, and eSign state form 962 documents on-the-go. The user-friendly interface ensures a smooth experience on all devices.

Get more for Indiana State Form 962

Find out other Indiana State Form 962

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile