Section 127 Plan Document Template Form

What is the Section 127 Plan Document Template

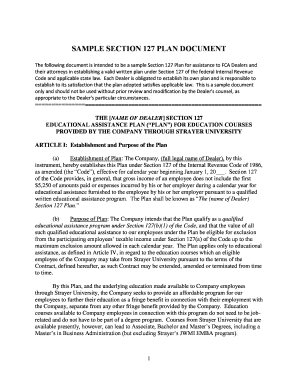

The Section 127 plan document serves as a formal outline for an employer's educational assistance program. This template is designed to ensure compliance with IRS regulations regarding tax-free educational benefits provided to employees. It details the specific terms of the plan, including eligibility criteria, the types of educational expenses covered, and the maximum benefit amounts. By utilizing a sample Section 127 plan document, businesses can effectively communicate the parameters of their educational assistance offerings while ensuring that they meet legal requirements.

How to use the Section 127 Plan Document Template

Using the Section 127 plan document template involves several straightforward steps. First, businesses should customize the template to reflect their specific educational assistance program details. This includes defining the eligibility criteria for employees, specifying covered expenses such as tuition and fees, and outlining the maximum benefits available. Once customized, the document should be reviewed for compliance with IRS guidelines. Finally, the completed plan should be distributed to employees and made accessible for reference, ensuring that all participants understand the program's benefits and requirements.

Key elements of the Section 127 Plan Document Template

Essential components of a Section 127 plan document include:

- Eligibility Criteria: Define which employees qualify for the educational assistance program.

- Covered Expenses: List the types of educational costs that the plan will reimburse, such as tuition, books, and fees.

- Benefit Limits: Specify the maximum amount that can be reimbursed per employee per year.

- Application Process: Outline the steps employees must take to apply for benefits under the plan.

- Compliance Statement: Include a declaration that the plan adheres to IRS regulations.

Steps to complete the Section 127 Plan Document Template

Completing the Section 127 plan document template requires careful attention to detail. Follow these steps:

- Review the template to understand its structure and required sections.

- Gather necessary information about your educational assistance program, including eligibility and covered expenses.

- Fill in the template with specific details relevant to your organization.

- Consult with legal or tax professionals to ensure compliance with IRS regulations.

- Finalize the document and distribute it to employees for their awareness and understanding.

Legal use of the Section 127 Plan Document Template

The legal use of the Section 127 plan document template is crucial for ensuring that the educational assistance program is compliant with IRS regulations. To maintain legal validity, the document must clearly outline the terms of the program and adhere to specific guidelines set forth by the IRS. This includes ensuring that the benefits provided do not exceed the annual limit of five thousand250 dollars per employee and that the plan is communicated effectively to all eligible employees. By following these legal requirements, organizations can protect themselves from potential penalties and ensure that their educational assistance programs are both beneficial and compliant.

Examples of using the Section 127 Plan Document Template

Examples of the Section 127 plan document template in action can provide valuable insights for organizations. For instance, a company may use the template to establish a program that covers tuition reimbursement for employees pursuing degrees related to their job functions. Another example could involve a business offering to pay for certification courses that enhance employees' skills. By implementing the Section 127 plan document, these organizations can provide significant educational benefits while ensuring compliance with tax regulations.

Quick guide on how to complete section 127 plan document template

Easily Prepare Section 127 Plan Document Template on Any Device

Managing documents online has become increasingly favored by enterprises and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly and without delays. Handle Section 127 Plan Document Template on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Change and eSign Section 127 Plan Document Template Effortlessly

- Find Section 127 Plan Document Template and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, be it by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow manages all your document-related needs with just a few clicks from any device you prefer. Edit and eSign Section 127 Plan Document Template and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the section 127 plan document template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a section 127 plan document and why is it important?

A section 127 plan document is a formal written agreement that outlines the specifics of an employee benefit plan under Section 127 of the Internal Revenue Code. This document is crucial as it ensures compliance with IRS regulations and provides clarity on benefits, allowing both employers and employees to understand the terms and advantages of the plan.

-

How can I create a section 127 plan document using airSlate SignNow?

Creating a section 127 plan document with airSlate SignNow is simple. You can start by using our intuitive template library or customize your own document to fit your company's needs. With our easy-to-use tools, you can quickly draft, edit, and get approvals for your section 127 plan document—all online.

-

Are there any costs associated with drafting a section 127 plan document through airSlate SignNow?

Yes, there are costs involved based on the subscription plan you choose when using airSlate SignNow. We offer various pricing tiers to accommodate different business sizes, ensuring you get a cost-effective solution for drafting and managing your section 127 plan document without compromising on features.

-

What features does airSlate SignNow offer for managing section 127 plan documents?

airSlate SignNow offers several features for managing section 127 plan documents, including eSigning, document automation, real-time collaboration, and secure cloud storage. These tools streamline the creation and management process, ensuring that your section 127 plan document is always accessible and up-to-date.

-

What are the benefits of using airSlate SignNow for a section 127 plan document?

Using airSlate SignNow for your section 127 plan document provides benefits like enhanced efficiency, reduced paper usage, and faster turnaround times. Additionally, our platform simplifies compliance by keeping your document securely stored and legally binding, making it easier to manage employee benefits.

-

Can I integrate other tools with airSlate SignNow when working on section 127 plan documents?

Yes, airSlate SignNow integrates with various tools and applications, enhancing your workflow when managing section 127 plan documents. Whether it’s CRM systems, cloud storage services, or other productivity software, our integrations help streamline the entire process of document management.

-

Is the section 127 plan document customizable within airSlate SignNow?

Absolutely! The section 127 plan document can be fully customized to meet the specific needs of your business within airSlate SignNow. You can edit templates, add clauses, and tailor the content to reflect your company's policies and benefits accurately.

Get more for Section 127 Plan Document Template

Find out other Section 127 Plan Document Template

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple

- eSign North Dakota Prenuptial Agreement Template Safe

- eSign Ohio Prenuptial Agreement Template Fast

- eSign Utah Prenuptial Agreement Template Easy

- eSign Utah Divorce Settlement Agreement Template Online