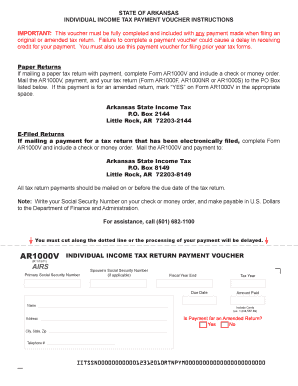

Ar1000v Form

What is the AR1000V?

The AR1000V form is a crucial document used for Arkansas income tax purposes. It serves as the state’s income tax return form for individuals, allowing taxpayers to report their income, claim deductions, and calculate their tax liability. Understanding the purpose of the AR1000V is essential for anyone who earns income in Arkansas, as it ensures compliance with state tax laws.

How to Use the AR1000V

Using the AR1000V involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form accurately, ensuring that all income sources and deductions are reported. After completing the form, review it for any errors before submission. It is advisable to keep a copy for your records, as this can be helpful in case of future inquiries from the Arkansas Department of Finance and Administration.

Steps to Complete the AR1000V

Completing the AR1000V requires careful attention to detail. Here are the steps to follow:

- Gather Documentation: Collect all relevant income documents.

- Fill Out Personal Information: Enter your name, address, and Social Security number.

- Report Income: Input all sources of income accurately.

- Claim Deductions: Identify and apply any eligible deductions.

- Calculate Tax Liability: Use the provided tables or software for accurate calculations.

- Review: Double-check all entries for accuracy.

- Submit: Send the completed form to the appropriate state agency.

Legal Use of the AR1000V

The AR1000V must be completed and submitted in accordance with Arkansas tax laws to be considered legally binding. This means that all information provided must be truthful and accurate. Filing the form on time and ensuring compliance with state regulations is essential to avoid penalties. The use of electronic signatures is permitted, provided that the signer meets the requirements set forth by state law.

Filing Deadlines / Important Dates

Timely submission of the AR1000V is crucial for compliance. The typical deadline for filing the form is April 15 of each year, aligning with federal income tax deadlines. However, it is important to check for any changes or extensions that may apply. Filing late can result in penalties and interest on unpaid taxes, making it vital to adhere to these dates.

Who Issues the Form

The Arkansas Department of Finance and Administration is responsible for issuing the AR1000V form. This state agency oversees tax collection and compliance, ensuring that all taxpayers are informed of their obligations. For any updates or changes to the form, taxpayers should refer to the official website of the Arkansas Department of Finance and Administration.

Quick guide on how to complete ar1000v

Prepare Ar1000v seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Ar1000v on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Ar1000v effortlessly

- Locate Ar1000v and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to finalize your changes.

- Select how you'd like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ar1000v and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar1000v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ar1000v and how does it benefit my business?

The ar1000v is a powerful electronic signature solution by airSlate SignNow that enables businesses to send and eSign documents seamlessly. By streamlining the signing process, the ar1000v helps reduce turnaround time and increases efficiency. Its user-friendly interface makes it easy for teams to adopt and integrate into their workflow.

-

How much does the ar1000v cost?

Pricing for the ar1000v varies based on the chosen plan and the number of users. airSlate SignNow provides flexible pricing options to accommodate businesses of all sizes, ensuring that you only pay for what you need. For detailed pricing information, visit our website or signNow out to our sales team.

-

What features are included with the ar1000v?

The ar1000v comes packed with essential features such as customizable templates, advanced security options, and real-time tracking. Additionally, it offers integrations with popular applications, making document management easier than ever. These features are designed to enhance your signing experience and improve overall business productivity.

-

Is the ar1000v secure for business transactions?

Absolutely! The ar1000v employs state-of-the-art security measures, including encryption and multi-factor authentication, to protect your sensitive information. With airSlate SignNow, you can trust that your documents are secure while maintaining compliance with industry standards and regulations.

-

Can the ar1000v integrate with my existing software?

Yes, the ar1000v offers seamless integrations with numerous third-party applications, including CRM systems and cloud storage solutions. This allows you to enhance your existing processes without the need for extensive changes. Our integration capabilities make it easy to adapt the ar1000v to fit into your current workflow.

-

What types of documents can I sign using the ar1000v?

With the ar1000v, you can sign a wide variety of documents, including contracts, agreements, and forms. The platform supports various file formats, ensuring that you can easily manage all of your signing needs. This flexibility means you can focus on your business without worrying about document compatibility.

-

How can the ar1000v improve my team’s efficiency?

The ar1000v simplifies the document signing process by enabling multiple signers to collaborate in real-time and reducing the time spent on manual paperwork. Its automated workflows and notifications ensure that documents are signed promptly, eliminating bottlenecks. As a result, your team can focus on more strategic tasks and improve overall efficiency.

Get more for Ar1000v

- Lohnausweis form

- Form jdf 433 petition for change of name adult legal forms courts state co

- Apartment guarantor form

- Fence agreement template form

- Festival vendor agreement template form

- Fencing neighbor fence agreement template form

- Fiduciary agreement template 787742267 form

- Group lottery contract template form

Find out other Ar1000v

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online