Colorado Caps Form

Understanding the Colorado Caps Form

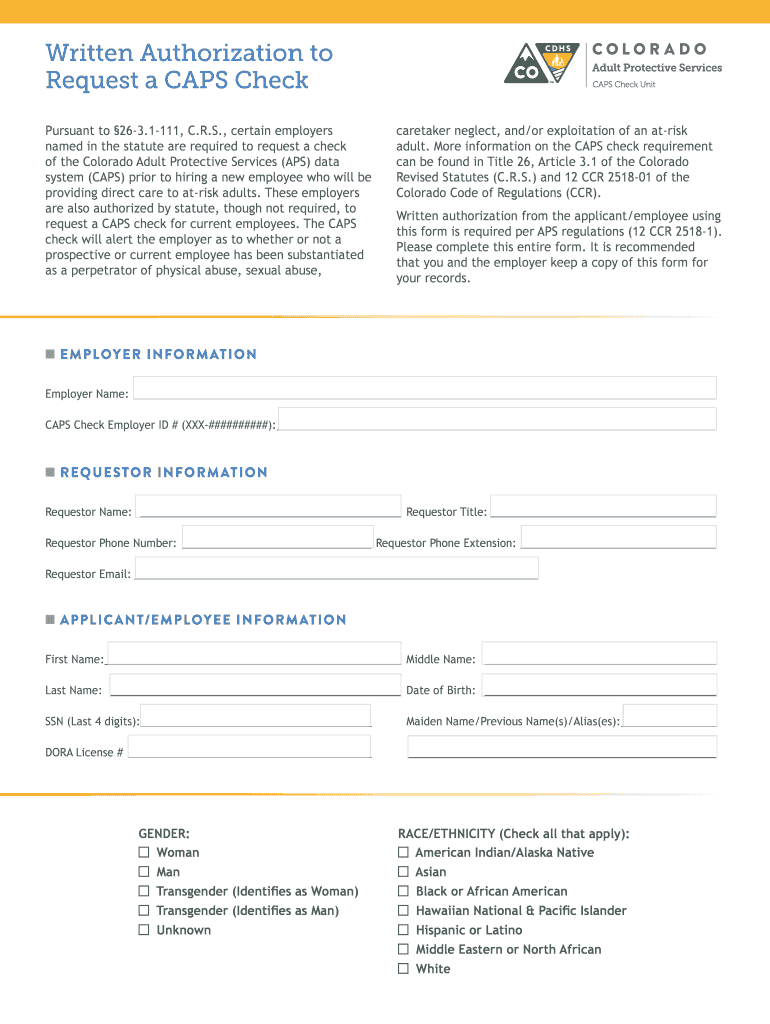

The Colorado Caps Form, often referred to as the caps check request form, is a critical document used for conducting background checks in the state of Colorado. This form allows individuals or organizations to request a comprehensive background check on a specific person, often for employment or licensing purposes. The information gathered through this form can include criminal history, employment verification, and other relevant data that helps ensure safety and compliance with state regulations.

Steps to Complete the Colorado Caps Form

Filling out the Colorado Caps Form involves several key steps to ensure accuracy and compliance with state requirements. Follow these steps:

- Obtain the latest version of the caps check request form from a reliable source.

- Fill in the required personal information, including the full name, date of birth, and any other identifying details of the individual being checked.

- Provide the reason for the background check, which may include employment, licensing, or other purposes.

- Include any necessary consent signatures from the individual being checked, which is crucial for legal compliance.

- Review the form for accuracy before submission to avoid delays.

Legal Use of the Colorado Caps Form

The legal use of the Colorado Caps Form is governed by state laws that dictate how background checks can be conducted. It is essential to obtain written authorization from the individual being checked, as this ensures compliance with privacy regulations. The form must be used solely for legitimate purposes, such as employment screening or licensing, and not for discriminatory practices. Understanding these legal parameters helps protect both the requester and the individual being checked.

Obtaining the Colorado Caps Form

The Colorado Caps Form can be obtained through various channels. Individuals or organizations can access it online through official state websites or request it directly from the Colorado Bureau of Investigation. It is important to ensure that the version obtained is current and meets all state requirements. Additionally, some legal or human resource professionals may have copies available for their clients.

Form Submission Methods

Once the Colorado Caps Form is completed, it can be submitted through multiple methods. Common submission options include:

- Online submission via designated state portals, which may provide quicker processing times.

- Mailing the completed form to the appropriate state agency, ensuring it is sent to the correct address.

- In-person submission at local government offices or designated agencies for immediate processing.

Key Elements of the Colorado Caps Form

Several key elements must be included in the Colorado Caps Form to ensure its validity. These elements typically consist of:

- Personal identification details of the individual being checked, such as name and date of birth.

- Reason for the background check, which must be clearly stated.

- Consent section, where the individual provides written authorization for the check.

- Contact information for the requester, including name and address.

Examples of Using the Colorado Caps Form

The Colorado Caps Form is often used in various scenarios, including:

- Employers conducting background checks on potential hires to ensure a safe workplace.

- Licensing agencies requiring background checks for applicants in sensitive positions, such as childcare or healthcare.

- Organizations seeking to verify the backgrounds of volunteers, particularly in roles involving vulnerable populations.

Quick guide on how to complete colorado caps form

Complete Colorado Caps Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without hold-ups. Manage Colorado Caps Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Colorado Caps Form without strain

- Find Colorado Caps Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign Colorado Caps Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado caps form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the caps form Colorado and how does it work?

The caps form Colorado is a standardized document utilized for various regulatory and administrative purposes. With airSlate SignNow, you can easily create, send, and eSign this form digitally, streamlining your workflow and ensuring compliance. The platform simplifies the process while maintaining the integrity of your important documents.

-

How much does it cost to use airSlate SignNow for caps form Colorado?

AirSlate SignNow offers several pricing tiers to accommodate different needs, starting from a basic plan that includes eSigning capabilities for caps form Colorado. The cost is competitive and designed to provide value by reducing the time and resources needed for document management. You can choose a plan that suits your business's size and requirements.

-

What features does airSlate SignNow offer for caps form Colorado?

AirSlate SignNow includes a variety of features such as customizable templates, secure eSignatures, and automated workflows for caps form Colorado. Users can also track document status and receive notifications, ensuring a seamless signing experience. This helps in reducing turnaround times and improving operational efficiency.

-

Can I integrate airSlate SignNow with my existing systems for caps form Colorado?

Yes, airSlate SignNow offers robust integrations with widely used software applications, making it easy to incorporate caps form Colorado into your existing processes. Whether you use CRM tools or project management software, you can streamline your document workflow effortlessly. This integration capability enhances productivity and collaboration within your team.

-

What are the benefits of using airSlate SignNow for caps form Colorado?

Using airSlate SignNow for caps form Colorado provides numerous benefits, including enhanced security, efficiency, and compliance. Digital signatures help to reduce the risk of errors while improving the speed of document processing. Additionally, the platform's user-friendly interface ensures that everyone can utilize it effectively without extensive training.

-

Is it easy to onboard new users for caps form Colorado with airSlate SignNow?

Onboarding new users to airSlate SignNow for caps form Colorado is straightforward and user-friendly. The platform provides comprehensive resources, including tutorials and customer support, to assist new users in getting up to speed quickly. This ease of use minimizes disruption and ensures that your team can efficiently utilize the signing and document management features.

-

What security measures are in place for caps form Colorado with airSlate SignNow?

AirSlate SignNow prioritizes security for caps form Colorado with advanced encryption protocols and compliance with industry standards. Each document signed on the platform is stored securely, protecting sensitive information from unauthorized access. These security measures ensure your business remains compliant and your documents are safe.

Get more for Colorado Caps Form

- Sample mt 700 letter of credit form

- Award comparison worksheet university of denver du form

- Hiv uninsured care programs in california form

- Cg 719k e form

- Film crew agreement template form

- Film co production agreement template form

- Film distribution agreement template form

- Commercial pest control contract template form

Find out other Colorado Caps Form

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast