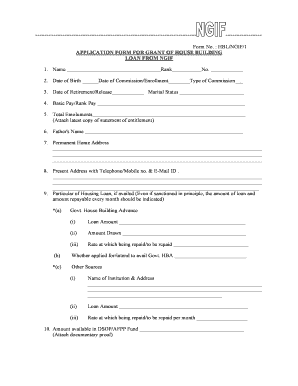

Ngif Home Loan Form

What is the Ngif Home Loan

The Ngif Home Loan is a financial product designed to assist individuals in purchasing or refinancing a home. This loan is tailored to meet the needs of various borrowers, including first-time homebuyers and those looking to renovate their existing properties. It offers competitive interest rates and flexible repayment options, making it an attractive choice for many. Understanding the specifics of the Ngif Home Loan can help potential borrowers make informed decisions regarding their housing finance options.

How to Obtain the Ngif Home Loan

Obtaining the Ngif Home Loan involves several steps to ensure that applicants meet the necessary criteria and can secure financing. First, potential borrowers should assess their financial situation, including credit score and income stability. Next, they will need to gather required documentation, such as proof of income, employment verification, and identification. Once the documentation is prepared, applicants can submit their loan application through the appropriate channels, which may include online platforms or in-person consultations with lenders.

Steps to Complete the Ngif Home Loan

Completing the Ngif Home Loan process requires careful attention to detail. Here are the essential steps:

- Evaluate your financial health and determine the loan amount needed.

- Gather necessary documents, including income statements, tax returns, and identification.

- Submit the application form, ensuring all information is accurate and complete.

- Await approval from the lender, which may involve additional verification steps.

- Review the loan terms and conditions before finalizing the agreement.

- Sign the loan documents and complete any required closing procedures.

Legal Use of the Ngif Home Loan

The Ngif Home Loan must be used in compliance with applicable laws and regulations. This includes ensuring that the loan is utilized for its intended purpose, such as purchasing or improving a primary residence. Borrowers should also be aware of the legal obligations associated with the loan, including repayment terms and potential penalties for default. Understanding these legal aspects can help borrowers navigate their responsibilities and protect their investment.

Eligibility Criteria

To qualify for the Ngif Home Loan, applicants must meet specific eligibility criteria set by lenders. Typically, these criteria include:

- A minimum credit score, usually around six hundred to six hundred fifty.

- Proof of stable income and employment history.

- Debt-to-income ratio within acceptable limits, often below forty-three percent.

- Residency status, as some loans may require applicants to be U.S. citizens or permanent residents.

Required Documents

When applying for the Ngif Home Loan, certain documents are essential to facilitate the approval process. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport.

- Recent pay stubs or proof of income.

- Tax returns for the past two years.

- Bank statements to verify assets and savings.

- Any additional documentation specific to the loan type or lender requirements.

Quick guide on how to complete ngif home loan

Prepare Ngif Home Loan seamlessly on any device

Digital document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Ngif Home Loan on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Ngif Home Loan effortlessly

- Locate Ngif Home Loan and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Ngif Home Loan and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ngif home loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an INBA booklet and how can it be used?

An INBA booklet is a specialized digital document designed for easy navigation and organization of information. With airSlate SignNow, you can create, send, and eSign your INBA booklet seamlessly, making it ideal for businesses that require efficient document management.

-

What features does airSlate SignNow offer for creating an INBA booklet?

airSlate SignNow provides a user-friendly interface for designing your INBA booklet, including templates, drag-and-drop functionalities, and customizable fields. Whether you need to include checkboxes, text fields, or signatures, these features help streamline the creation process.

-

What are the benefits of using an INBA booklet with airSlate SignNow?

Using an INBA booklet with airSlate SignNow ensures that your documents are not only visually appealing but also fully functional. The ability to collect eSignatures quickly enhances workflow efficiency, saving your team valuable time and reducing paper waste.

-

How does pricing for airSlate SignNow work for creating INBA booklets?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, allowing you to create and manage your INBA booklet effectively. Plans are based on user count and features, ensuring that you only pay for what you need.

-

Can airSlate SignNow integrate with other apps for managing an INBA booklet?

Yes, airSlate SignNow integrates with a variety of applications, making it easy to manage your INBA booklet alongside other business tools. Integrations with CRM systems, cloud storage solutions, and productivity apps help streamline your workflow.

-

How secure is the information in my INBA booklet when using airSlate SignNow?

Security is a top priority for airSlate SignNow. All information within your INBA booklet is protected with advanced encryption, ensuring that your documents and eSignatures are safe from unauthorized access.

-

Is it easy to share an INBA booklet with clients or team members?

Absolutely! airSlate SignNow allows you to share your INBA booklet with clients and team members via secure links or email invitations. This feature facilitates collaboration and ensures that all parties can view and sign the document without hassle.

Get more for Ngif Home Loan

Find out other Ngif Home Loan

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation