Lic Hfl Griha Shobha Application Form

What is the undertaking form LIC?

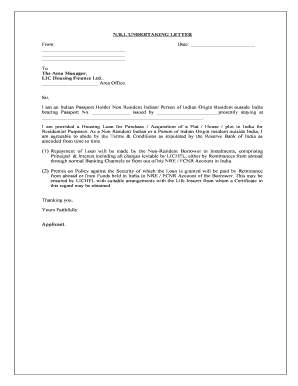

The undertaking form LIC is a crucial document used in the context of housing finance, specifically for Non-Resident Indians (NRIs) seeking loans or financial assistance from Life Insurance Corporation (LIC) of India. This form serves as a declaration of intent and commitment to repay the loan, ensuring that all parties involved understand the terms and conditions associated with the financing. It is essential for establishing a legal framework for the transaction, making it a vital component of the loan application process.

Steps to complete the undertaking form LIC

Completing the undertaking form LIC involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal and financial information, including identification documents and income details. Next, fill out the form with precise information, paying close attention to the sections that require signatures and declarations. Once completed, review the form for any errors or omissions. Finally, submit the form electronically through a trusted platform like signNow, which provides secure eSignature options and maintains compliance with relevant legal standards.

Key elements of the undertaking form LIC

The undertaking form LIC contains several critical elements that must be accurately completed. These include:

- Personal Information: Full name, address, and contact details of the applicant.

- Loan Details: Amount requested, purpose of the loan, and repayment terms.

- Declaration: A statement confirming the applicant's commitment to repay the loan as per the agreed terms.

- Signatures: Required signatures from the applicant and any co-applicants, ensuring legal validity.

Legal use of the undertaking form LIC

The undertaking form LIC is legally binding when executed correctly. To ensure its validity, it must comply with eSignature laws such as the ESIGN Act and UETA. This means that the form should be signed using a reliable electronic signature solution that provides an audit trail and verifies the identity of the signers. By adhering to these legal standards, the undertaking form can be enforced in a court of law, protecting the interests of both the lender and the borrower.

Form submission methods

The undertaking form LIC can be submitted through various methods, depending on the lender's requirements. Common submission methods include:

- Online: Many lenders allow for electronic submission via their website or a secure document management platform.

- Mail: The completed form can be printed and sent via postal service to the lender's designated address.

- In-Person: Applicants may also choose to deliver the form directly to the lender's office, ensuring immediate receipt.

Eligibility criteria for the undertaking form LIC

To complete the undertaking form LIC, applicants must meet specific eligibility criteria. Typically, these include being a Non-Resident Indian with a valid passport, having a stable source of income, and being of legal age to enter into a financial agreement. Additionally, applicants should have a good credit history and meet any other requirements set forth by the lending institution. Understanding these criteria helps streamline the application process and increases the chances of approval.

Quick guide on how to complete lic hfl griha shobha application form

Effortlessly Prepare Lic Hfl Griha Shobha Application Form on Any Device

Digital document management has gained widespread acceptance among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as it allows you to obtain the necessary template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Lic Hfl Griha Shobha Application Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Lic Hfl Griha Shobha Application Form seamlessly

- Obtain Lic Hfl Griha Shobha Application Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or misplaced paperwork, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Modify and eSign Lic Hfl Griha Shobha Application Form to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lic hfl griha shobha application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the undertaking form lic and how can airSlate SignNow help?

The undertaking form lic is a document that can be utilized for various business processes, ensuring compliance with licensing requirements. airSlate SignNow simplifies the creation and signing of this form, making it easy to manage and track. With its intuitive interface, users can efficiently complete the undertaking form lic without any hassle.

-

How much does it cost to use airSlate SignNow for undertaking form lic?

Pricing for airSlate SignNow varies depending on the plan you choose, but it remains a cost-effective solution for handling the undertaking form lic. We offer several tiers that cater to different business needs, ensuring you have the right features at a price point that works for you. You can check our pricing page for the latest offers and choose a plan that fits your budget.

-

What features does airSlate SignNow offer for the undertaking form lic?

airSlate SignNow comes equipped with essential features such as electronic signatures, document templates, and real-time tracking to streamline the undertaking form lic process. Additionally, users can customize templates and automate workflows, saving time and reducing errors. These features signNowly enhance the efficiency of managing this crucial document.

-

How does airSlate SignNow ensure the security of my undertaking form lic?

Security is a top priority for airSlate SignNow when handling the undertaking form lic and all other documents. We employ robust encryption protocols, secure storage, and user authentication measures to protect your data. Rest assured, your undertaking form lic will be stored safely and can only be accessed by authorized users.

-

Can I integrate airSlate SignNow with other applications for undertaking form lic?

Yes, airSlate SignNow offers seamless integrations with a variety of applications to enhance your workflow related to the undertaking form lic. You can easily connect it with CRM systems, cloud storages, and more to ensure your documents are well managed and easily accessible. This interoperability simplifies the entire process of handling your licensing forms.

-

Is there a mobile app for airSlate SignNow for managing the undertaking form lic?

Absolutely! airSlate SignNow provides a mobile app that allows you to manage the undertaking form lic on-the-go. With the app, you can send, sign, and track documents from your mobile device, ensuring you can handle your important licensing forms anytime, anywhere. This flexibility enhances productivity and responsiveness.

-

What are the benefits of using airSlate SignNow for the undertaking form lic?

Using airSlate SignNow for the undertaking form lic offers several benefits, including increased efficiency, ease of use, and cost savings. The platform reduces the time spent on paperwork while providing a user-friendly experience for both senders and signers. Moreover, it helps in maintaining compliance and improving document accuracy.

Get more for Lic Hfl Griha Shobha Application Form

Find out other Lic Hfl Griha Shobha Application Form

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer